Lista DAO is a decentralized Liquid Staking and Stablecoin (CDP) protocol built on the BNB Chain. This is one of the pillars of the BNB Smart Chain ecosystem, incubated and invested with 10 million USD from Binance Labs, the leading fund in the Crypto market.

What is Lista DAO?

Lista DAO, formerly Helio Protocol, is an open-source liquidity protocol built on the BNB Chain. It allows users to earn profits by pledging crypto assets such as BNB, ETH, and stablecoins and borrowing lisUSD, the protocol’s centralized stablecoin, also known as “destablecoin.”

Lista DAO operates based on a 2-token model (lisUSD and LISTA) and a set of mechanisms that support instant conversion, asset collateral, borrowing, profit farming, etc. This protocol operates on the BNB Chain ecosystem and plans to expand to many other ecosystems.

Read More: BounceBit Review: The First Bitcoin Restaking project on Binance Megadrop

Products

Liquid Staking

It enables users to Stake BNB to earn 1% to 3% APR returns and receive slisBNB LST coins in return, which can be used in the DeFi market.

slisBNB is a Token Reward-bearing standard similar to Rocket Pool’s rETH. That means slisBNB will increase in value over time due to the accumulation of Staking Rewards from the BNB Smart Chain and is not tied to BNB.

Lista DAO will delegate BNB stakes to Validators operating the BNB Chain PoS network. When earning BNB rewards from operating the network, validators will receive it first (but there is no specific amount) and divide the remaining portion to BNB Stakeholders on the Lista protocol at a rate of 95% and 95% respectively. 5%.

Fully Collateralized Stablecoin (CDP)

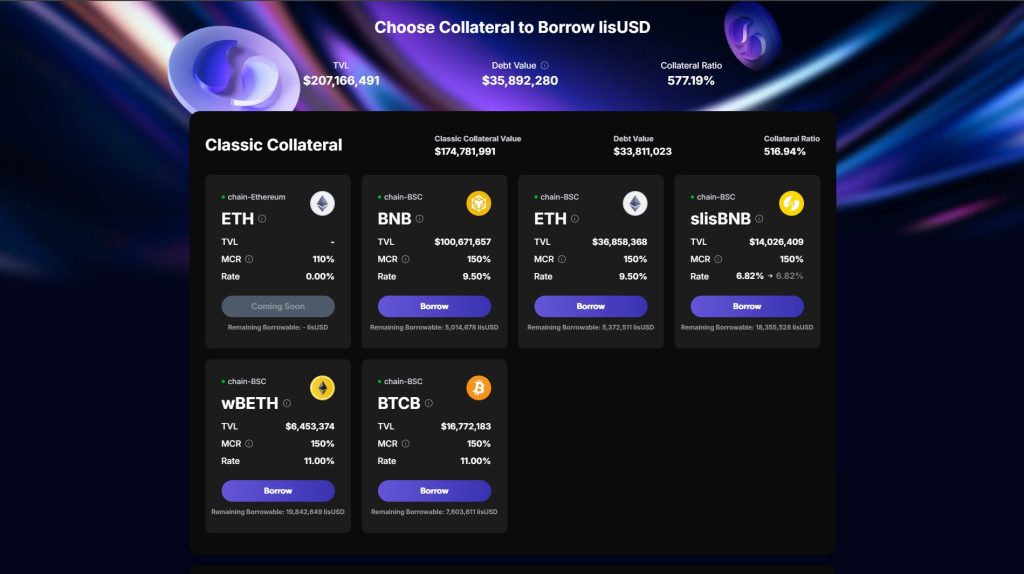

Lista allows users to deposit BNB, ETH, slisBNB, wbETH, BTCB, weETH, ezETH & STONE as collateral to mint or borrow Stabelcoin lisUSD.

lisUSD is a Stablecoin pegged to USD that can only be minted from the Lista protocol based on the borrower’s collateral. LisEUD will be burned when the borrower repays to complete the loan or when their loan position is liquidated.

Currently, the lisUSD lending interest rate is 0%. The low interest rate strategy is also a way new projects like Lista often compete with large projects like MakerDAO, Liquity,…

Read More: Top Low-Cap Gems with High Potential for Binance Listing

Tokenomics

Token Metrics

- Ticker: LISTA

- Total supply: 1.000.000.000 LISTA

Token Allocation

- Binance Megadrop – 10%

- Airdrop – 10%

- Investors & Advisors – 19%

- Team – 3.5%

- Community – 40%

- DAO Treasury – 8%

- Ecosystem – 9.5%

Token Use Case

- Governance: LISTA token holders can vote on the governance of the protocol.

- Incentives: LISTA tokens serve as rewards for lisUSD borrowers with collateral or provide liquidity in the lisUSD and slisBNB pools.

- Reward: LISTA tokens can be locked to receive veLISTA back and vote to emit LISTA Tokens for collateral or liquidity pools.

- Fee Sharing: Users who lock their LISTA to veLISTA will also be eligible for protocol revenue sharing.

Team, Investors, and Partner

Team

- Terry Huang (Co-Founder & COO) graduated with a Master’s in Theoretical Physics from Tamkang University. He has over three years of experience working at Binance as a Local Marketing Manager, Country Manager, and Project Lead.

- Mark PX Chan (Growth): He graduated with a Bachelor of Economics and founded Musechain, an initiative to bring the entire NFT market into a wallet valued at 400 thousand USD.

Investors and Partner

August 11, 2023: Binance Labs announced an investment of 10 million USD in Lista DAO, a project also incubated by this fund.

Lista DAO has many partnerships, especially projects within the BNB Chain ecosystem. Pancakeswap, Venus, APX, Magpie, Wombat Exchange,… have a close relationship with the protocol thanks to a set of interconnected products.

Binance Megadrop

After BounceBit, Lista DAO is the second project released on Binance’s Megadrop platform. Some information about LISTA Megadrop is as follows:

- Megadrop time: 2024-05-30 00:00:00 (UTC) to 2024-06-19 23:59:59 (UTC)

- Ways to participate in Megadrop: Lock BNB or do Web3 tasks.

- LISTA token listing time: 2024-06-20 10:00 (UTC)

- Rewards will be distributed on 2024-06-20 06:00:00 (UTC)

Roadmap

Q2 2024

- Focusing on building a safe and secure protocol with solid liquidity and a strong utility case for lisUSD on the BNBchain. This will include forming and strengthening partnerships and integrations between different DeFi Protocols on the BNB chain.

- Focused on integrating ETH LSTs, LRTs, and respective LP tokens as a collateral option for lisUSD, diversifying our portfolio and providing users with more collateral options.

- Upgrading our smart contracts to be more scalable includes the following features: collateral addition module, liquidation module, and AMO module upgrades.

- Multichain strategy, where we will begin exploring cross-chain opportunities, starting with Ethereum.

- Transitioning of our codebase from Maker DAO to Liquity.

Q3 2024

- Introduce BNB restaking and respective Liquid restaking tokens (LRTs) into the Lista DAO ecosystem.

- Launch of veLISTA & the veTOKEN model for Lista DAO

- To turn on LISTA Token emissions

- Further user interface & user experience (UIUX) optimization

Q4 2024

- Further improvements in slisBNB utility & application scenarios

- Multichain expansion to Ethereum

Conclusion

Lista is the leading project in the Liquid Staking and CDP segment on the BNB Chain. Lista DAO operates as an open-source liquidity protocol, generating profits from collateralizing digital assets such as BNB, ETH, Stablecoins, and other cryptocurrencies.

CoinCu assessed that although this product is not new, due to its strong position on BNB Chain and support from Binance Labs, it is difficult for any project to surpass this ecosystem.

FAQs

1. What do Lista DAO products include?

- Collateralized debt positions (CDPs) to mint stablecoins from collateral.

- Liquid staking allows users to stake assets and receive rewards.

- Stablecoin lisUSD is backed by collateral.

- Duo token model with stablecoin lisUSD and governance token LISTA.

2. When users stake BNB tokens, what tokens will users receive?

Users will receive Synclub’s slisBNB – yield-bearing & liquid staking token, representing the staking position.

3. How is lisUSD minted?

lisUSD is a decentralized stablecoin (destablecoin) minted from mortgaging assets Lista supports, including BNB, ETH, stablecoins, and other crypto assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |