Key Points:

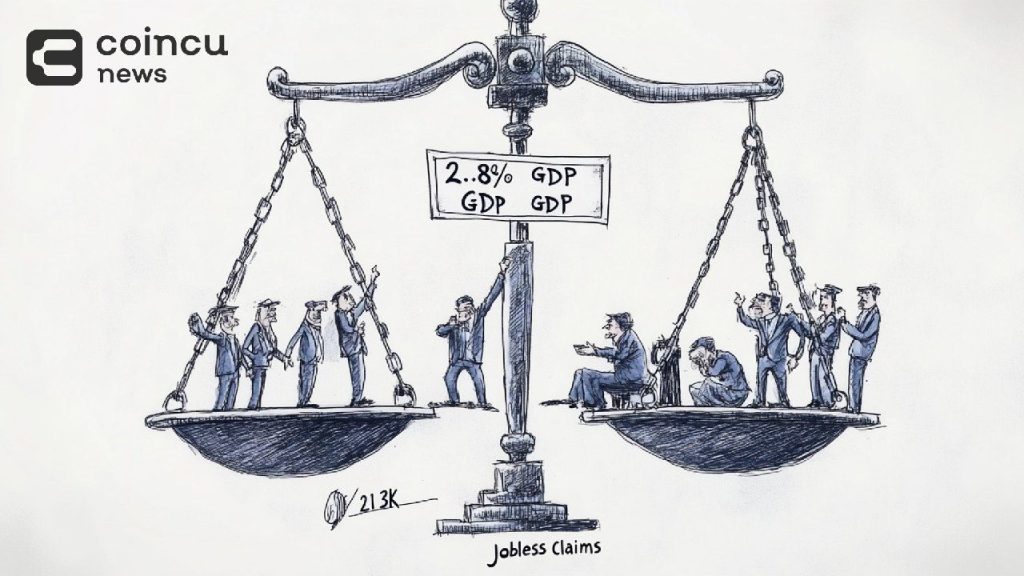

- US Q3 GDP revised to 2.8%, matching expectations, while core PCE stands at 2.1%, slightly below projections.

- Initial US jobless claims hit 213k for the November 23 week, lower than the forecasted 216k.

US Q3 GDP revised to 2.8% as expected, with core PCE adjusted to 2.1%. Weekly initial jobless claims hit 213k, lower than the anticipated 216k figure.

US Q3 GDP Revision and Core PCE Updates

To match previous projections, the U.S. has changed its annualized quarterly real GDP growth rate for Q3 to 2.8%. In addition, the core Personal Consumption Expenditures (PCE) price index—a major inflation gauge—was lowered to 2.1%, rather below the projected 2.2%. These numbers show a consistent but wary economic performance, according to Wu Blockchain.

Notwithstanding the changes, the economic situation is somewhat constant. While the little decline in the core PCE suggests relief from inflationary pressures, the GDP revision shows a steady increase. Since they evaluate the balance between inflation control and expansion, these measures are crucial in establishing Federal Reserve policy.

Read more: US Jobless Claims Drop to 217,000, Lowest Since May

US Jobless Claims Beat Forecast Amid GDP Stability

At 213k, the first jobless claims for the week ending November 23 exceeded the projection of 216k. This indicates a good indication for the labor market, therefore highlighting its resilience in the face of more general economic changes. Claims below expected point to ongoing job growth.

These employment numbers line up with the updated Q3 GDP of 2.8%, thereby underscoring a balanced economic story. Although statistics linked to inflation, such as the core PCE at 2.1%, show only modest fluctuations, the strong employment market provides a vital counterbalance in boosting consumer confidence and expenditure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |