Puffer Finance, a restaking protocol that receives an investment from Binance Labs to develop technology and infrastructure, Puffer Finance has emerged as a prominent topic in the restaking community. Let’s take a closer look at this project!

What is Puffer Finance?

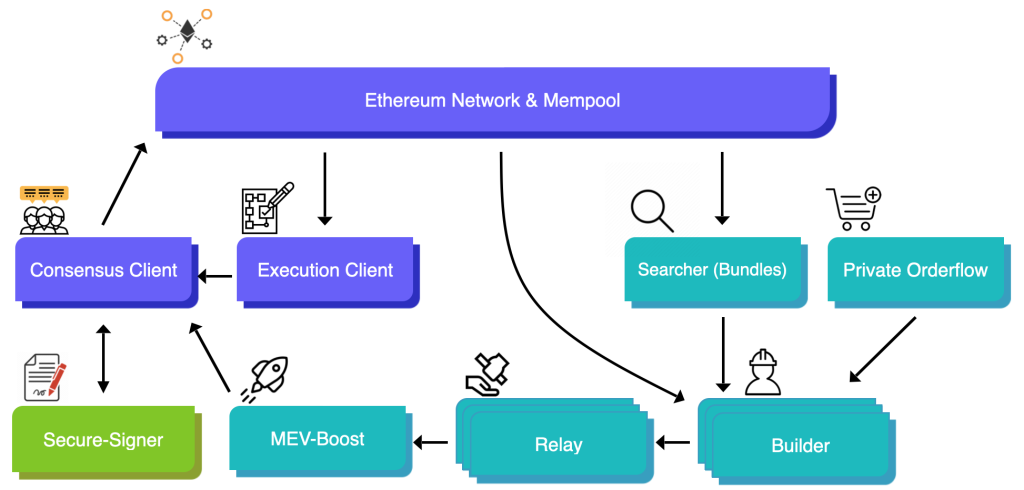

Puffer Finance is a liquid restaking protocol that operates on EigenLayer. It incorporates anti-slashing mechanisms and secure signer tools to prevent validator misbehavior. The platform aims to enhance Ethereum’s Proof of Stake ecosystem by promoting diverse validator sets and reducing centralization. It thus addresses challenges that individual validators often face. Puffer Finance mainly caters to mainstream users and individual validators who lack the 32 ETH required for Ethereum validation. For mainstream users, Puffer Finance offers a platform to stake ETH, earn pufETH tokens, and make profits. Conversely, Validators only need 2 ETH to operate a Puffer node, rather than the 32 ETH required to run an Ethereum node.

Puffer Finance’s Technology

Secure Signer

Puffer Secure Signer is a remote signing tool funded by the Ethereum Foundation that is designed to prevent suspicious activities associated with Intel SGX usage. The Secure Signer leverages Trusted Execution Environments (TEE), currently deployed as Intel SGX. To mitigate undue impacts, Puffer Finance is committed to ensuring diversity by planning to deploy the Secure-Signer on AMD’s SEV TEE and new hardware upon their market release.

RAV

RAV (Remote Attestation Verification) is a tool that Ethereum uses to monitor the remote activities of validators operating within the network. To put it simply, RAV is the way Ethereum minimizes the damage a validator could cause to the network, thereby enhancing performance, security, and scalability in a safe manner.

How Does Puffer Finance Work?

- Puffer DAO introduces a restaking module that allows only PoS validation without restaking, creating a secure environment for Node Operators (NoOps).

- Stakers will stake their ETH and receive corresponding amounts of pufETH in return.

- NoOps submit validator tickets and 1 ETH to the Puffer Protocol to register for node operation. In exchange, they receive pufETH, locked until the NoOp no longer performs validation functions.

- Each restaking module will contain a queue of NoOps registered for validation. When the Puffer Pool accumulates enough 32 ETH from user deposits and rewards, it will grant operation rights to waiting NoOps.

- Once the validation process is deployed, NoOps will be validated according to the time specified on their validator tickets. Throughout this process, NoOps will retain 100% of the rewards from validation.

- Restaking operators will perform AVS and receive commissions from their services, thereby increasing rewards for stakers.

- Upon exiting validation, NoOps will receive their locked pufETH back, and any unused validator tickets will be refunded to them.

Tokenomics and Use Case

There is currently no information available.

Team and Investors

Team

Co-Founder & CEO: Amir Forouzani

Amir holds a Bachelor of Applied Science (BASc.) from Monash University. He later pursued a Bachelor’s degree in Science at the University of California, followed by a Master’s degree in Science at the University of Southern California. His most notable work experience includes a nearly three-year stint at Nase.

Jason Vranek: Co Founder & CTO

Jason earned his Bachelor’s in Computer Science, Master’s in Computer and Information Science, and Ph.D. in Computer Science and Engineering from the University of California. Despite having limited work experience—only two months at Chainlink Labs—he has spent a significant amount of time at his alma mater, serving in various roles such as teaching assistant, tutor, and programmer.

Investors

- 01/01/2023: At the Pre-Seed round, Puffer successfully raised $650K with participation from Jump Capital, IoTex, and Arcanum Capital and received a Grant from the Ethereum Foundation.

- 09/08/2023: Puffer successfully raised $5.5M with participation from Lemniscap, Faction, LBank Labs, SNZ Capital, and some prominent Angel Investors such as Sreeram Kannan, Calvin Liu from EigenLayer, Frederick Allen from Coinbase, Mr Block from Curve Finance,…

- January 2024: Binance Labs announced an investment in Puffer Finance.

Read More: Top 10 Binance Labs Investments To Watch

The Vision of Puffer Finance

Puffer Finance’s vision is to revolutionize staking in the blockchain ecosystem by offering users and validators a secure and efficient platform. With investment from Binance Labs, Puffer Finance aims to diversify validator sets, reduce centralization, and improve the accessibility of staking opportunities for both individual validators and mainstream users. By introducing innovative features like the restaking module and secure signer tools, Puffer Finance strives to enhance the staking experience, safeguarding the integrity and decentralization of Proof of Stake networks such as Ethereum.

Conclusion

In this Puffer Finance review, we can see that it’s a promising project in the LRT sector. Its proprietary technologies, such as Secure Signer and RAV, embody progress in the blockchain world.

CoinCu rates Puffer Finance as an advanced project built by an experienced and professional development team. Notably, this project is receiving strong support from reputable investors, including the Ethereum Foundation. Although the project is still in development, has not launched a token, and has a long development time ahead, it is a potential project. We will continue to follow, evaluate, and look for opportunities in the future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |