Key Points:

- ConsenSys acquired Wallet Guard to boost MetaMask security.

- The SEC sued ConsenSys for operating as an unregistered broker.

ConsenSys buys Wallet Guard to enhance MetaMask’s security with scam detection. The acquisition highlights Consensys’ focus on user safety amid rising Web3 threats despite facing SEC allegations.

ConsenSys has bought Wallet Guard, a security tool that protects digital assets and data from theft, scams, and fraud. The buy should originally equip MetaMask with Wallet Guard’s advanced safety features, offering users better protection within the Web3 ecosystem.

Consensys buys Wallet Guard to Enhance Security

Once more, Wallet Guard will bring enhanced security capabilities to MetaMask, including scam and drainer detection. This is owed to its expertise in transaction validation and client-side heuristics.

According to The Block, the entire Wallet Guard team will move full-time to Consensys and work under MetaMask’s product safety division.

Wallet Guard co-founder and co-CEO Ohm Shah is elated at the prospect of bringing such expertise and dedication to end-user security to MetaMask’s millions of users globally. MetaMask, the leading crypto wallet app, has over 30 million monthly active users.

This month, Consensys rolled out pooled staking for its Web3 wallet, allowing users of the popular MetaMask browser extension to stake any amount of ether toward Ethereum network security and, in return, earn validator rewards.

Readmore: Jupiter To Launch Ape Meme Coin Platform Trading At 0.069% Fee

Rising Threats and Legal Challenges in Crypto

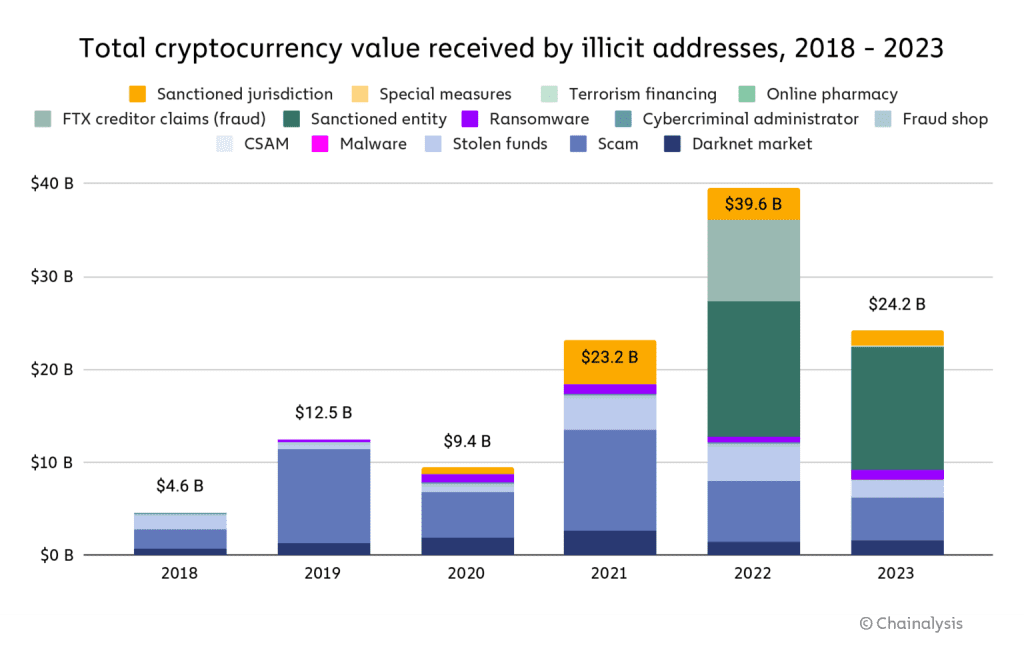

The acquisition underscores the increased focus on user safety that Consensys is eyeing when the threat of crypto hacks and scams in Web3 only continues to rise. According to the “2024 Crypto Crime Report” by Chainalysis, over $1.7 billion in crypto assets were stolen through scams in 2023.

A new lawsuit from the United States Securities and Exchange Commission against Consensys questions these successes. The SEC alleges that Consensys has been operating an unregistered broker, amassing more than $250 million in fees without filing for registration.

Consensys has come back with a suit of its own, demanding that an end be brought to what it argues is an anti-crypto agenda headed by ad hoc enforcement action.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |