friend.tech is a hot name these days with the orientation to become the next generation of SocialFi on Coinbase’s new layer 2 platform, Base. However, the fantastic growth at the time of friend. tech’s launch lasted only a short time as its daily trading volume continued to plummet in the following days, especially its root platform, Base associated, continued to experience negative information that disappointed the community.

friend.tech explodes with millions of trading volume

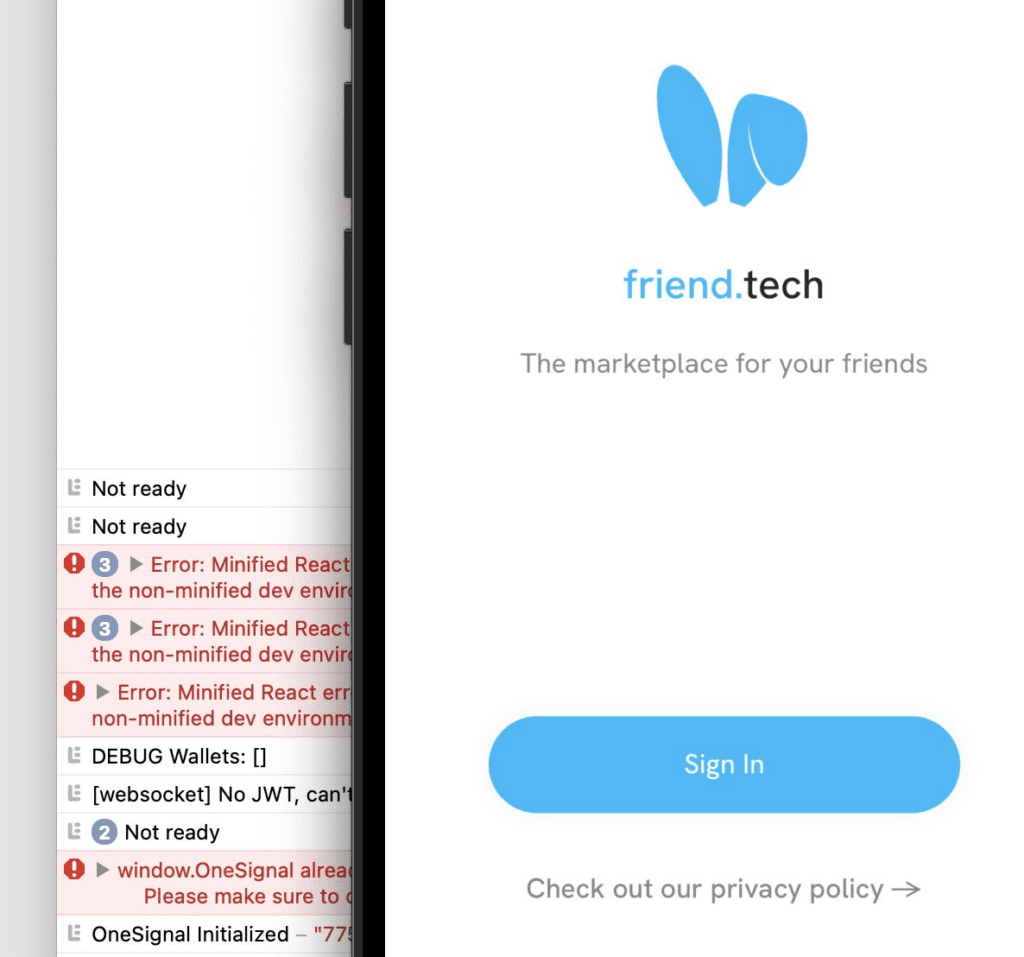

friend.tech is a web3 social networking project built on Base and just opened a limited beta version; users need to have an invitation code from other users to access and create an account. In addition, the friend.tech social network only supports mobile applications, not desktop versions.

One of the notable features of friend.tech is that users can own “shares” – shares of other users, KOLs, or celebrities.

This social network allows users to make purchases and sell shares of other individuals on the application platform. These shares function similarly to other digital assets, potentially changing in value over time, and they are ranked by friend.tech based on price floors and number of buyers.

Notably, this social network also said that it plans to issue tokens in the future, which makes the community look forward to an airdrop for those who use the application. According to initial information, the first airdrop will occur on August 18.

This hype has resulted in impressive numbers for both the project and the foundation on which it is built. The data highlights an essential milestone for Coinbase-initiated L2 Network Facility. For the first time, the number of daily active users crossed the 100,000 mark, reaching 136,000.

This increase includes the addition of nearly 42,000 new users. One notable observation is a potential correlation between this rapid growth and the growing popularity of ‘tech friends’, a social network built on the Grassroots network. Friend.tech’s invite-only beta went live on August 10 and has already done 4,700 ETH (about $8.6 million) in trading volume the very next day.

Layer 2 Base can drown growth

friend.tech is launched on Base, layer-2 on Ethereum by Coinbase, touted as a secure, low-cost and developer-friendly solution. Base’s vision is to be one of the best places for developers to build DApps on Ethereum. Currently, Base has no plans to issue its token but uses ETH as a transaction fee.

Besides, the platform also strongly attracted the community’s attention through the BALD memecoin. It surprised many investors with a 40,000% increase and $57 million in capitalization added within 24 hours – unimaginable numbers with many coins/tokens on the market.

But things could have gone better than in the dream. Layer 2 Base has been constantly entangled in noise since the person behind the BALD memecoin on layer-2 Base suddenly withdrew the liquidity of the BALD/WETH pool, causing the token price to drop by more than 80%. This memecoin is considered a rug pull on July 31.

Then on August 1, LeetSwap, the largest DEX on layer-2 Base, had to suspend trading to investigate the reported vulnerability. The evidence shows that a liquidity pool on LeetSwap was exploited to withdraw 340 ETH, equivalent to 630,000 USD.

Following the flow of events, RocketSwap Labs was the next victim of on-chain miners on August 14. PeckShield said the project lost 471 ETH, or about $870,000. But it is worth mentioning that instead of quickly dispersing, the hackers took a paradoxical action to create a new memecoin named LoveRCKT (Love RCKT – RocketSwap’s token).

And the latest event was on August 16 with a rug-pull crash from SwirlLend when the community discovered the project had transferred around $289,500 in crypto from Base. It then transferred 94 ETH from Linea, connecting the cryptocurrency to Ethereum. It then created a new token and laundered 253.2 ETH through the Tornado Cash crypto mixer.

SwirlLend has shut down its social media accounts and website. Its total value locked on Base fell from $784,300 to $49,200. Deployed on Layer 2, Base is a great advantage for friend.tech, but it is also becoming a fatal weakness of the project because if it is not watched by miners, then the situation. The Base’s current status also reduces much of the appeal of the projects that are built on top of it.

The risk may lie in Friend.tech itself

Base’s hype may have been just an immediate boost to the project’s desirable numbers. But since the record numbers reached on August 11 after the launch, the daily trading volume has continuously plummeted in the following days so far, there has been no improvement. From 4,700 ETH dropped to just 334.6 ETH on August 16 (a decrease of almost 93%).

friend.tech’s origin story could be clearer, possibly with red marks. The developer nicknamed Racer, the force behind the app, previously launched TweetDAO, an innovative but short-lived foray into decentralized social media. While it garnered initial attention, TweetDAO was soon exhausted and its main Twitter account was eventually suspended.

Likely just a temporary craze similar to Bitclout, the project that emerged in 2021 with a similar way of working. This is not the first time sharing social products in the crypto ring has appeared; as early as 2021, Basis founder Nader Al-Naji released the decentralized social product BitClout.

Due to investment endorsements by leading institutions such as Sequoia Capital, A16z, and Coinbase Ventures, BitClout captured the attention of the entire cryptosphere when it was launched. However, the fact that BitClout put user data on its platform without user consent has also caused strong discontent in the community.

Friend. Tech’s stock valuation model seems simple at first glance. But this raises a bigger question: What is the real value being traded? If one person is buying “shares” in another’s social presence, how is this quantified and, more importantly, qualified?

Besides that, the project’s website is sparse, with very little information about the project, no information about the roadmap, founder, or any kind of white paper about the project. Currently, the friend.tech desktop site is now directing users to use their mobile devices to download the app.

Most importantly, any platform that interacts with personal data must prioritize user privacy, but for friend.tech this is quite contradictory. The site has a call to action that prompts the user to read its privacy policy, but when the user wants to see it, they receive a “coming soon” reply. The lack of any privacy policy raises concerns for users who need to know where their data might be transferred or what it’s headed towards.

Conclusion

friend.tech offers an exciting look at the potential intersections of social media and decentralized finance. As always, with new crypto projects, there is always a mix of optimism and skepticism. But it is also important to analyze a project’s origins and understand its goals. While its soaring numbers make a convincing case, lingering uncertainty means users must also raise their guard.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.