Key Points:

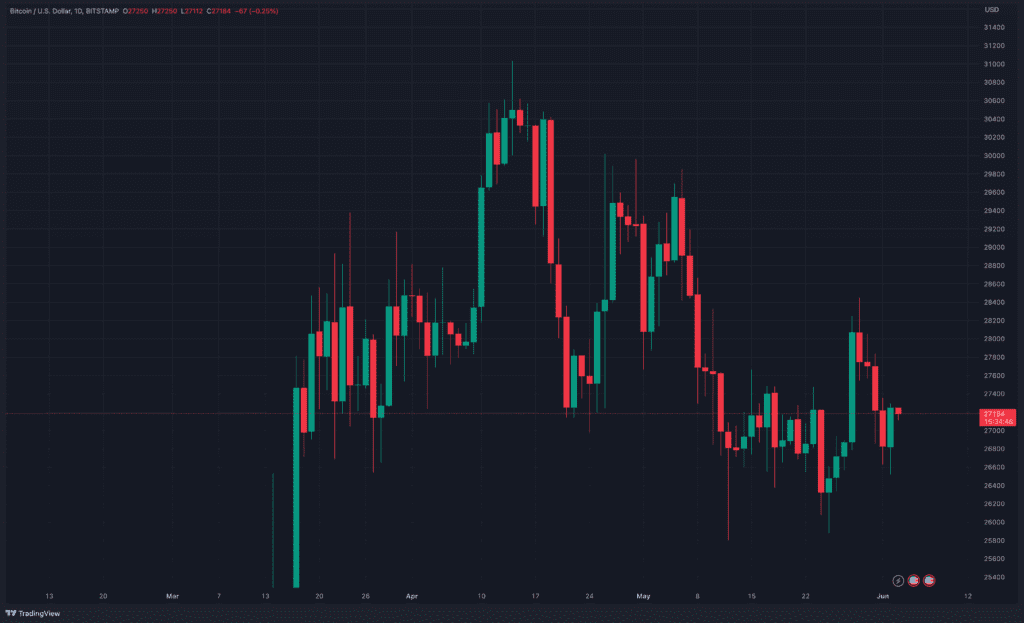

- As Bitcoin reclaims $27,000, market participants will closely monitor its price action and key levels to gauge the strength of the current bullish momentum.

- In May, the United States experienced a higher-than-expected unemployment rate of 3.7%, surpassing the forecasted 3.5%.

- At $30,000, perhaps investors need to be more patient.

Bitcoin price posted steady at $27,000, alongside the recent move by the United States that left investors wondering.

On Friday, Bitcoin was severely jolted by an unexpectedly good employment report, as well as a week’s worth of shock and commotion about the United States debt limit, end-game negotiations, and renewal fears.

Bitcoin originally displayed positive momentum around the $27,200 mark, but a reversal occurred with the announcement of solid US non-farm payroll numbers, forcing it to fall below $27,000.

The most valuable cryptocurrency in terms of market value was recently trading at over $27,180.

This rising rise has spurred hope and discussion regarding BTC’s likely future trajectory.

Market players will carefully follow Bitcoin’s price behavior and key levels as it reclaims this critical level to measure the strength of the current bullish trend.

Ether was recently trading for a little more than $1,900. The second biggest cryptocurrency has spent most of the previous seven days below this level as ETH investors dealt with macroeconomic headwinds as well.

Markets rose after the Labor Department reported that the economy created 339,000 jobs in May, or 75% more than experts predicted and much more than the 294,000 jobs gained in April.

The hot jobs statistics provided the most recent indication that the labor market remains tight, indicating that the economy isn’t finished growing and that inflation will remain a problem. But, a May unemployment rate of 3.7%, higher than the expected 3.5%, provided a more encouraging figure that the US Federal Reserve may use to justify a pause in its steady diet of interest rate rises.

Over longer periods, bitcoin has created a descending triangle pattern, which often heralds a breakout.

If Bitcoin, on the other hand, succeeds in breaking over $27,500, the next goal may be around $28,200. If the price falls, the $26,500 level is a good place to purchase. At $30,000, maybe we need to wait for a better signal.

To make educated selections in bitcoin trading, it is essential to remain up to speed on the newest market trends and price changes.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News