Understanding the Average Directional Index (ADX)

The Average Directional Index (ADX) is a powerful tool used to assess the strength of a trend. Traders and financial experts across various markets rely on this indicator to make informed decisions based on trend strength.

Originally developed by Welles Wilder for daily commodity charts, the ADX has gained widespread popularity among technical traders. It is a non-directional indicator that measures trend strength, regardless of whether prices are rising or falling. The ADX is part of the Directional Movement System, which also includes the DMI+ and DMI- indicators. It is represented by a single line with readings ranging from 0 to 100, and is typically displayed alongside the two DMI lines used in its calculation.

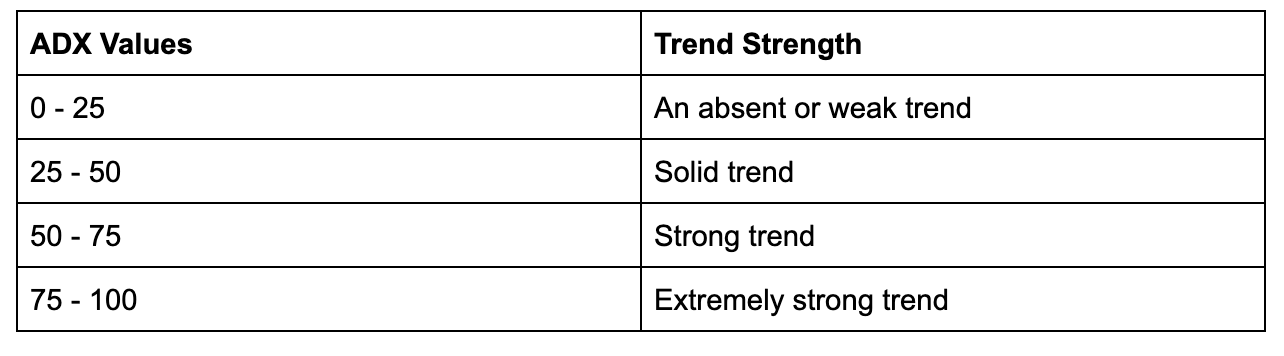

Interpreting ADX values is relatively straightforward:

Calculating the Average Directional Index (ADX)

To calculate the ADX indicator, follow these steps:

1. Calculate the Directional Movement (+DM) using the formula:

+DM = Current High – Previous High

2. Calculate -DM using:

-DM = Previous Low – Current Low

3. Choose the higher value between +DM and -DM.

4. Calculate the True Range (TR) using one of the following formulas:

– Current high – Current low

– Current low – Previous close

– Current high – Previous close

5. Calculate the smoothed 14-period averages of TR, +DM, and -DM using the following formulas:

First 14TR = Sum of the first 14 TR readings

Next 14TR = first 14TR – (prior 14TR/14) + current TR

6. Calculate the +DI and -DM values using:

+DI = (Smoothed +DM / ATR) x 100

-DI = (Smoothed -DM / ATR) x 100

7. Calculate the directional movement index (DMI) using the equation:

DX = ( | +DI – -DI | / | +DI + -DI | ) x 100

8. To calculate ADX, determine the DX for all 14 periods. For the first ADX, divide the sum of all 14 periods of DX by 14. For the remaining 13, use the following formula:

ADX = (Previous ADX x 13 + Current ADX) / 14

It’s important to note that manual calculations are not necessary, as the entire process is automated during trading.

Other popular trading indicators include on-balance volume (OBV), accumulation/distribution line, moving average convergence divergence (MACD), and relative strength index (RSI).