Key Points:

- Bitcoin Spot ETF inflows hit $5.3181M on December 31, led by Fidelity’s $36.8115M contribution.

- Ethereum Spot ETF saw inflows of $35.9324M, with Fidelity FETH adding $31.7719M.

Bitcoin Spot ETF inflows reached $5.3181M on Dec 31, while Fidelity FBTC saw $36.8115M. Ethereum Spot ETFs surged with $35.9324M in inflows the same day.

Bitcoin Spot ETF Inflows Drive Market Growth

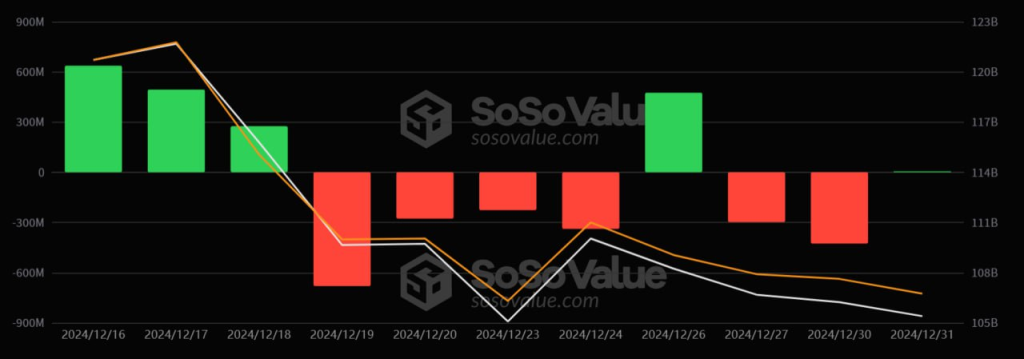

Bitcoin Spot ETFs gained massive inflows of $5.3181 million on December 31. Fidelity‘s single contribution was $36.8115 million, underlining strong investor interest in the product. Heavy inflows helped to push the ETF’s total net asset value to $105.401 billion. The continuous inflows are a reflection of increasing confidence in Bitcoin ETFs.

The growing momentum of Bitcoin Spot ETFs signals a strong shift toward regulated crypto investment options. Leading the inflow of contributions, Fidelity joins the bandwagon, reflecting increased institutional involvement in the digital asset space and positioning bitcoin ETFs as a pivotal market trend, according to Sosovalue.

Read more: Bitcoin Spot ETF Outflows Reach $426M Over Two Days

Ethereum Spot ETF Inflows Surge With Fidelity’s Boost

Ethereum Spot ETFs were no exception, with 31 December also recording an inflow of a cumulative $35.9324 million. Fidelity’s FETH was tops as it accounted for $31.7719 m. Predictably, the Net Asset Value of Ethereum Spot ETFs rose to $12.116 billion as a result of increased appetite for Ether-based investment products.

Inflows surge, indicating the growing institutional interest in Ethereum as a viable asset for long-term portfolios. With Fidelity driving large inflows, Ethereum Spot ETFs are emerging as the instrument of choice for investors seeking to diversify their crypto holdings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |