Key Points:

- Court ruling rejects Coinbase’s motion, affirming SEC’s allegations of securities law violations.

- Coinbase’s operations as an exchange, broker, and through its Coinbase Staking Program scrutinized.

- Legal implications extend to control person liability and compliance challenges in the crypto industry.

Coinbase staking program in response to allegations brought forth by the U.S. Securities and Exchange Commission (SEC).

The ruling, which addresses multiple facets of Coinbase’s operations, has far-reaching implications for the cryptocurrency industry.

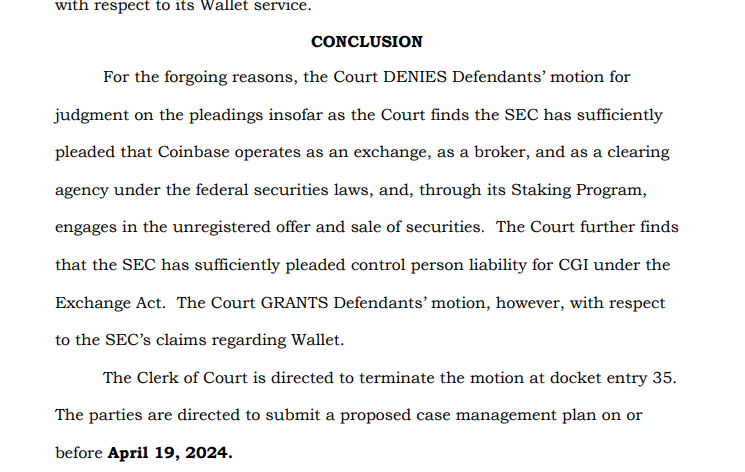

According to the court’s decision, the SEC has successfully demonstrated that Coinbase operates as an exchange, a broker, and a clearing agency under federal securities laws. This finding underscores the regulatory scrutiny faced by cryptocurrency platforms like Coinbase, highlighting the need for compliance with existing securities regulations.

Read more: What is Bitcoin Halving? Why is this event of interest?

SEC Allegations Upheld in Securities Law Case!

Of particular concern to the court was Coinbase Staking Program, which allows users to stake cryptocurrencies in exchange for rewards. The court determined that Coinbase’s involvement in the Staking Program constitutes the unregistered offer and sale of securities, raising legal questions regarding the platform’s compliance with securities laws.

The court found that the SEC has sufficiently pleaded control person liability for Coinbase Global Inc. (CGI) under the Exchange Act. This ruling suggests that Coinbase Staking Program may be held liable for the actions of its executives or individuals in positions of control within the company, further emphasizing the importance of regulatory compliance and corporate governance in the cryptocurrency sector.

Implications of SEC Allegations on Coinbase’s Future!

The court granted Coinbase’s motion with respect to the SEC’s claims regarding Wallet, indicating a partial victory for the cryptocurrency exchange platform. Despite this reprieve, the broader implications of the court’s ruling underscore the regulatory challenges facing cryptocurrency companies and the need for comprehensive legal strategies to navigate the evolving regulatory landscape.

The ruling against Coinbase serves as a reminder of the increasing regulatory scrutiny faced by cryptocurrency platforms, highlighting the importance of compliance with securities laws and regulations. As the cryptocurrency industry continues to mature, regulatory compliance will remain a key consideration for market participants, shaping the future of the digital asset ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |