Key Points:

- $2.4 billion worth of Bitcoin and Ethereum contracts expire on May 3.

- Put-to-call ratios for Bitcoin and Ethereum are at 0.49 and 0.36.

- Market typically recovers shortly after options expirations.

Bitcoin and Ethereum options contracts worth $2.4bn expire on May 3, potentially causing market volatility. The put-to-call ratios suggest bearish trends for both.

Bitcoin and Ethereum options contracts, amounting to a combined value of $2.4 billion, are scheduled to expire on May 3. This event could result in escalated market volatility.

Understanding Bitcoin and Ether Options Contracts

These options contracts are derivative contracts allowing investors to bet on Bitcoin and Ethereum price movements, without the necessity of owning the cryptocurrencies themselves.

The two types of options contracts are call and put options. Call options grant investors the right to purchase a cryptocurrency at a fixed price before a set date. Conversely, put options enable investors to sell a cryptocurrency at a specific price before the expiry date.

Readmore: April Is The Worst Month For Bitcoin Amid ETF Outflows: Report

Using the Put/Call Ratio to Assess Market Sentiment

The put/call ratio, often utilized by investors to gauge market status, considers more put purchases than calls as a bearish indication, and more calls than puts as a bullish sign. A put-to-call ratio under 0.7 is viewed as bullish, whereas a ratio over 1 is seen as a bearish signal.

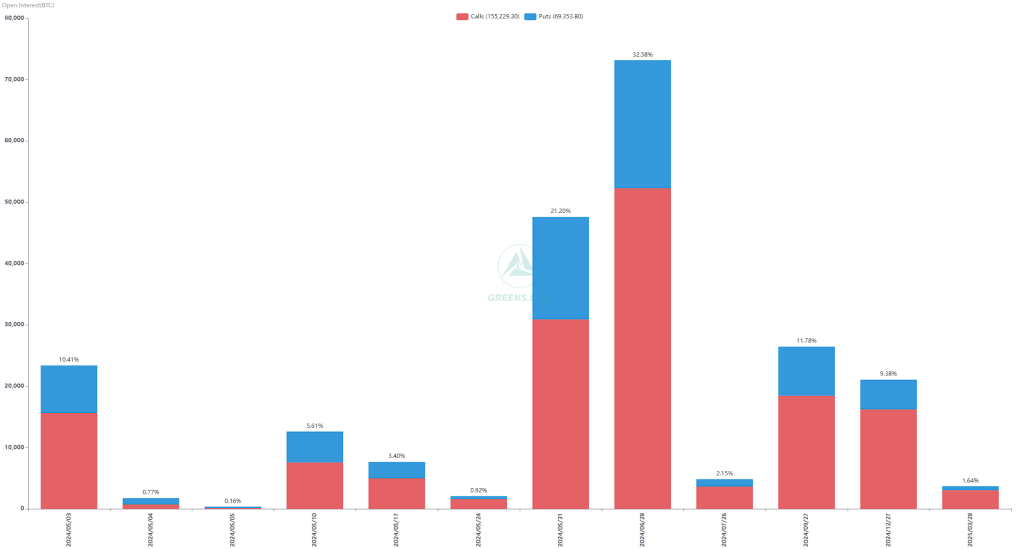

On May 3, 23,000 Bitcoin contracts valued at $1.4 billion are due to expire. Current data from the GreeksLive indicates a put-to-call ratio for Bitcoin options contracts at 0.49, with a maximum pain point of $61,000.

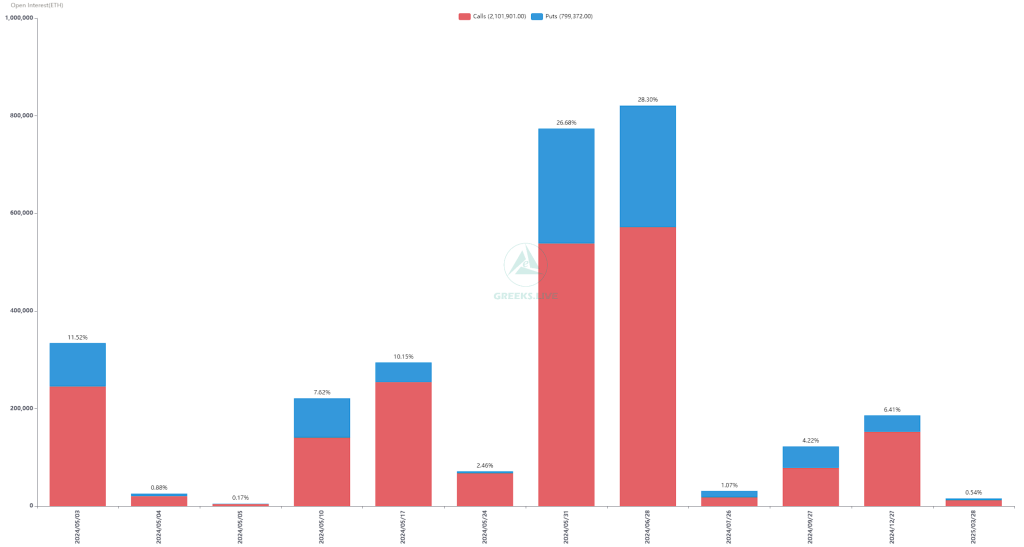

Likewise, 330,000 Ethereum contracts, with a notional value of $1 billion, are projected to expire on the same day. These contracts have a put-to-call ratio of 0.36 and a maximum pain point of $3,000.

Market Impact of Expiring Options Contracts

Historically, the expiration of options contracts has led to short-term price instability in the spot crypto market. Over the past few weeks, Bitcoin and Ethereum have been subject to bearish forces.

Bitcoin’s price dropped below $60,000, reflecting nearly a 20% weekly correction post-halving, and Ethereum’s price fell under $2,900. However, the cryptocurrency market typically recovers from this options-induced volatility within a few days of expiration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |