Key points:

- Polymarket traders are betting on a decrease in the federal funds rate at the upcoming Federal Reserve’s FOMC meeting, scheduled for September 17-18.

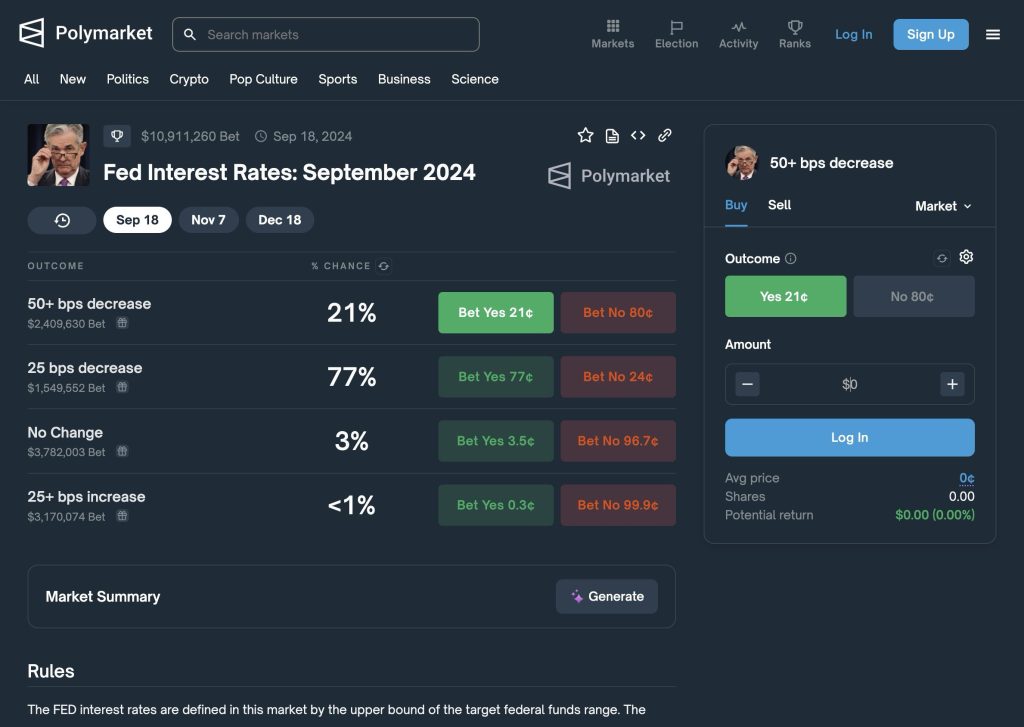

- A bet totalling $10.9 million shows that 77% of traders expect a 25-basis-point cut, 21% predict a 50-basis-point cut, and only 3% believe there will be no change.

Polymarket’s interest rate forecast shows that 77% of traders expect a 25 bps Fed rate cut at the upcoming FOMC meeting, driven by lower inflation and a weakening job market.

Interest Rate Forecast on Polymarket

Polymarket traders are betting that the Federal Reserve will cut the federal funds rate at its upcoming FOMC meeting on September 17-18, 2024. With $10.9 million in bets, 77% of traders predict a 25 basis point cut, while 21% expect a 50 basis point cut.

Only 3% believe there will be no rate cut. Falling inflation and a weakening job market drive this expectation, increasing the likelihood of the Fed adopting more accommodative economic measures.

Read more: Fed Chair Powell Excites Markets With Latest Rate Cut Signal

Impact of Interest Rate Forecast on Market Sentiment

These predictions align with the Federal Reserve’s dual mandate of balancing inflation control with economic growth. While the consensus among analysts favours a 25 basis point cut, a more significant cut could come if economic conditions deteriorate further. In anticipation of the Fed’s potential rate-cutting cycle, analysts have forecast a decline in Bitcoin price volatility.

Polymarket’s role in the crypto landscape has grown significantly, with cumulative volume rising from $1 billion in July to $1.52 billion by the end of August, as traders increasingly use the platform to predict various outcomes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |