Key Points:

- Metaplanet Inc. bought ¥250 million more in Bitcoin.

- Bitcoin is now Metaplanet’s primary treasury reserve.

- They manage Bitcoin based on holding duration and market value.

Metaplanet increases Bitcoin holdings with an additional purchase of $1.6M USD. The company views Bitcoin as its primary treasury reserve and plans more acquisitions.

Metaplanet Inc., a Tokyo Stock Exchange-listed company under the ticker TSE: 3350, has just announced a significant increase in Bitcoin holdings.

Metaplanet Increases Bitcoin Holdings Significantly

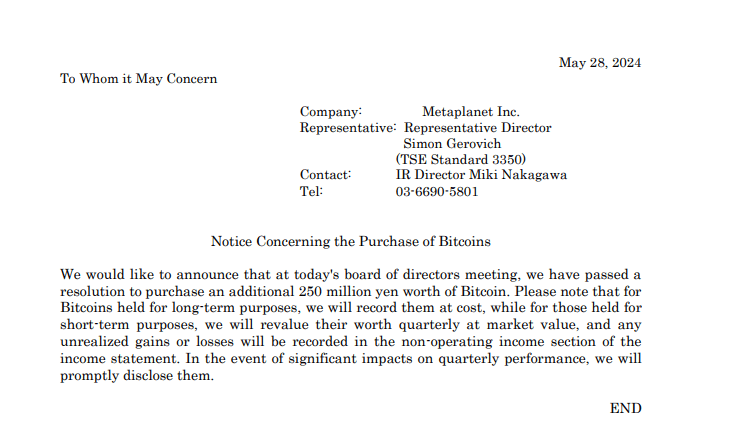

At a board of directors meeting, the company approved the purchase of an additional ¥250 million in Bitcoin, which is equivalent to approximately $1.6 million USD.

The company, which provides consultative services for businesses seeking to adopt Bitcoin, has initiated a strategic transition. Metaplanet now views Bitcoin as the primary treasury reserve asset and plans to use surplus cash flow to accumulate more Bitcoins.

In addition to consulting services, Metaplanet Inc. is known to assist businesses in maximizing their potential within their existing corporate frameworks.

Readmore: First FTX Executive Sentenced To 7.5 Years In Prison

Metaplanet’s Strategic Transition Towards Bitcoin

The company also manages corporate reorganizations. Metaplanet’s services range from developing strategies to facilitating integration, thereby enabling organizations to regard Bitcoin as a crucial foundation for their future.

The company recently outlined how they will manage their Bitcoin holdings. They expressed that Bitcoins held for long-term purposes will be recorded at cost, while Bitcoins intended for short-term purposes will be revalued quarterly at market value.

Metaplanet’s strategic Bitcoin purchase aligns with the increasing global trend of companies recognizing Bitcoin as a strategic and valuable asset class. Earlier this month, Metaplanet acquired an additional 19.87 BTC for a purchase price of 200 million yen.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |