Key Points:

- Ethereum network fees hit a six-month low, with the median gas price hitting a 3-year low, hinting at an altcoin rebound.

- Ether’s price is above $3,200, and we are awaiting the SEC’s ETF decision.

- Consensys challenges SEC’s Ethereum classification to protect innovation.

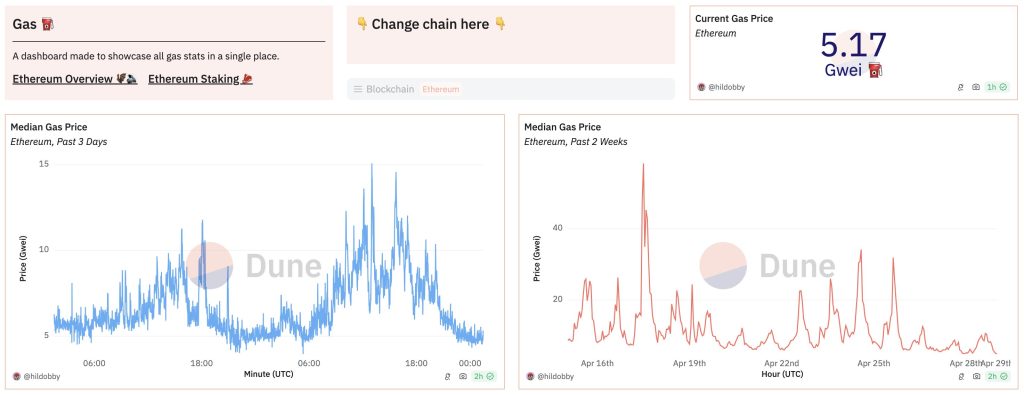

The median gas price of Ethereum has recently hit a three-year low, with April 27 seeing a median gas price of merely 6.43 gwei, marking the seventh lowest single-day median price in the past three years.

Ethereum Network Fees Plummet, Signaling Altcoin Potential

Currently hovering around 5 gwei, the Ethereum network fee has dipped to a six-month low despite Ethereum’s price surge, hinting at a potential rebound for altcoins, as per Santiment, a blockchain data analytics platform.

In contrast, the Ethereum network fee spiked to an eight-month high in February 2024 amid fervent interest in the ERC-404 token standard. The current drop in Ethereum network fee suggests a potential uptick in Ethereum network activity and a resurgence in altcoins, coinciding with a surge in Ethereum’s circulating supply.

Despite these developments, Ether’s price has remained relatively stable, above $3,200, and it is awaiting significant catalysts such as the Securities and Exchange Commission’s (SEC) decision on a spot Ethereum ETF.

Consensys Fights SEC’s Ethereum Classification, Backs Innovation

Additionally, Consensys‘ legal efforts to address Ethereum’s regulatory concerns have fueled optimism. The firm has contested the SEC’s attempt to classify Ethereum as a security, arguing that such categorization would stifle innovation and harm developers, investors, and institutions leveraging Ethereum’s decentralized framework.

As traders monitor these developments, the Ethereum ecosystem braces for potential shifts in market dynamics, with regulatory clarity and network activity poised to influence the trajectory of Ether and altcoins alike.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |