Key Points:

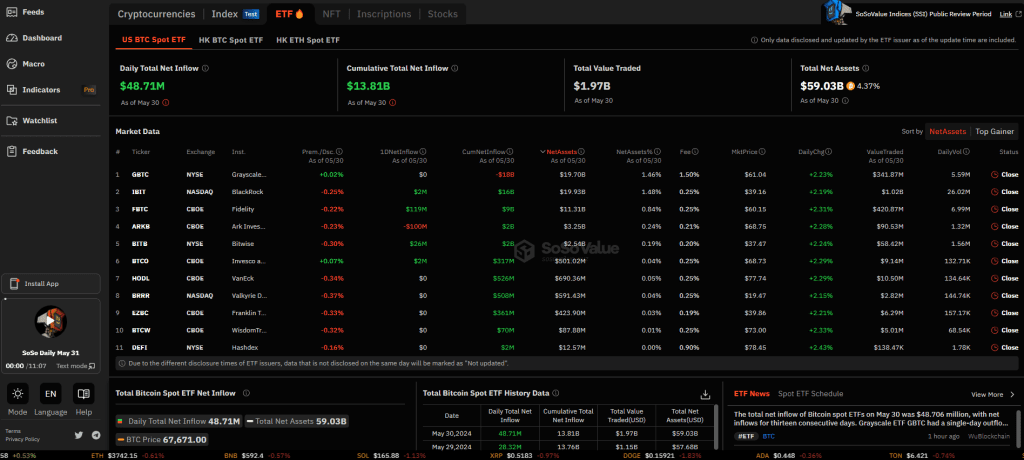

- Bitcoin spot ETFs saw a $48.706M net inflow on May 30, marking thirteen consecutive days of positive inflows.

- Fidelity’s FBTC ETF led with a massive $119M single-day inflow, highlighting strong investor interest.

- Total historical net inflows for Bitcoin spot ETFs reached an impressive $13.809B, showcasing growing mainstream acceptance.

Bitcoin spot ETFs experienced a notable net inflow of $48.706 million, marking thirteen consecutive days of positive net inflows.

This consistent upward trend highlights the growing investor interest and confidence in Bitcoin as a mainstream financial asset.

The most significant inflow was observed in Fidelity’s Bitcoin ETF (FBTC), which recorded a single-day inflow of $119 million. This substantial inflow underscores Fidelity’s strong position in the market and its appeal to investors seeking exposure to Bitcoin through regulated financial products.

Readmore: KuCoin Delists Polyhedra’s Token Amid Battle For ‘ZK’ Token Symbol

Fidelity ETF Leads with Significant Inflows

The Grayscale Bitcoin Trust (GBTC), another prominent player in the market, experienced a single-day outflow of $0.00. While this indicates a neutral position for the day, it suggests stability and a lack of major selling pressure for Grayscale’s product.

The historical net inflow of Bitcoin spot ETFs has now reached an impressive $13.809 billion. This milestone reflects the growing institutional acceptance and adoption of Bitcoin ETFs as a viable investment vehicle. The steady inflows over the past thirteen days are particularly noteworthy, as they suggest a sustained demand for Bitcoin exposure among investors.

The influx of funds into Bitcoin spot ETFs is seen as a positive indicator for the cryptocurrency market, potentially driving further price appreciation and market maturity. The consistent inflows highlight the confidence investors have in Bitcoin’s long-term prospects, despite the inherent volatility in the cryptocurrency market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |