Key Points:

- Hong Kong SFC warns against MEXC’s unlicensed operations targeting investors.

- MEXC added to list of suspicious platforms violating local laws.

- Crypto investors cautioned of potential scams and urged to trade on registered platforms.

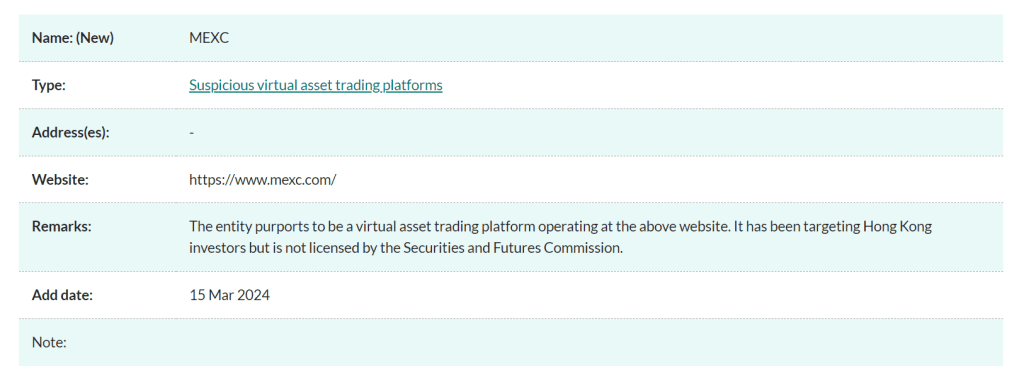

Hong Kong SFC has issued a public warning concerning MEXC’s unlicensed operations within its jurisdiction.

Hong Kong SFC highlighted that despite purporting to be a virtual asset trading platform targeting Hong Kong investors, MEXC lacks the necessary licensing.

As a result, MEXC has been included in Hong Kong’s list of suspicious virtual asset trading platforms, alongside other notable crypto firms like ByBit. The SFC emphasized that MEXC’s operation in the city-state constitutes a violation of local laws, particularly under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

Readmore: Popular Bitcoin ETFs: Exploring the Pros and Cons

MEXC Added to List of Suspicious Platforms

This warning isn’t the first time the Hong Kong SFC has addressed concerns related to MEXC. Earlier, the regulator warned of scammers impersonating the exchange, using phishing links to lure unsuspecting victims into potential crypto investment scams.

Hong Kong SFC reiterated its commitment to taking enforcement action against unlicensed activities where necessary, indicating a potential regulatory crackdown on MEXC if compliance isn’t met. Additionally, the regulator cautioned crypto investors against trading on unregistered platforms, highlighting the risks of potential investment losses.

The SFC’s warning regarding MEXC comes amidst its recent closure of the registration window for crypto firms to apply for licensing in Hong Kong. Unregistered entities are mandated to cease operations by the end of May, underscoring the regulatory tightening within the Asian city-state’s crypto space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |