Key Points:

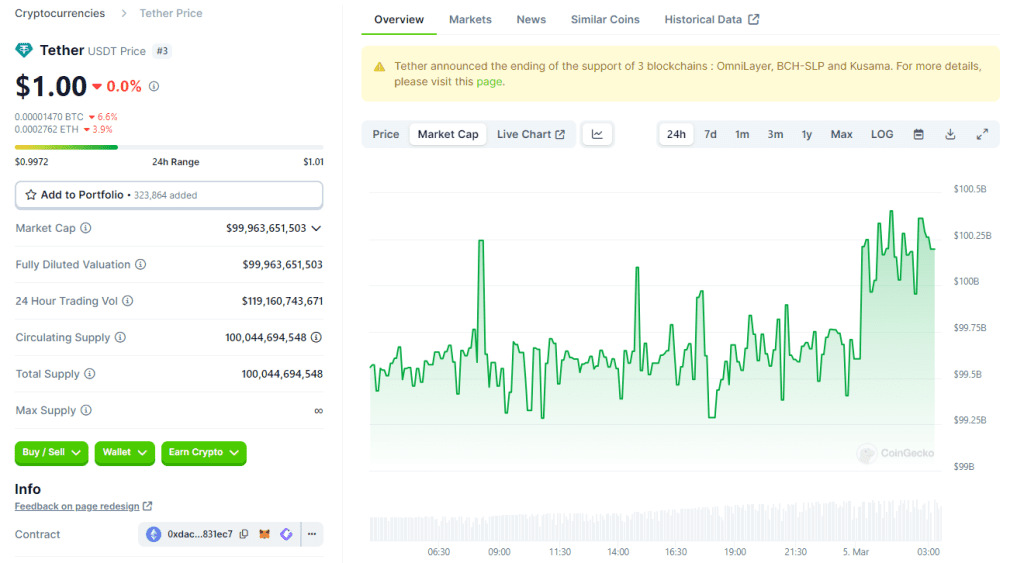

- Tether’s stablecoin, USDT, recently hit a milestone with its market cap briefly exceeding $100 billion.

- The trading volume of USDT also surpassed $119 billion, reflecting high trading activity.

Tether’s USDT briefly surpassed $100 billion in market cap amidst a crypto trading frenzy, with USDT trading volume exceeding $119 billion.

Tether’s stablecoin, USDT, recently reached a historical milestone as its market capitalization briefly exceeded $100 billion, as per CoinGecko data. The trading volume of USDT also exceeded $119 billion, indicating a high level of activity.

What’s driving the surge in USDT trading volume?

As the most popular stablecoin, USDT plays a crucial role in the digital asset market. It stands as a bridge between traditional fiat money and blockchain-based markets, providing liquidity for trading and lending.

Increasingly, it’s being used for transfers and savings in developing regions to access dollars outside of the traditional banking system.

USDT’s history traces back to 2014, and since then, it has expanded to several blockchains and launched stablecoins pegged to other assets.

Readmore: BlackRock Spot Ethereum ETF Is Now Delayed By SEC To Extend Approval Period

Scrutiny Over Tether’s Reserve Management Practices

Its market value saw significant growth during the 2020-2021 crypto bull market, rising from $4 billion to $83 billion by mid-2022. It is now the preferred trading pair for cryptocurrency prices on centralized exchanges.

Despite the success, Tether has faced scrutiny over its reserve management, including the use of risky backing assets and a lack of independent audits. However, the company states that it is now primarily backed by more secure investments such as U.S. Treasury bills and deposits in money market funds.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |