Key Points:

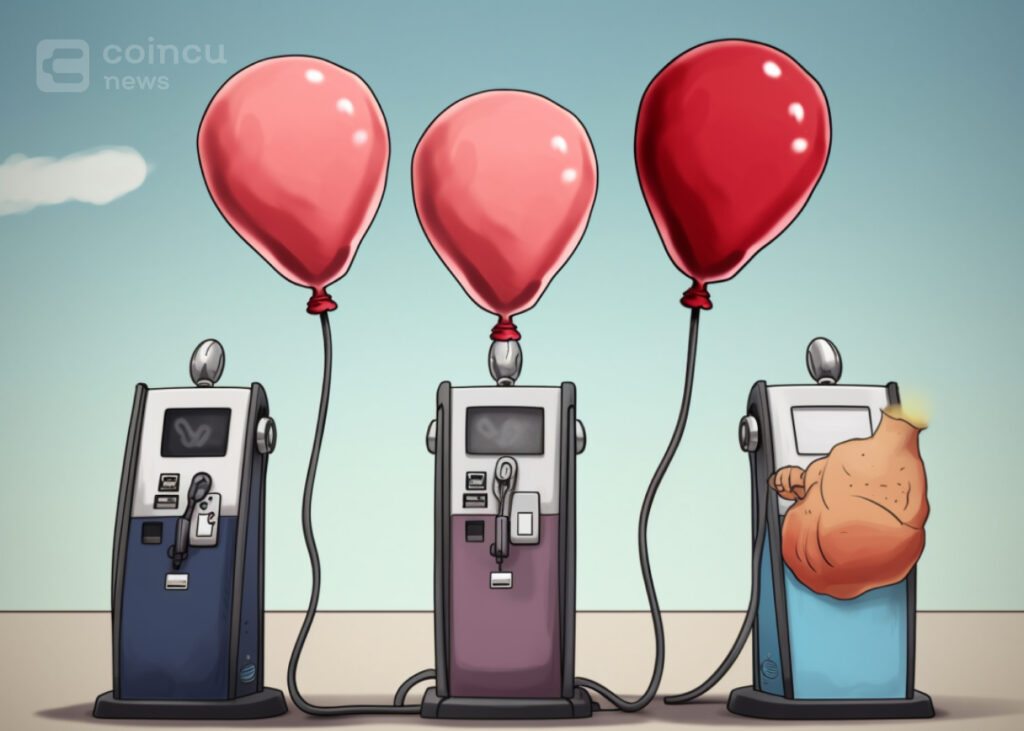

- Ethereum’s daily transaction fees dropped to an 8-month low of around $2.8 million, signifying decreased network activity and usage.

- The decline in fees is countered by platform’s growing adoption of layer 2 scaling solutions, showcasing the platform’s commitment to scalability improvements and a more efficient transaction experience.

Recent data from CryptoQuant has unveiled a significant drop in Ethereum’s daily transaction fees, hitting an 8-month low of approximately $2.8 million.

On the previous day, users’ total fees for executing transactions on Ethereum dwindled to 1,719 ETH, marking the lowest single-day figure since December 26. This stands as a stark 89% decrease from the year’s high of 16,720 ETH recorded on May 5.

A reduction in total fees paid signifies a diminished network utilization, as fees directly correlate with network activity, primarily pending transactions. The decline in fees is a reflection of subdued demand for transactions, pointing to comparatively low user activity within the network.

However, the bright side of this trend lies in the burgeoning popularity of Ethereum‘s layer 2 scaling solutions. These solutions provide an off-chain approach to processing transactions, aiming to alleviate network congestion and enhance scalability. The adoption of these solutions bodes well for Ethereum, as they lay the foundation for more efficient and cost-effective transactions, potentially alleviating the need for high transaction fees.

The focus on layer 2 scaling solutions hints at Ethereum’s commitment to addressing scalability challenges and enhancing user experience. As the Ethereum ecosystem continues to evolve, such initiatives promise to strengthen the platform’s long-term sustainability and usability, fostering a more robust and accessible blockchain ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Chubbi

Coincu News