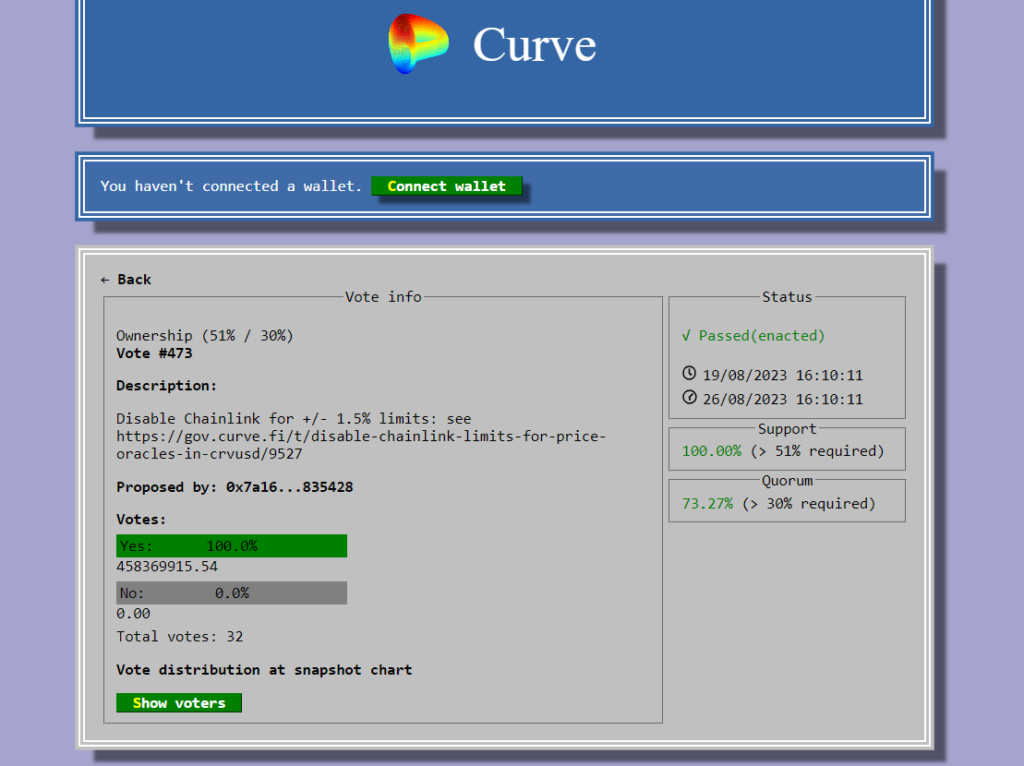

Key Points:

- Curve governance platform has approved a proposal by founder Michael Egorov to eliminate the ±1.5% safe limit for the Chainlink price in the oracle crvUSD.

- Egorov’s proposal ensures more precise data by switching to Chainlink’s data source when deviations exceed the set limit from the internal oracle EMA.

Curve founder Michael Egorov has successfully passed through an on-chain vote on the Curve governance platform.

This proposal pertains to the adjustment of the ±1.5% safe limit associated with the Chainlink price in the oracle crvUSD.

Egorov’s proposal highlights a crucial concern surrounding the stability and accuracy of oracle data, which plays a pivotal role in informing DeFi protocols about real-world market prices. The proposal suggests that while the use of spot prices directly from the market might seem appropriate during times of high volatility, it can potentially lead to unwarranted losses. Egorov’s proposition, therefore, aims to ensure a balance between utilizing Chainlink’s data source and maintaining stability during turbulent market conditions.

The key tenet of the approved proposal involves removing the existing ±1.5% safe limit for the Chainlink price within the oracle crvUSD system. Under this adjustment, if the Chainlink price substantially deviates from the internal oracle EMA (Exponential Moving Average) by more than the specified limit, the Chainlink data source will be engaged directly. This mechanism seeks to provide a safeguard against extreme price fluctuations that might otherwise result in unnecessary financial losses for users.

The successful passage of this proposal showcases the effectiveness of decentralized governance in the DeFi space. The decision-making process, carried out through on-chain voting, reflects the commitment of community members and stakeholders to enhance the robustness of DeFi protocols.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.