Key Points:

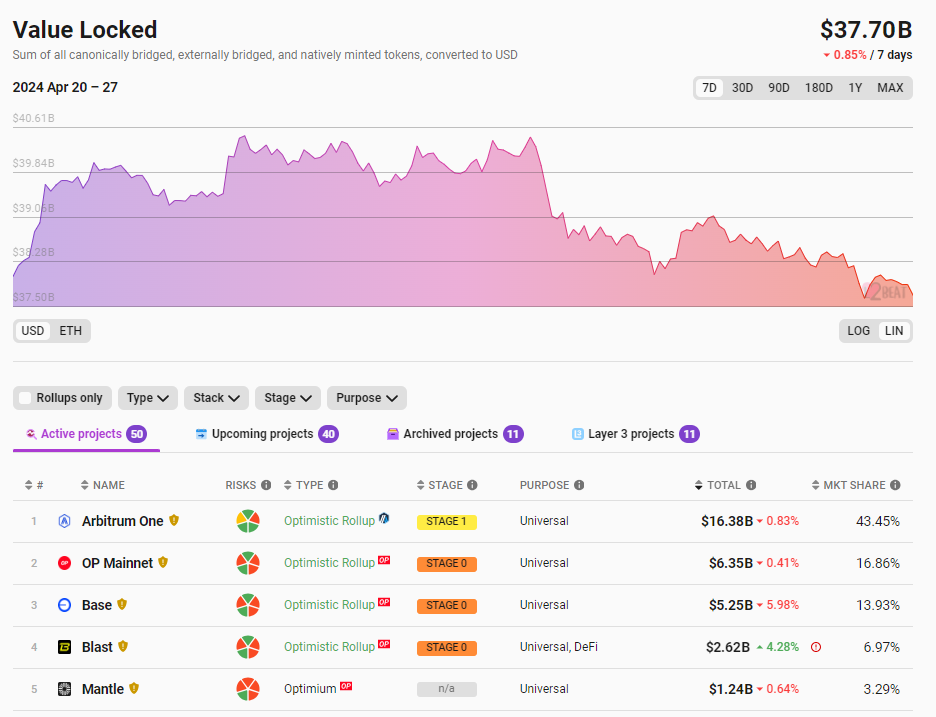

- Total locked-up volume: US$37.7 billion, down 0.85%.

- Arbitrum One leads with $16.38 billion.

- Base sees significant decline while Blast experiences notable increase.

Recent data from L2BEAT sheds light on the current state of the Ethereum Layer 2 network, revealing both notable figures and trends within the ecosystem.

As of the latest update, the total locked-up volume of the Ethereum Layer 2 network stands at an impressive US$37.7 billion. However, this figure represents a slight decrease of 0.85% compared to the previous day.

Delving deeper into the data, it’s evident that certain Layer 2 solutions hold significant positions within the network. The top five locked positions are dominated by platforms such as Arbitrum One, OP Mainnet, Base, Blast, and Mantle, each contributing to the overall landscape of Ethereum’s scalability solutions.

Arbitrum One leads the pack with a substantial locked-up volume of $16.38 billion. While still commanding a significant portion of the network, it experienced a marginal decline of 0.83% on the 7th, reflecting the dynamic nature of Layer 2 activity.

Base Witness Significant Decline, Blast Surges

Following closely behind is OP Mainnet, securing the second position with a locked-up volume of $6.35 billion. Despite a slight decrease of 0.41% on the 7th, OP Mainnet remains a key player in Ethereum’s Layer 2 ecosystem.

Base, another prominent Layer 2 solution, saw a more significant decline of 5.98% on the 7th, bringing its locked-up volume to $5.25 billion. This notable decrease underscores the volatility and fluctuation inherent in decentralized networks.

Blast and Mantle experienced contrasting movements in their locked-up volumes. Blast witnessed a noteworthy increase of 4.28% on the 7th, reaching a total of $2.62 billion. In contrast, Mantle observed a modest decline of 0.64%, with its locked-up volume standing at $1.24 billion.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |