Key Points:

- The Federal Reserve will announce its decision on interest rates on November 1, with a high probability that rates will remain unchanged.

- The United States will release the unemployment rate for October this week.

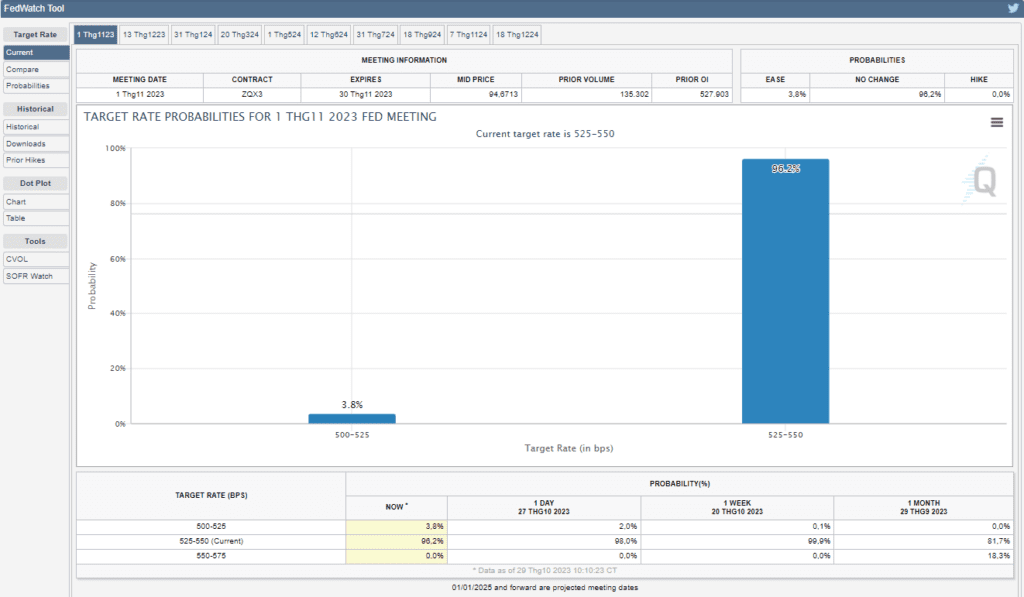

The Fed interest rate decision will be announce on Nov 1. 94.2% chance rates will remain unchanged. Unemployment rate for October will also be released.

The Federal Reserve is scheduled to announce its decision on interest rates on November 1. According to CME, there is a 94.2% chance that the current interest rates will remain unchanged and not increase. The United States will also release the unemployment rate for October this week.

BTC experienced a 14% increase in value in the week leading up to the FED interest rate decision on November 1. It is currently trading at around $34,200 after reaching a new yearly high of $35,000 but failing to break through that price level.

Fed Interest Rate Decision

On October 10, Atlanta Fed Bank President Raphael Bostic and Minneapolis Fed President Neel Kashkari suggested that the central bank may not require further rate hikes. Meanwhile, Dallas Fed President Lorie Logan and Fed Governor Christopher Waller argued that the rise in Treasury yields has already fulfilled the Fed’s job, eliminating the need for an immediate rate hike, according to Reuters.

Fed Chair Jerome Powell stated late last month that “inflation is still too high,” causing expectations that another rate hike may be possible later this year.

Since last year, the Fed has raised interest rates 11 times, the fastest rate of tightening since the early 1980s. However, economists and central bankers generally agree that interest rates will remain higher for an extended period of time.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.