Key Points:

- First Trust Portfolios introduces the First Trust Bitcoin Buffer ETF to manage risks and gains in the volatile cryptocurrency market.

- Ongoing discussions with the SEC indicate a favorable trend for spot Bitcoin ETF approvals, signaling optimism in the cryptocurrency sector.

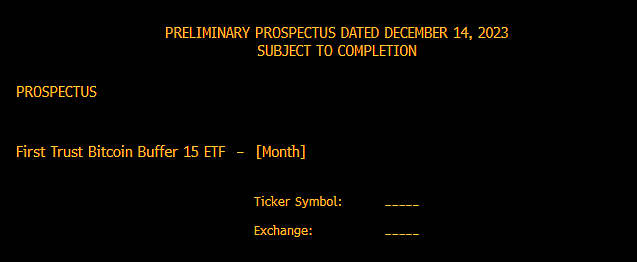

First Trust Portfolios, L.P., a reputable investment management company, has taken a significant step in the evolving landscape of cryptocurrency investments. The firm recently submitted a Form N1-A filing to the United States Securities and Exchange Commission (SEC), unveiling plans for an innovative financial instrument—the First Trust Bitcoin Buffer ETF.

First Trust Unveils Innovative First Trust Bitcoin Buffer ETF to Navigate Crypto Volatility

According to James Seyffart, an ETF analyst at Bloomberg, First Trust’s application outlines a “buffer” Bitcoin ETF that aims to mitigate downside risks by preventing a specified percentage of losses while simultaneously capping potential upside gains. The distinguishing feature of the First Trust Bitcoin Buffer ETF is its unique protection against the initial 30% of potential losses in the underlying ETF during specified Target Outcome Periods. This groundbreaking development comes amid a growing trend in the financial industry, with other major players entering the Bitcoin ETF arena. In June, BlackRock, a leading investment asset management firm, filed an application for a spot BTC ETF with the SEC, designating Coinbase as its custodian. BlackRock’s move sparked a wave of similar applications from industry giants like Fidelity Investments, WisdomTree, Valkyrie, VanEck, and Invesco. While awaiting SEC approval for these applications, the broader crypto industry remains keenly interested in the regulator’s stance on Bitcoin ETFs. Recent positive signals suggest ongoing negotiations between companies and the SEC regarding spot Bitcoin ETF applications. In the coming weeks, market observers anticipate additional entrants in the field to unveil unique strategies for differentiating themselves in the competitive landscape of Bitcoin exposure.DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.