Key Points:

- DWF Labs withdraws $127,000 worth of FRONT tokens from Binance, holding $299,000 in FRONT tokens now.

- Frontier’s DeFi aggregation platform supports multiple blockchain apps.

- FRONT token surges 4.2% to $0.435, reaching a $39.3 million market cap; DWF Labs previously moved $2.85 million LEVER tokens to Binance.

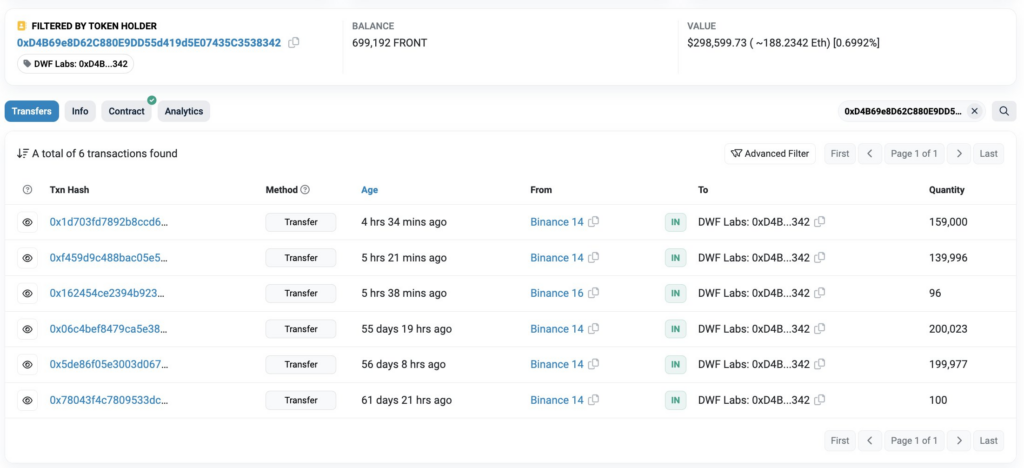

Lookonchain monitoring has revealed that DWF Labs recently made a significant move in the cryptocurrency space by withdrawing 299,092 FRONT tokens, valued at approximately $127,000, from Binance.

DWF Labs FRONT Withdrawal Causes Holdings To Increase Significantly

This transaction occurred just four hours ago, and as of now, DWF Labs holds a substantial 699,192 FRONT tokens, with a total estimated worth of $299,000.

Following this significant move by DWF Labs, the FRONT token witnessed a remarkable 4.2% surge in its price, currently trading at $0.435 as of the time of writing. Consequently, the token’s market capitalization has seen a commendable 3% increase, reaching a total of $39.3 million.

Prior to this, DWF Labs had caught attention in the crypto realm with a substantial transfer of 1.8 billion LEVER tokens, valued at $2.85 million, into Binance.

Frontier’s DeFi Aggregator Spurs FRONT Token Surge

Frontier, the platform associated with FRONT tokens, operates as a DeFi aggregation layer, facilitating seamless asset management across various blockchains and DeFi applications. Notably, Frontier has extended its support to multiple applications spanning Ethereum, Binance Chain, Bandchain, Kava, and Harmony.

At its core, Frontier acts as an aggregator, addressing the challenge of fragmentation in the DeFi space by enabling the tracking and consolidation of DeFi protocols. This includes widely recognized protocols like Compound, Maker, Synthetix, Aave, InstaDApp, Uniswap, bZx, Balancer, and Curve.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.