Key Points:

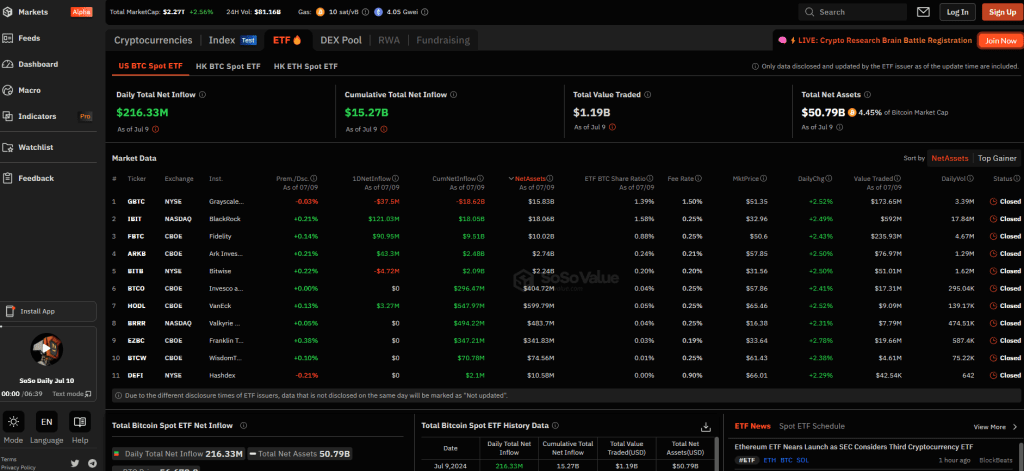

- BlackRock’s ETF IBIT recorded the highest single-day net inflow, highlighting strong investor confidence.

- Fidelity’s ETF FBTC saw a significant net inflow, underscoring its growing appeal among investors.

- Grayscale’s ETF GBTC experienced a notable outflow, contrasting with the positive trends of its competitors.

Bitcoin spot ETFs printing a notably outsized total net inflow of $216 million. This surge in investment is an indication of growing interest and confidence in Bitcoin-based exchange-traded funds among investors.

BlackRock’s ETF IBIT led with a healthy single-day net inflow of $121 million. The large figure emphasizes BlackRock’s dominant market position and the demand for its Bitcoin spot ETFs product. Inflows into IBIT suggest that investors are long-term focused on Bitcoin’s potential.

Fidelity’s ETF FBTC was a bit further behind, with a single-day net inflow of $90.9503 million. In terms of attracting investments, a high performance further enhances Fidelity’s position in the Bitcoin spot ETFs space. The better flow from the investors indicates that they are increasingly looking at Fidelity’s ETF as a tenable, appealing option to take exposure in Bitcoin.

Read more: BlackRock Spot Bitcoin ETF Returns Positive With $121.3M Inflows

Grayscale ETF Faces Significant Outflow

Grayscale’s ETF GBTC witnessed $37.4956 million outflows over a day. While it was witnessing the positive trends in the ETFs from BlackRock and Fidelity, this outflow raises some questions of its own in terms of investor sentiment towards Grayscale’s offering. Various factors could have led to such an outflow, such as the dynamics of the market, competing ETFs, or investor-moving strategies.

Addressing the net inflows, or the difference between outflows and inflows, the total inflow is $216 million into Bitcoin spot ETFs. Indeed, this measure captures the overwhelming confidence in Bitcoin as an investment store in the days ahead. Bitcoin ETFs will surge upwardly as and when institutional and individual investors push for more exposure to alternative cryptocurrencies. After all, these smart investment choices provide a regulated and convenient approach toward getting exposure to Bitcoin without directly owning the cryptocurrency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |