Key Points:

- QCP Capital warns that the BTC support level would be testing at 25k in the last quarter of 2023.

- BTC’s Q4 performance remains uncertain despite historical seasonality trends.

BTC support level may face a potential test at 25k in Q4 2023 due to external factors like ETF approval and government deals.

Bitcoin (BTC) surged by 15% in the past two weeks and an impressive 9% in the last three days. This uptrend has been a breath of fresh air after a lackluster Q3 that saw BTC plummet by 12%.

The recent rebound has led many to wonder if this marks the long-awaited Q4 rally. Seasonal trends suggest that October is traditionally a strong month for BTC, though Q4 as a whole has shown mixed results historically.

However, QCP Capital reportedly remains cautious about the sustainability of this rally. They’ve raised concerns that BTC support level might test the critical point of 25k sometime during the final quarter of 2023, citing several reasons for their skepticism:

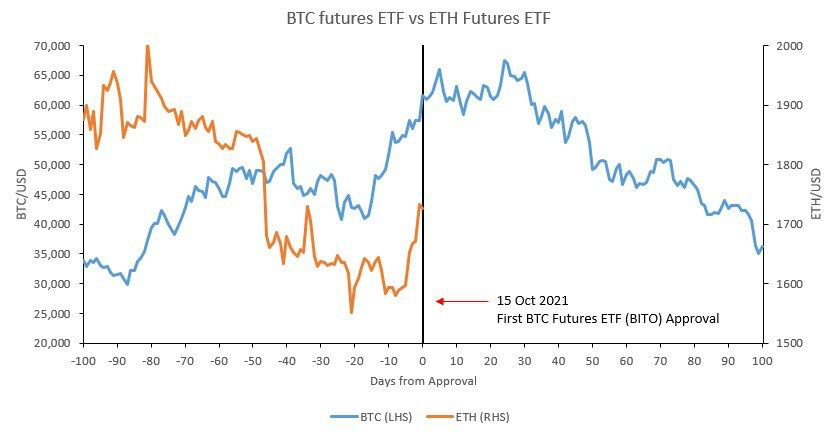

Impact of Futures ETFs

The recent surge in BTC value has largely been fueled by external factors such as the anticipation of SEC approvals for Ethereum (ETH) futures ETFs, lower-than-expected core PCE inflation, and a last-minute continuing resolution (CR) deal to keep the U.S. government operational until November 17.

QCP Capital points to history as a lesson. When the BTC futures ETF was approved two years ago, it led to a new all-time high in BTC within 25 days. However, they argue that futures-only ETFs may not significantly affect the spot market, potentially directing demand away from it.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.