Key Points:

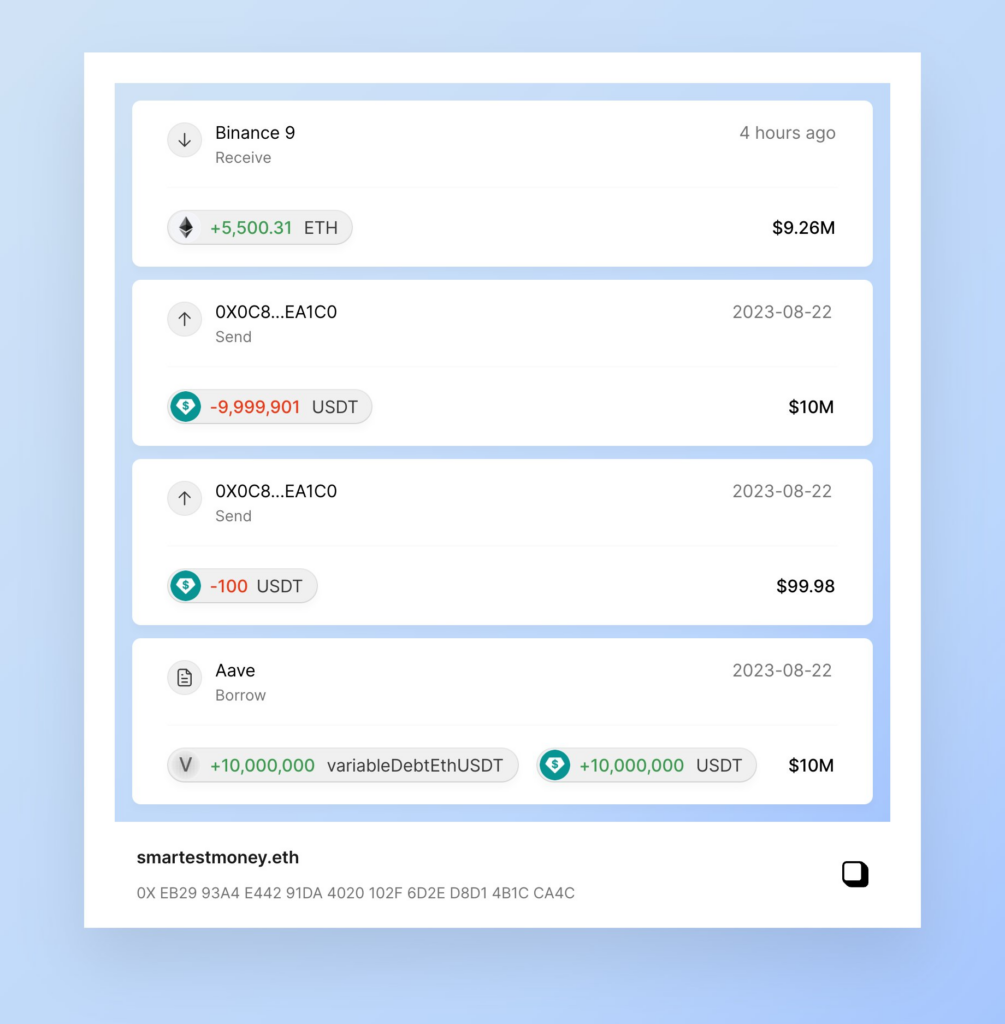

- A prominent crypto whale borrowed $10 million USDT from Aave, using ETH as collateral.

- The whale withdrew 5,500 Ethereum (approx. $9.24 million) from Binance, sparking curiosity about their intentions.

- This move follows a pattern of accumulating 22,771 Ethereum since July 31, now valued around $38.5 million.

On-chain analyst Ember widely referred to as a “giant whale,” executed a strategic move that has sent ripples through the market.

Yesterday, this enigmatic entity borrowed a staggering 10 million USDT from the decentralized lending platform Aave. The borrowing was secured by collateralizing a substantial amount of Ethereum (ETH), which was then promptly transferred to the popular exchange Binance.

The intrigue deepened as the whale proceeded to withdraw a substantial sum of 5,500 Ethereum, equivalent to approximately $9.24 million at current market values. This intricate maneuver has caught the attention of market observers and analysts alike, igniting discussions about the whale’s intentions and its potential impact on the cryptocurrency landscape.

What adds an extra layer of intrigue is the timeline leading up to this event. Since July 31, the same whale has been steadily accumulating Ethereum from Binance, amassing an impressive total of 22,771 ETH. With Ethereum’s market value fluctuating, the estimated worth of this accumulation stands at approximately $38.5 million. Impressively, the average acquisition price for this sizable haul hovers around $1,690 per ETH.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.