Key Points:

- QCP Capital report reveals a spike in Bitcoin call option buying, totaling $10 million.

- Notable concentration at $60K and $80K strikes from April to December.

Bitcoin call option buying, particularly at strike prices above $60,000, according to a recent report.

QCP Capital’s Options Vol-cast report, released on Thursday, highlighted a substantial increase in Bitcoin call option purchases, with nearly $10 million spent on premiums for strike prices at $60,000 and $80,000. These call options cover expiries from April through December this year.

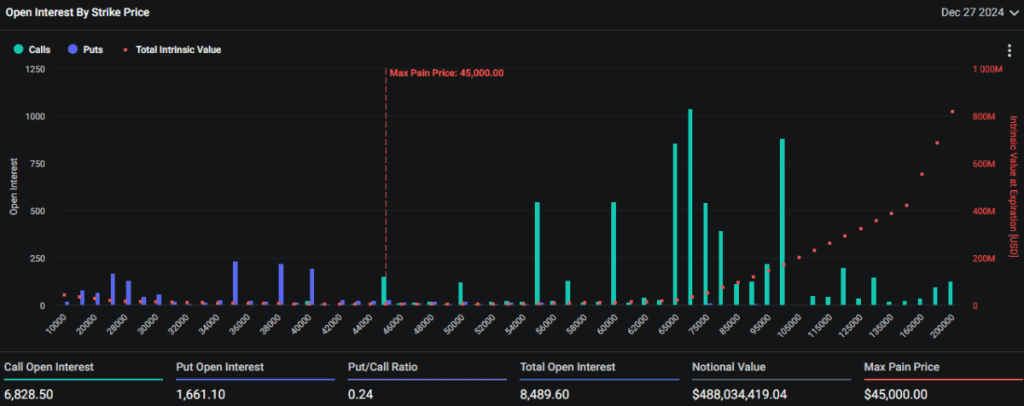

The report aligns with data from the Deribit cryptocurrency derivatives exchange, revealing a significant concentration of open Bitcoin call options at strike prices of $65,000 and above. Notably, for the December end-of-year expiry, there is a concentrated cluster at a striking $100,000.

Bitcoin Options Frenzy Signals Market Optimism and High Stakes

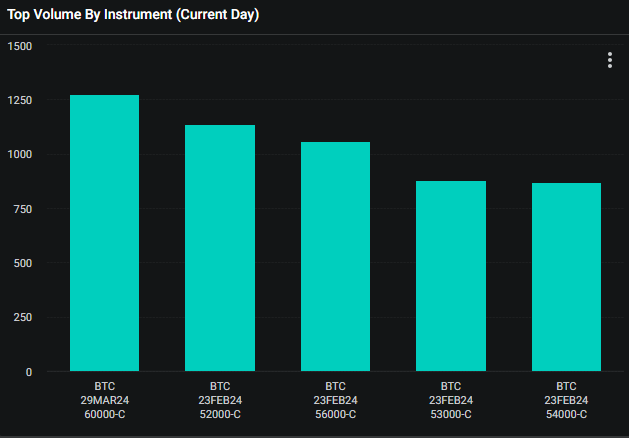

Examining upcoming expiries, the largest volume of Bitcoin options is concentrated in calls at a $60,000 strike price for the end of March expiry. According to Deribit data, there are 1,273 contracts for Bitcoin calls at $60,000, totaling a notional value surpassing $67 million.

This concentration of Bitcoin calls at $60,000 and above implies a notable anticipation among market participants that the cryptocurrency’s price will surpass this level. The trend indicates a growing optimism or expectation in the market, as investors actively engage in call option buying to capitalize on potential future price increases.

Bitcoin Call Options at $60K Reflect Investor Confidence

For those unfamiliar with options trading, buying an options premium involves paying a fee to acquire the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specified timeframe. In this case, investors are expressing their confidence in Bitcoin’s upward movement by purchasing call options at various strike prices.

As the market dynamics evolve, the increased interest in call options reflects a nuanced sentiment among investors, shedding light on their expectations for Bitcoin’s trajectory in the coming months.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |