Key Points:

- Large investors show confidence by accumulating ARB tokens despite recent price fluctuations.

- This is a significant development as Arbitrum welcomes Chainlink’s Cross-CCIP mainnet, boosting the ARB ecosystem.

- Risk management tools and unique features within Arbitrum attract attention, making it an attractive option for traders and investors.

In a recent turn of events, large cryptocurrency holders, often referred to as “whales,” have been showing strong support for the Arbitrum ecosystem. Their continuous accumulation of the ARB token, even after a recent dip, reflects a bullish sentiment.

Whales Boost ARB Token With Recent Accumulation Activities

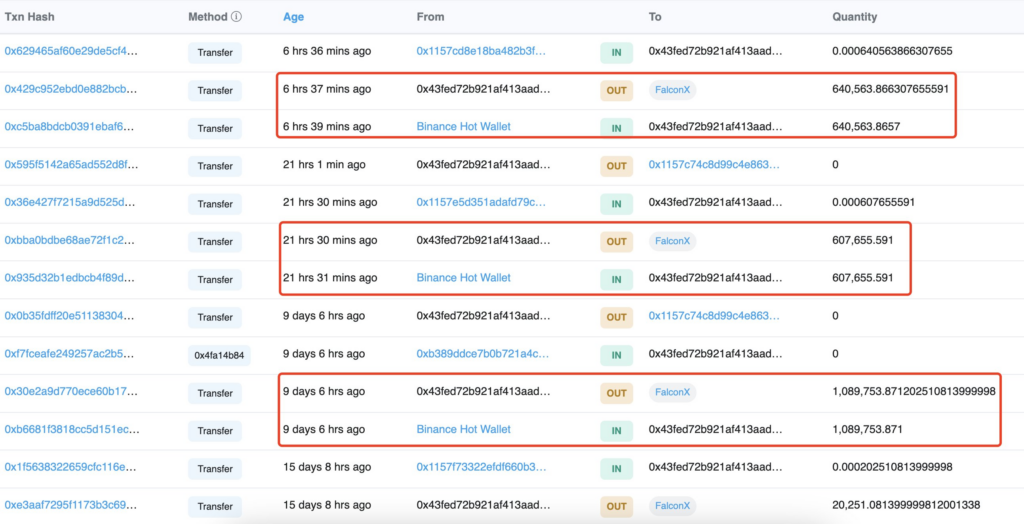

According to data from on-chain analyst Lookonchain, a prominent whale recently purchased 2.28 million ARB tokens, valued at approximately $1.86 million, through FalconX. These tokens were withdrawn from Binance to FalconX on 9/14 and subsequently transferred to another address. The estimated average acquisition price for the whale stands at around $0.81.

ARB had experienced a decline to $0.74 on September 11, partly influenced by the broader crypto market’s downward trend, which also saw Bitcoin drop below $25,000. However, the token rebounded, with buyers showing interest at around $0.87 before stabilizing near $0.82.

Chainlink Integration and Innovative Features Fuel Growth

Arbitrum, a leading Ethereum Layer 2 scaling solution, recently made a significant stride by launching the Chainlink Cross-Chain Interoperability Protocol (CCIP) mainnet on its Arbitrum One chain. This development is expected to enhance the ARB ecosystem by improving user experiences and attracting more developers. Such advancements have played a role in boosting ARB‘s price in recent days.

The network’s appeal to whales is evident due to its role in alleviating Ethereum’s network congestion and high gas fees. Notably, the protocol has introduced an innovative feature allowing users to protect against “Impermanent Loss,” a critical risk management tool that benefits large-scale traders and investors.

As Arbitrum continues to evolve, it emerges as a compelling choice for those seeking to optimize their Ethereum-based operations. The growing confidence of whales and the integration of the Chainlink protocol signal promising prospects for the ARB token and the Arbitrum ecosystem as a whole.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.