The Web3 ecosystem is swiftly evolving into a cross-chain bridges landscape, characterized by a proliferation of decentralized applications spanning hundreds of distinct blockchains and layer-2 solutions.

Each of these platforms operates with its unique approach to addressing matters of security and trust. This trend is expected to persist, driven by the persistent challenge of blockchain scalability, further amplified by the introduction of new blockchains, layer-2 and layer-3 solutions, and self-contained networks like application-specific blockchains. These tailored networks cater to the specific technical and economic prerequisites of individual or smaller clusters of decentralized applications.

However, an inherent limitation persists: blockchains inherently lack the capability to seamlessly communicate with one another. Consequently, blockchain interoperability emerges as an imperative necessity to fully harness the potential of the multi-chain ecosystem. At the heart of blockchain interoperability lies the foundation of cross-chain messaging protocols, which empower smart contracts to both retrieve and transmit data to and from other blockchains.

As a significant portion of economic activity remains compartmentalized within isolated networks, the need for robust cross-chain interoperability solutions becomes increasingly apparent. These solutions play a pivotal role in facilitating the secure and seamless movement of both data and tokens across an interconnected network of blockchains.

Furthermore, a critical component of cross-chain interoperability is the cross-chain bridge, an infrastructure that facilitates the transfer of tokens from a source blockchain to a destination blockchain.

How Do Cross-Chain Bridges Work?

The blockchain universe is entering a new era of interconnectedness, thanks to the remarkable innovation of cross-chain bridges. These decentralized applications have taken center stage by enabling the seamless transfer of assets from one blockchain to another. In doing so, they significantly enhance the utility of tokens, forging cross-chain liquidity connections between distinct blockchains. The mechanics of a typical cross-chain bridge involve locking or burning tokens on the source chain through a smart contract and subsequently unlocking or minting tokens through another smart contract on the destination chain.

Token bridges, often underpinned by a specific cross-chain messaging protocol, are designed for a single, precise purpose: the movement of tokens between different blockchains. In essence, a cross-chain bridge represents a narrowly focused application of a cross-chain messaging protocol, frequently serving as an application-specific link between two blockchains. However, the versatility of these bridges extends beyond the basics, enabling more extensive cross-chain functionality that goes beyond mere token transfer.

Cross-chain bridges serve as a cornerstone for an array of applications, each amplifying the utility of blockchain technology:

- Cross-Chain Decentralized Exchanges (DEXs): By employing cross-chain bridges, DEXs are able to facilitate the exchange of assets between different blockchains, significantly expanding the liquidity and trading options available to users.

- Cross-Chain Money Markets: These bridges empower the creation of cross-chain lending and borrowing platforms, providing users with an avenue to maximize their assets’ potential.

- Generalized Cross-Chain Functionality: In some instances, cross-chain bridges play a pivotal role in offering more expansive and generalized cross-chain functionality. This includes the ability to facilitate a wide range of applications that span multiple blockchains.

As the crypto landscape matures and the demand for interoperability surges, cross-chain bridges emerge as a vital solution to realize the full potential of blockchain technology. By enabling the fluid transfer of assets across blockchains, they fuel the growth of decentralized finance (DeFi) and Web3 ecosystems. Moreover, cross-chain bridges offer users enhanced flexibility and opportunities for diversifying their investments.

Types of Cross-Chain Bridges

Cross-chain bridges are the backbone of the evolving multi-chain ecosystem, serving as conduits for tokens and data to traverse between disparate blockchains. These bridges are powered by three main mechanisms, each with its unique characteristics:

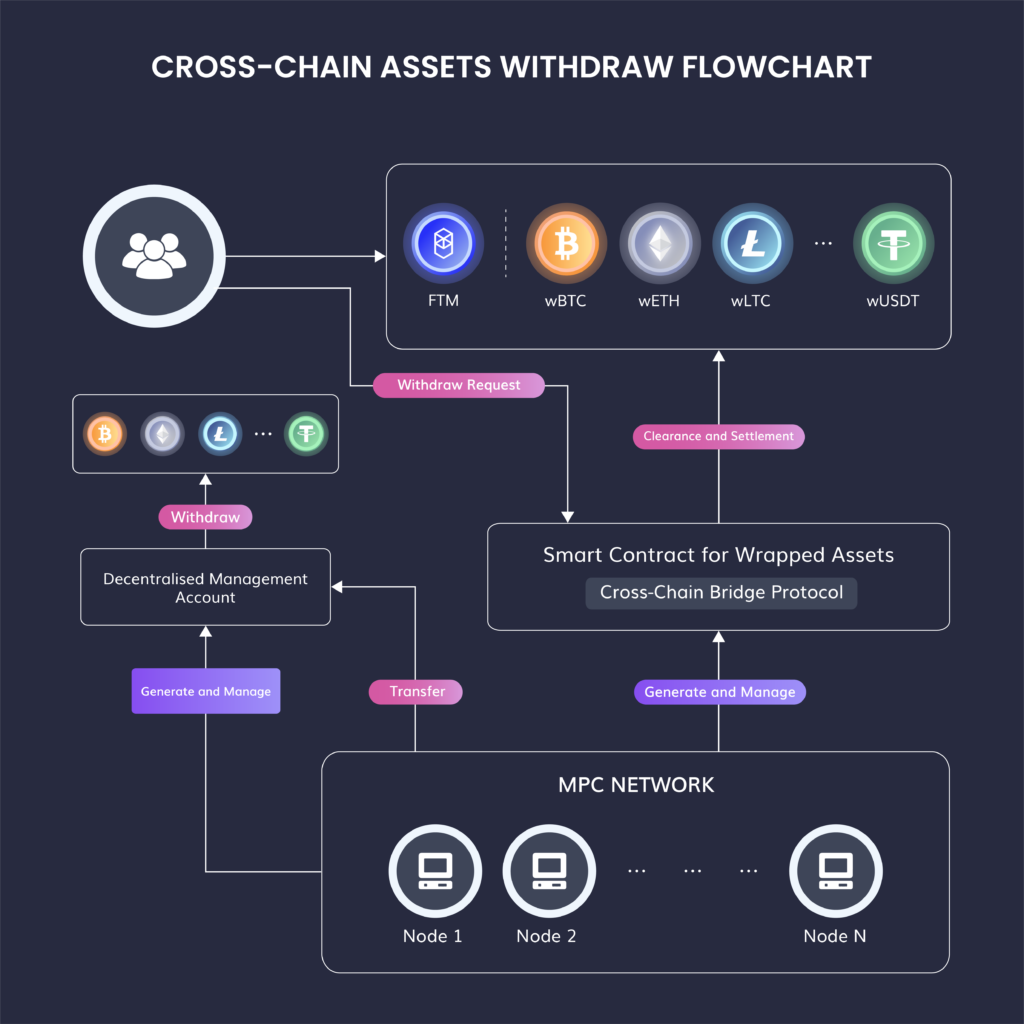

1. Lock and Mint Mechanism: In this approach, a user locks tokens in a smart contract on the source chain, and wrapped versions of these locked tokens are minted on the destination chain, resembling IOUs. To reverse the process, the wrapped tokens on the destination chain are burned, unlocking the original coins on the source chain. This mechanism offers bidirectional token transfer with flexibility.

2. Burn and Mint Mechanism: Users initiate this mechanism by burning tokens on the source chain, which are then re-issued (minted) on the destination chain as native tokens. It simplifies the process by ensuring that tokens are consistently native to the destination chain.

3. Lock and Unlock Mechanism: Here, users lock tokens on the source chain and subsequently unlock the same native tokens from a liquidity pool on the destination chain. Cross-chain bridges of this type often attract liquidity on both ends through economic incentives, such as revenue sharing.

Moreover, cross-chain bridges can extend their capabilities to include arbitrary data messaging. This entails the transfer of not only tokens but any form of data between blockchains. These programmable token bridges merge token bridging with arbitrary messaging, executing a smart contract call on the destination chain once tokens arrive at their destination.

Programmable token bridges introduce enhanced cross-chain functionality. They enable actions such as swapping, lending, staking, or depositing tokens into a smart contract on the destination chain within the same transaction as the bridging operation. This efficiency opens the door to a multitude of sophisticated use cases in the multi-chain landscape.

Another aspect of cross-chain bridges worthy of examination is their position on the trust-minimization spectrum. The degree of trust-minimization corresponds with the level of computational expense, flexibility, and generalizability. Solutions positioned further along this spectrum are characterized by stronger trust-minimization guarantees, which come at the cost of reduced flexibility and generality. These trade-offs are purposefully made to accommodate use cases that demand the utmost trust-minimization assurances, reinforcing the bridge’s reliability and security.

Why Cross-Chain Bridges Are Necessary in Web3?

The Web3 ecosystem is flourishing with innovation, brimming with decentralized applications (DApps) spread across an array of diverse blockchains and layer-2 solutions. Yet, an underlying challenge persists – these blockchains don’t natively converse with each other. Each chain operates within its self-contained domain, adhering to its unique rules governing protocol design, currency, programming language, governance structure, culture, and various other aspects. This individuality results in a significant communication barrier between chains, limiting their capacity to interact and coalesce. In essence, the current state of inter-blockchain communication often resembles isolated economies operating independently, with minimal connectivity between them.

The pressing need for cross-chain bridges can be best illustrated through a simple analogy. Imagine these blockchains as separate continents, each endowed with distinct strengths and resources. Continent A boasts bountiful natural resources, Continent B possesses fertile lands for agriculture, while Continent C thrives with a booming manufacturing industry and skilled artisans.

In a world where these continents can efficiently connect and share their strengths, a prosperous global community emerges. However, without the means to bridge their distinct economies through shipping, bridges, tunnels, or other infrastructure, these regions remain isolated. Continent A lacks access to food, Continent B fails to optimize its food production, and Continent C remains incapable of manufacturing top-tier products. The result is a suboptimal state of affairs.

Yet, consider the alternative—a world where these economies are interconnected, where each region specializes in its unique competency while benefiting from the collective wealth and innovation of the entire world through trade. This is precisely the vision of blockchain interoperability, the construction of cross-chain bridges, and the creation of interconnected economies within the Web3 ecosystem.

The challenges of blockchain interoperability extend beyond technological intricacies. They encompass the realization of a world where data, value, and assets can fluidly traverse the diverse blockchain networks. The development of secure, efficient, and scalable cross-chain messaging protocols and bridges is vital to this vision.

To guide users through the intricate terrain of cross-chain, we’ve curated a list of the Top 5 crypto bridges worth exploring. Our selection criteria encompass factors such as bridge security, network compatibility, liquidity, fee dynamics, and the overall user-centric experience.

1. LayerZero ($ZRO)

LayerZero is engineered to streamline the development of decentralized applications (dApps) across diverse blockchains, unraveling complexities and facilitating seamless information exchange while upholding paramount security standards for both users and dApps.

A Glimpse into LayerZero’s Key Features:

1. Dex Crosschain: With LayerZero, dApps have the capacity to efficiently conduct decentralized exchanges (Dex) across multiple blockchains. This feature opens up a world of opportunities for users and developers, as assets can be freely and securely traded across various blockchain networks.

2. Unlock Liquidity: LayerZero doesn’t just enable cross-chain transactions; it unlocks liquidity across the decentralized landscape. Users and dApps can seamlessly access and utilize liquidity pools from different blockchains, bolstering the efficiency and fluidity of the broader DeFi ecosystem.

3. Multichain Lending and Borrowing: One of LayerZero’s standout capabilities is its support for multichain lending and borrowing. This means that users can access a broad spectrum of lending and borrowing services across various blockchains, eliminating the traditional boundaries that often restrict DeFi operations.

4. Derivatives for Every Asset: LayerZero empowers dApps to create derivatives for virtually any asset. This flexibility transcends traditional limitations, making it possible to tokenize and trade derivatives of a wide range of assets, from cryptocurrencies to real-world commodities.

5. Transaction Optimization: LayerZero’s architecture is designed to optimize transactions, minimizing latency and enhancing the efficiency of data transfers across blockchains. This ensures that users experience smooth and swift interactions while enjoying the benefits of cross-chain functionality.

6. Determine State: In the multifaceted world of blockchain technology, determining the state of various assets and networks is paramount. LayerZero provides dApps with the tools to efficiently monitor and manage the state of assets and applications across multiple blockchains, thereby ensuring robust security and seamless operations.

LayerZero’s introduction marks a significant leap forward in the development of decentralized applications, breaking down barriers and streamlining the interactions between different blockchains. The protocol’s features, ranging from Dex Crosschain to transaction optimization, offer users and developers a comprehensive toolkit for creating a more connected and versatile decentralized ecosystem. By enabling the efficient exchange of information and value across a network of blockchains, LayerZero is set to usher in a new era of DeFi, unleashing untapped possibilities and fostering the growth of the blockchain landscape.

2. Composable Finance ($LAYR)

Composable Finance stands as the foundational layer that acts as a bridge connecting Layer 1 (L1) and Layer 2 (L2) networks. But it doesn’t stop there—Composable Finance is not only expanding Inter-Blockchain Communication (IBC) capabilities to other ecosystems but is also pushing the boundaries of trust-minimized interoperability. This innovative platform is abstracting the cross-chain experience for users, enabling the seamless, chain-agnostic execution of user intentions.

1. Composable Cross-chain Virtual Machine (Composable XCVM): At the heart of Composable Finance’s capabilities is the Composable XCVM, a technological marvel that facilitates trust-minimized cross-chain execution. It empowers users to interact with various blockchains, whether they reside in Layer 1 or Layer 2. This breakthrough technology ensures that user intentions are executed seamlessly, regardless of the blockchain’s origin. It transforms the way users experience and interact with the blockchain, eliminating the complexities traditionally associated with cross-chain transactions.

2. Routing Layer: The Routing Layer is an integral component of Composable Finance’s infrastructure, responsible for facilitating the seamless flow of data and assets across different blockchains. It optimizes the routing process, ensuring that cross-chain transactions occur with efficiency and speed. This feature is paramount in the Composable Finance architecture, as it lays the foundation for the platform’s ability to abstract the complexities of cross-chain execution.

3. Mosaic: Mosaic is a concept intrinsic to Composable Finance, representing the unique interplay of interoperability and composable elements within the platform. Mosaic not only simplifies the cross-chain experience for users but also enriches it by enabling the efficient combination of diverse blockchain resources and services. This amalgamation of capabilities allows users to harness the full potential of blockchain technologies, breaking down silos and fostering a more interconnected and versatile ecosystem.

4. Parachain: Parachains are an essential feature of Composable Finance, serving as the gateways that enable access to a wide array of blockchains. Parachains effectively expand the platform’s reach, connecting it to different ecosystems and networks. This extension of capability opens up a world of possibilities for users and developers, allowing them to explore and benefit from the extensive array of services and resources available across various blockchains.

Composable Finance’s relentless pursuit of trust-minimized interoperability is paving the way for a more connected and inclusive blockchain ecosystem. As the platform abstracts the complexities of cross-chain transactions and fosters seamless execution, users and developers are presented with a world of opportunities to harness the full potential of blockchain technologies.

3. Biconomy ($BICO)

Biconomy emerges as a transformative force, offering a multi-chain transaction infrastructure that simplifies and democratizes the Web 3.0 experience. Through Biconomy’s intuitive plug & play APIs, it becomes effortless for anyone, regardless of their cryptocurrency knowledge and expertise, to access decentralized applications (dApps). Biconomy stands as a solution to many blockchain challenges, introducing features like gasless transactions, instant cross-chain transfers, and flexible gas fee payment options, empowering users to engage with the decentralized world with ease.

- Modular Smart Accounts: Biconomy’s modular smart accounts are a game-changer. They facilitate seamless, gas-efficient transactions by allowing users to create smart contracts with adjustable parameters. This feature opens up a world of possibilities for developers and users alike, making it easier to customize transactions to suit their unique needs.

- Paymasters Service: Biconomy’s Paymasters service introduces a novel approach to gas fees. Users can delegate the responsibility of paying gas fees to a third party, streamlining the transaction process and ensuring a smoother user experience. It significantly reduces the friction associated with handling gas costs while engaging with dApps.

- Bundler Service: The Bundler service is another pioneering feature offered by Biconomy. It optimizes gas consumption by bundling multiple transactions into a single package. This not only lowers the overall gas fees but also enhances the efficiency of the transaction process. It’s a win-win for both users and developers, who can provide a more cost-effective experience for their customers.

- Gasless SDK (EOA): Biconomy simplifies the process of interacting with decentralized applications by offering a gasless SDK. This enables users to engage with dApps without needing to manage gas payments, making the experience more user-friendly and appealing to a broader audience.

Biconomy’s innovative approach addresses the real-world barriers that have, at times, hindered the adoption of Web 3.0 technologies. By offering a user-centric infrastructure with a focus on accessibility, reduced friction, and cost-effectiveness, Biconomy plays a vital role in advancing the Web 3.0 ecosystem. It opens the doors for a more inclusive and seamless future in decentralized applications, ensuring that anyone, regardless of their cryptocurrency background, can participate in the exciting world of Web 3.0.

4. Celer Network ($CELR)

Celer is a blockchain interoperability protocol enabling a one-click user experience accessing tokens, DeFi, GameFi, NFTs, governance, and more across multiple chains.

Celer presents itself as a blockchain interoperability protocol that streamlines the user experience, offering one-click access to diverse functionalities spanning across chains. It’s a world where developers can construct inter-chain-native dApps effortlessly, capitalizing on efficient liquidity utilization, coherent application logic, and shared states. Meanwhile, users of Celer-enabled dApps are set to revel in the diverse, multi-blockchain ecosystem, all within the simplicity of a single-transaction user experience, effortlessly accessible from a single chain.

Celer’s Key Features

- State Guardian Network (SGN): At the core of Celer’s infrastructure lies the State Guardian Network (SGN). This component plays a pivotal role in ensuring the security and reliability of cross-chain transactions. By serving as the guardian of crucial states across multiple chains, the SGN offers robust protection and trust, crucial for successful multi-chain operations.

- Layer2.finance: Celer’s Layer2.finance component is designed to streamline the financial aspects of the multi-chain ecosystem. It optimizes the financial workflows across chains, offering a seamless and efficient way for users to manage and transact with various assets. This innovative approach significantly enhances the user experience.

- CelerX: CelerX serves as the gateway to an immersive gaming and entertainment experience. It leverages Celer’s blockchain interoperability to create a unified gaming ecosystem where users can access a wide array of GameFi and NFTs across multiple chains. This is an exciting development for the gaming and entertainment industry, creating a seamless and interactive space for users and developers alike.

- Cbridge: Celer’s Cbridge acts as the bridge that facilitates smooth and secure communication between diverse chains. This bridge plays a pivotal role in ensuring that data and assets flow effortlessly and safely across the multi-chain environment, making it a crucial component for the success of Celer’s blockchain interoperability vision.

Celer’s blockchain interoperability protocol is poised to change the landscape of decentralized technologies. It empowers developers to build and innovate within a seamless multi-chain environment, providing users with a unified and user-friendly experience. As Celer continues to evolve and expand its reach, it holds the promise of fostering a more integrated and connected blockchain ecosystem, where the potential of diverse chains can be harnessed with ease and efficiency.

5. Across Protocol

Across is an interoperability solution powered by intents. Intents is proving to be a winning solution in the bridging space as Across tends to dominate the routes it supports, as it is frequently able to provide the cheapest and fastest bridge option. Across, secured by UMA’s optimistic oracle, sets itself apart from its competitors with its intents-based infrastructure and by exclusively transferring canonical or genuine assets cross-chain, prioritizing user security. Currently, Across is leading the industry in daily bridge volume because of its competitive rates and speeds and a long track record of user safety.

The Across Advantage: Highest Speeds, Lowest Fees

At its launch in 2021, Across dedicated itself to optimizing its bridging framework for capital efficiency, theorizing that the most capital efficient bridge would ultimately win. While many bridges have adopted messaging or lock and mint designs for their cross-chain solution, Across was the first to pioneer the intents model, which utilizes a third-party filler network to execute bridge transfers. These third-party relayers or fillers send bridge users funds on the destination chain, using their own capital, and wait to get repaid with the user’s original funds via the chain’s official bridge. This design allows transfers to happen extremely quickly, at a much cheaper fee than sending a cross-chain message and much more securely than lock and mint bridges which send representative, synthetic assets to users on the destination chain.

Key Features of Across Protocol

- Across Bridge: Across is quoted in the top 2 results on bridge aggregators upwards of 90% of the time, on its supported routes. Its unique design makes it the cheapest and fastest bridge in production, and boasts a zero slippage model.

- Across+: Although Across is famous for its bridge, the protocol understands that eventually bridging needs to go away, as in, it needs to be abstracted to the background. Across+ is the protocol’s chain abstraction tool which allows protocol to bundle bridge + action(s) into their dapp, allowing them to pull capital cross-chain to their platforms. This product was built to help L2-native protocols with user and capital onboarding by removing the bridging hurdle from the equation.

- Across Settlement: As our ecosystem continues to disconnect as a result of the emergence of 100’s of rollups, liquidity is more fragmented and cross-chain interoperability becomes more crucial. Across Settlement is able to provide best execution cross-chain settlement with its modular, intents-based infrastructure. Messages are verified in bundles, and execution happens optimistically by a third-party set of fillers. These factors result in faster, cost-effective cross-chain transfers, remove trust assumptions and provide a Web2-grade UX.

More recently, Across teamed up with Uniswap Labs to announce their proposed standard for cross-chain intents, ERC-7683. This standard proposes that intent-based protocols use a unified order system, so that a universal filler network can be used to execute intents. If widely adopted, this unification would result in end users enjoying lower bridge costs and an improved UX, to mention a few. As the multichain economy continues to evolve, intents-based settlement is the key to solving interoperability and Across is at the core of its execution.

Conclusion

As the cross-chain ecosystem continues to evolve, the importance of selecting a cost-effective and dependable bridge cannot be overstated, as it plays a pivotal role in ensuring smooth asset transfers between diverse blockchain networks. Our in-depth analysis highlights the significance of choosing trustworthy, audited, and user-centric platforms, such as Across Protocol, Stargate Finance, and Orbiter Finance, to name a few.

These platforms not only guarantee secure and economical bridging but also contribute to the creation of a more integrated and efficient blockchain infrastructure. Whether you are navigating the realms of Layer 1, Layer 2, or exploring bridging solutions for both EVM and non-EVM environments, our curated selection of bridges serves as a robust starting point for making well-informed decisions on your cross-chain journey.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.