Open Exchange (OPNX) is a relatively new exchange in the cryptocurrency space, but because of its connections to Su Zhu and Kyle Davies, the two creators of the 3AC investment fund, this exchange has run into a lot of controversy. Let’s read this Open Exchange review article now to discover more about the exchange!

Overview

2022 bore witness to the catastrophic collapse of several major organizations, laying bare the inherent fragility of crypto businesses. The chain reaction began with the unprecedented downfall of Terra (LUNA), an event considered a rare Black Swan incident in the crypto world.

This catastrophic event sent shockwaves through the community, plummeting the value of LUNA tokens from $100 to nearly $0 and inflicting severe liquidity losses on numerous large organizations. Following this, other projects, such as Celsius and BlockFi, declared bankruptcy.

However, the consequences of the LUNA collapse were not the end of the turmoil. Shortly thereafter, the FTX and Alameda empires also crumbled. Alongside the disintegration of these organizations came a multitude of losses, primarily affecting users who entrusted their assets to these now-bankrupt institutions. These individuals found their funds trapped, with seemingly little hope of recovery.

The scale of uncontrolled assets left in the wake of these collapses is staggering, estimated at a staggering $25 billion. This financial crisis prompted Su Zhu, the founder of the once-prominent 3AC fund, who himself suffered bankruptcy due to the LUNA collapse, to join forces with his partner Kyle Davies. Together, they conceived an ambitious plan to address this issue: the creation of an exchange dedicated to trading debt assets frozen or locked on bankrupt platforms.

Originally conceptualized as GTX, symbolizing its role as a successor to FTX, the project underwent a renaming process and emerged as Open Exchange, or OPNX.

In a significant development, OPNX announced in March of this year its acquisition of all assets belonging to CoinFLEX, solidifying FLEX as the primary token of the exchange. CoinFLEX had previously suffered substantial losses, and the emergence of OPNX signals a potential turnaround for the exchange.

What is OPNX?

OPNX, which was officially introduced to the public in February, has set out to address the growing concern among cryptocurrency investors who have seen their assets compromised due to platform failures. According to the project’s official information, as much as 90% of investors affected by these bankruptcies have struggled to regain control of their assets.

Unlike many traditional cryptocurrency exchanges, OPNX is charting a new course in the crypto space. It acknowledges that cryptocurrencies are a high-risk asset class, and it is often the lack of decentralization that leaves investors vulnerable when “poor-quality” projects fail. To mitigate losses and provide support for users affected by bankrupt exchanges or projects, OPNX is focusing its efforts on this critical mission.

One distinguishing feature of OPNX is its dual-token system, consisting of OX and FLEX tokens. Notably, the exchange is now facilitating the seamless transition of old FLEX tokens into the native OX tokens at a 1:1 ratio, offering a lifeline to affected investors.

The cryptocurrency landscape has seen its fair share of ups and downs, with investor trust frequently shaken by high-profile platform failures. These incidents have underscored the need for innovative solutions that prioritize the protection and recovery of investor assets.

OPNX, with its unique approach and commitment to assisting investors affected by platform failures, is poised to make a significant impact on the cryptocurrency market.

What problem does OPNX solve?

A Game-Changer in Cryptocurrency Asset Recovery

OPNX has emerged as a pioneering solution to a persistent problem in the cryptocurrency world: the efficient recovery of assets from bankrupt crypto companies. This innovative exchange provides users with a platform that seamlessly combines bankruptcy declarations and cryptocurrency trading, offering a comprehensive range of services to address this critical issue.

Traditionally, when cryptocurrency exchanges face bankruptcy, users are often left in limbo, unable to access their funds for extended periods, and are forced to navigate complex legal processes. OPNX, however, streamlines this recovery process by allowing users to trade their claims as collateral on the cryptocurrency futures market. This groundbreaking approach empowers users to regain control of their assets quickly and efficiently.

OPNX further distinguishes itself by offering a diverse array of trading options, including spot and futures cryptocurrency trading. This multifaceted approach caters to the various needs of cryptocurrency enthusiasts and traders, ensuring that they have access to the tools they require on a single platform.

Bridging the Gap Between DeFi Transparency and CEX Performance

One of OPNX’s core objectives is to combine the transparency and reliability of DeFi (decentralized finance) with the performance and user experience of CEX (centralized exchange). The exchange aspires to establish itself as the world’s most transparent centralized exchange, setting a new standard for trust and accountability in the industry.

While OPNX has garnered significant attention and interest, it’s important to note that access to the platform may be restricted in certain regions due to regulatory considerations. Users in areas such as Afghanistan, Belarus, the Central African Republic, the Republic of Congo, Cote d’Ivoire (Ivory Coast), Crimea, Cuba, Iran, Iraq, North Korea, Liberia, Libya, Myanmar (Burma), Quebec (Province), Somalia, South Sudan, Sudan, Syria, the United States, Venezuela, Yemen, and Zimbabwe may face limitations on registration and usage.

Notably, the inclusion of the United States in this list raises questions, as the country has witnessed several high-profile crypto bankruptcies, including Genesis, BlockFi, and Celsius. However, OPNX’s commitment to addressing this issue on a global scale remains unwavering, and the platform holds the potential to revolutionize asset recovery for cryptocurrency users worldwide.

Highlights

Unlike traditional methods that often result in protracted legal battles and minimal returns for users, OPNX aims to expedite the asset recovery process, ensuring that affected individuals can reclaim their lost assets promptly.

What sets OPNX apart is its status as a decentralized exchange employing a Proof-of-Reserves (PoR) mechanism, coupled with zero-knowledge proof technology to guarantee a high level of transparency. The exchange boasts a diverse range of financial products, spanning Spot, Futures, custody services, and even traditional stock and forex trading.

For those who previously held FLEX tokens, OPNX offers an enticing incentive, granting them a 50% discount on trading fees. Additionally, FLEX token holders can opt to convert their holdings into OX tokens, with OPNX providing a 25% OX bonus from the OPNX treasury at a conversion rate of 1:125, delivering a lucrative opportunity for both investors and users.

Furthermore, OPNX is committed to promoting open markets and facilitating the trading of all asset classes on public order books. Transparency remains a core tenet, with the development team pledging to abstain from internal transactions while working on a zero-knowledge-proof system for public validation, ensuring precision while safeguarding user privacy.

In a bid to foster liquidity, OPNX supports the tokenization of real-world assets (RWA), bridging the gap between traditional and digital finance realms.

OPNX token

Key Metrics

- Token name: OPNX Token

- Ticker: OX

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0x78a0a62fba6fb21a83fe8a3433d44c73a4017a6f

- Token Type: Utility

- Total Supply: 9,860,000,000 OX

- Circulating Supply: 2,833,236,466 OX

Use cases

In the Open Exchange system, OX tokens are utilized for trading incentives, voting privileges, and throughout the staking process in addition to serving as transaction fees. One unique feature is that on the system, staking this coin is entirely free.

OPNX’s Herdnomics function enables users to stake OX to:

- Receive free lifetime trading discounts of up to 100%. While trading on the platform, this offers customers a number of important advantages.

- Use OX for payments to significantly lower real-world asset tokenization costs. This makes it easier to utilize and access actual assets on OPNX.

- Users who are staking OX may vote to eliminate all non-refundable fees, burn tokens, or indicate changes to OPNX fees. When trading volume exceeds their free allotment, reductions must be made for staking participants, including costs paid by OX staking players and non-staking participants.

As a result, staking OX tokens has a positive impact on users as well as Open Exchange’s ability to control costs, provide transparency, and promote fairness.

Team

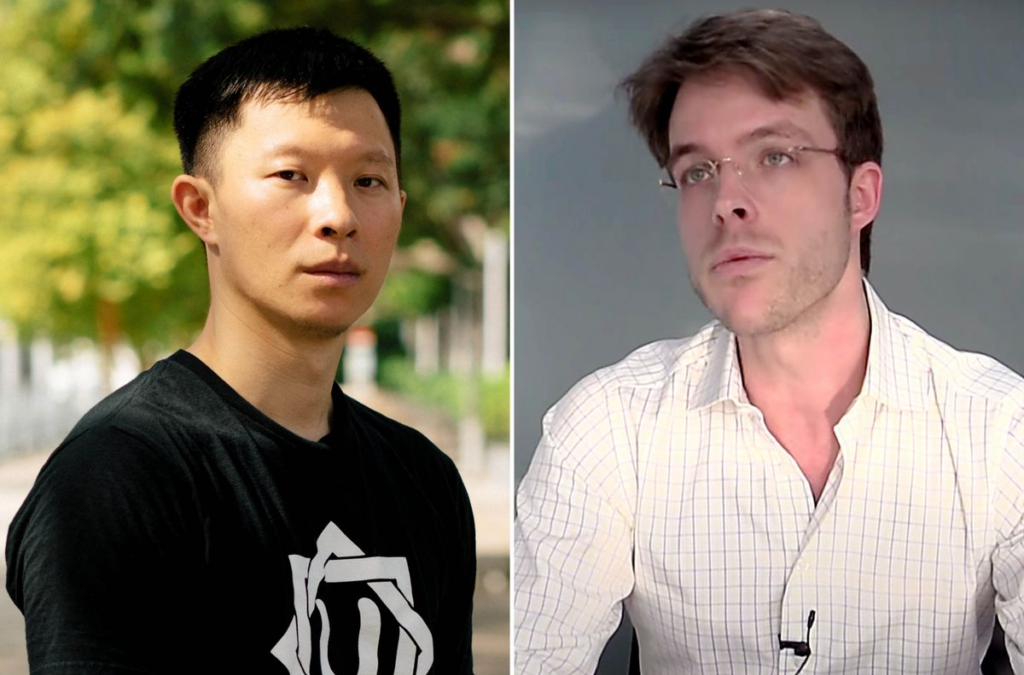

While Leslie Lamb, a strong female leader, is the project’s formal CEO, the OPNX exchange was unveiled by Three Arrow Capital’s original founders Zhu Su and Kyle Davies. Leslie Lamb, who formerly served as CoinFLEX’s chief marketing officer, is now playing a significant part in the OPNX initiative. Leslie Lamb’s involvement benefits the Open Exchange initiative by adding variety and development in addition to valuable leadership and expertise.

Investors and Partners

Investors

Leading investors have shown interest in OPNX with success. OPNX got investments of up to $25 million in a single fundraising round in March of this year from prestigious backers. This significant sum will undoubtedly aid the project’s growth and operational scalability, offering customers a pleasant and secure bitcoin trading environment on Open Exchange.

Partners

With well-known exchanges that have previously collapsed, Open Exchange has forged partnerships. These associates consist of BlockFi, Celsius, FTX, and Genesis. Open Exchange gains a lot from working with exchanges that have encountered obstacles and problems. Open Exchange establishes a strong and dependable basis by using expertise and lessons learned from prior mistakes, giving customers security and confidence in the bitcoin trading process.

Development potential

Open Exchange has a lot of room to grow as a bitcoin trading platform. Our initiative has gained the respect and confidence of the cryptocurrency world by forging alliances with well-known exchanges and working with influential investors.

Users may trade in a secure and ethical environment because of OPNX’s decentralized approach and transparency. The integrity and transparency of the assets exchanged on the platform are supported by the Proof-of-Reserves (PoR) mechanism and zero-knowledge proof technology. Investors and consumers will find this trustworthy and appealing.

Users have a wider selection and a wider range of trading options thanks to the combination of cryptocurrency trading and stock/forex trading on OPNX.

Other advantages for users include lower transaction costs, incentives, and voting rights thanks to the Herdnomics function and the staking of OX tokens. This encourages communication and involvement within the community, strengthening OPNX’s development ecology.

Conclusion of Open Exchange Review

Open Exchange is a potential cryptocurrency trading project, with a decentralized model and transparency. Leading investors have previously shown interest in this initiative, and it has forged alliances with renowned exchanges. Hopefully, Coincu’s Open Exchange Review article has helped you get the necessary information.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.