Pencils Protocol represents over $300 million in TVL, the cornerstone Scroll ecosystem DeFi. Pencils Protocol is designed as a Scroll-based next-generation decentralized finance platform. It provides an all-in-one suite for DeFi services, from auctions to staking and yield farming. Harnessed by Scroll’s advanced zero-knowledge technology, Pencils Protocol infuses user and investor experiences with safety, scale, and efficiency in DeFi.

What is Pencils Protocol?

Pencils Protocol is a DeFi platform built on layer 2 Scroll that enables users to earn profit through staking, lending, farming, and launchpad activities. Geared with this solution and a points system, Pencils Protocol won the largest TVL on Scroll’s ecosystem, breaking over $300 million in locked assets.

Read More: Scroll Airdrop Guide: Potential Big Airdrop Projects For Early 2024

Product

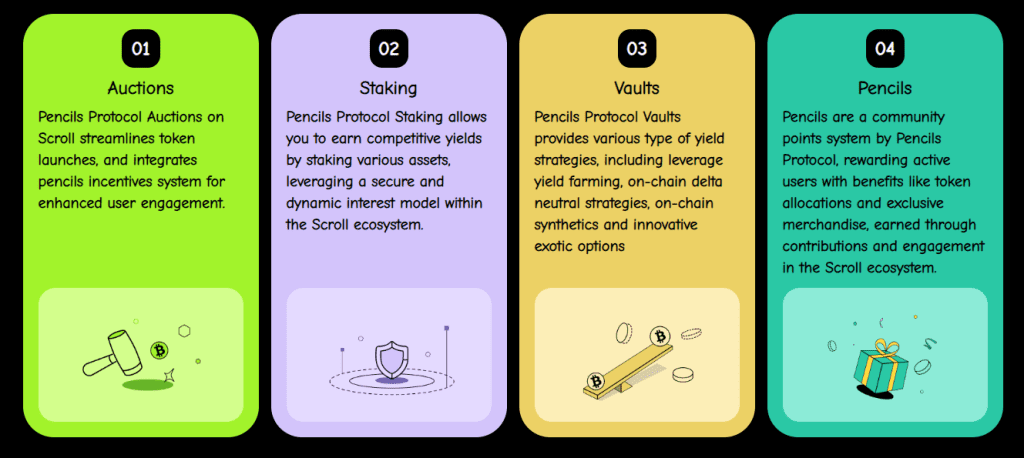

Pencils Protocol is a suite of products aimed at helping users generate profits within the Scroll ecosystem, including:

- Auctions (Launchpad): This product allows projects to conduct IDO sales to raise capital from the community through auctions. Any participant who becomes a member early enough will be granted Pencils points.

- Staking: Stake assets such as ETH, LST, LRT, WBTC, USDC, and USDT and profit from lending interest. Moreover, depositors get extra Points from Pencils and Scroll.

- Vaults: Users could deposit funds into Vaults and borrow more assets from the Staking product to provide AMMs liquidity and gain more profit.

- Shop: A storefront to easily facilitate Point airdrop transactions across multiple chains, pre-market trading, cards, tickets, RWAs, ERC721, and ERC404.

- Pencils Points: This point system encourages early community participation. For example, $1,000 deposited in stablecoins would mean 1 Pencil per day; the same amount in pufETH is 1.5 Pencils, while ETH/wrsETH/Stone means 2 Pencils. These Points are then converted into the protocol’s governance tokens at launch.

Only Staking and Pencils Points products have been launched and are live. Auctions, Vaults, and Shop products are still in development, and their detailed information is pending.

With such a rich set of DeFi products, Pencils Protocol occupies a very central position within the Scroll ecosystem, entailing huge profit and growth potential.

Read More: Starknet Foundation DeFi Spring 2.0 Added 50 Million STRK To Boost The Ecosystem

Tokenomics

So far, the project has not announced any details about its governance token. However, users making Pencils Points can convert such points into tokens once they are launched.

Team, Investors, and Partner

Team

Details about the team members are primarily undisclosed, except for Michael Ipovich, Head of Partnerships, who regularly participates in AMAs with the community on X (Twitter).

Investors

On May 22, 2024, Pencils Protocol raised $2.1 million in a seed round, valuing the project at $25 million. Investors include Animoca Brands, OKX Ventures, Galxe, Ryan Li (Cyber co-founder), and Sandy Peng (Scroll co-founder).

Pencils Protocol Airdrop Guide: Step By Step

Step 1: Open the Pencils Protocol’s asset deposit interface. Connect your wallet and select the assets you want to deposit.

Step 2: Click “Deposit” to specify an amount to deposit. You can use the following tokens for deposit: STONE, wrsETH, pufETH, WETH, USDT, USDC, SolvBTC, and WBTC.

Roadmap

Q1 2024

- Introduce the beta version of the launchpad with fair token issuance models and toolkits.

- Present the PDD tokenomics and Launch Seasons Event for establishing the leading launchpad brand and more than 50,000 verified users in season 1.

Build a global KOL ecosystem to empower the community.

Q2 2024

- Token staking with the pToken incentive model

- Release the beta version of the Vault product for profit aggregation.

- Launch of the Pencils Point system to extend ecological integration and incentive utilities.

- More than 100 partnerships have been developed to aid in project deployment and development.

Q3 2024

Shop with multi-chain Point transactions, pre-market trading, cards, tickets, RWA, ERC721, ERC404, etc.

Increase the number of registered and verified users to 300,000, with a value launched on the platform of over $20 million.

Q4 2024

- Determine and incubate new community-driven projects. Offer technical support regarding market makers and smart contract auditors.

- As of Q3 2024, this is a larger project. Only the Pencils Staking product has been launched, while the other two key products—Launchpad and Vault—remain to be finalized.

Conclusion

Due to the point reward program’s incentive for airdrop hunting, Pencils Protocol drives the Scroll ecosystem. This created another problem: user retention after airdrop distribution.

CoinCu highlights Pencils Protocol as a key DeFi project in the Scroll ecosystem, boasting a TVL of over $300 million. It’s one to watch and join early for potential airdrops.

FAQs

1. What is Yield Farming on Pencils Protocol?

Yield farming on Pencils Protocol is staking or lending crypto assets to receive further cryptocurrency rewards.

2. How do I participate in farming using the Pencils Protocol?

To participate, you need to connect your wallet to the platform, deposit your chosen cryptocurrency into a farming pool, and start earning rewards.

3. Is there a minimum to start farming?

The minimum amount varies from one farming pool to another and from one protocol guideline to another.

4. How are the farming rewards calculated?

Rewards are calculated by the amount staked, the stake’s duration, and the pool’s reward rate.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |