Key Points:

- The TON network block experienced a severe outage on August 27, 2024, stopping block production for nearly three hours and causing Bybit to halt Toncoin transactions.

- The TON network issues coincided with significant drops in Bitcoin and Ethereum prices, leading to $318 million in liquidations across the cryptocurrency market.

The TON Network Block production halted for 3 hours on August 27, 2024, causing alarm. Bybit suspended Toncoin transactions, and the token dropped 5.6%.

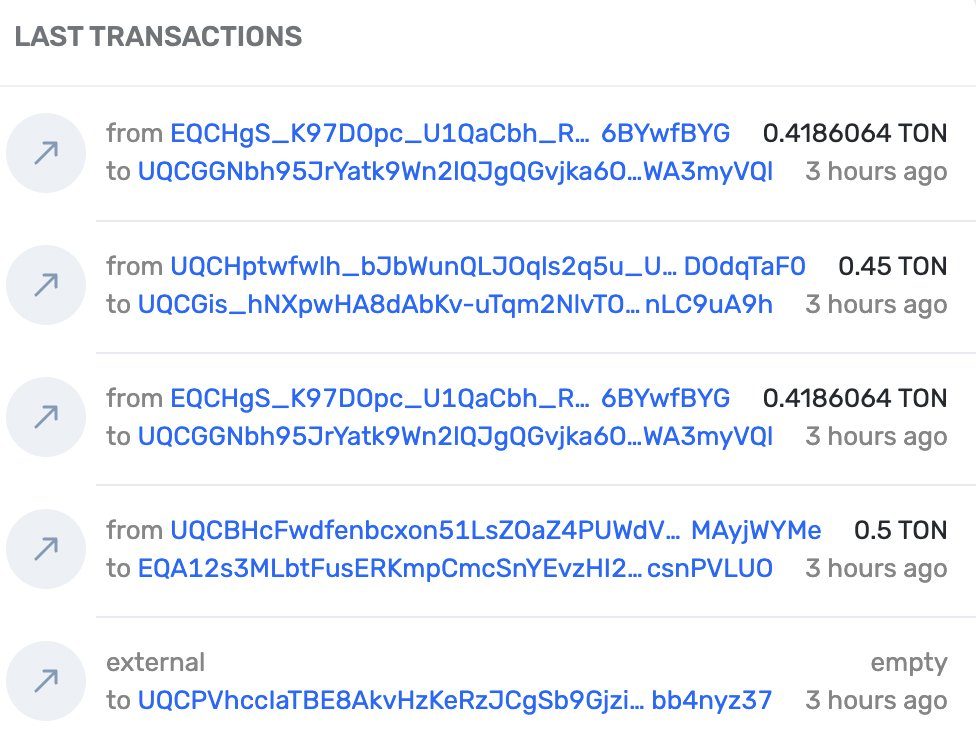

The Telegram Open Network fared severely on August 27, 2024, when the TON network stopped producing blocks for nearly three hours. The last block was generated at 10:11:46 PM UTC, giving users and exchanges alike quite a bit of cause for alarm.

TON Network Block Production Halts

Following the standstill, Wu reported that Bybit halted all deposits and withdrawals for Toncoin, the native token of the TON blockchain. The network outage’s aftereffects quickly impacted TON’s market performance, and the token was down 5.6% late Wednesday, as shown by CoinMarketCap data.

It is infrequent that a blockchain network does not produce any blocks for such a long time, and this usually has dire consequences. As of this writing, the TON network team has not commented on this incident.

According to a report by CoinDesk, the recent airdrop of the DOGS memecoin may have initiated the failure in the TON network due to increased transaction volume. The observers say the network could not hold this demand as TPS counts fell below-predicted levels.

Read more: Telegram CEO Pavel Durov’s Arrest Draws Vitalik’s Concern Over Western Bias

Broader Cryptocurrency Market Impact

The problems on the TON Network coincided with other dramatic events in the cryptocurrency market. Bitcoin dropped below $59,000 USDT at 10:00 PM UTC to $58,100. The king of cryptocurrency currently trades at $59,242, which is -6.17% in the last 24 hours. Ethereum also went below $2,400, touching the low of $2,394 before trading at $2,445 as of this writing, reflecting -9.23% in the last 24 hours.

The movements in these two cryptocurrencies caused a big liquidation across the cryptocurrency market, amounting to $320 million in the 24 hours following the disruption of the TON Network, as shown by Coinglass data.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |