Key Points:

- The Bitcoin spot ETF inflows of $1.24 billion over 11 consecutive days, including $427 million on July 19.

- BlackRock’s IBIT topped with $707M inflow, while Fidelity’s FBTC added $244M, showing strong market interest.

- With a total net asset value of $60.927 billion, the Bitcoin spot ETF market shows robust growth and investor confidence.

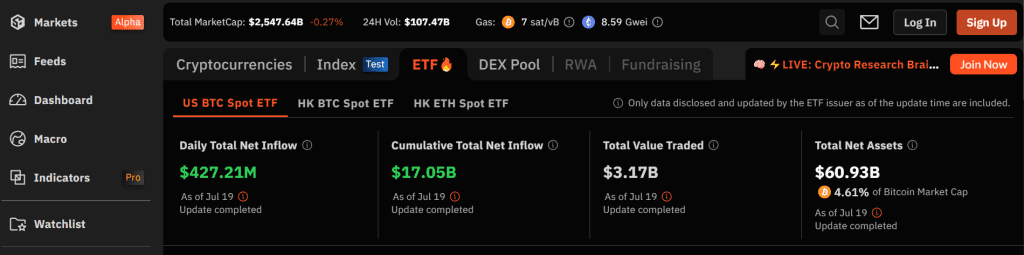

According to SoSoValue, the latest statistics indicate that in the week of July 15-19, 2024, there was a net into the Bitcoin spot ETF inflows amounting to $1.24 billion.

This marked the 11th trading day of consecutive net inflows, including a $427 million net Bitcoin spot ETF inflows on July 19. These continued inflows mirror the growing interest and building confidence among investors in investment products linked with Bitcoin.

BlackRock and Fidelity ETFs Lead Weekly Inflows

BlackRock‘s Bitcoin ETF stormed the list of the major players in this space, setting a weekly net inflow of $707 million to set total net Bitcoin spot ETF inflows at $18.968 billion. The other leading competitor, FBTC by Fidelity, performed very well, accumulating a net inflow of $244 million for the week and a total net inflow of $9.963 billion. On the other side of the equation, Grayscale’s ETF—GBTC—witnessed a net outflow of $56.12 million for the week, adding to its historic net outflow balance of $18.694 billion.

Read more: Bitcoin Spot ETFs See $216M Net Inflow, BlackRock and Fidelity Lead Gains!

Current Total Net Asset Value of Bitcoin ETFs

As of the last update, the aggregate net asset value of Bitcoin Spot ETFs is $60.927 billion. The ratio of the market value against the total value of Bitcoin is 4.61%, which is the ETF net asset ratio. The accumulative net inflow for Bitcoin spot ETFs increases to $17.052 billion.

Bitcoin ETF by ARK, AKRB, had delayed updates in trading data, which were hamstrung by the fault of official channels and a global Windows system failure, but the data was updated.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |