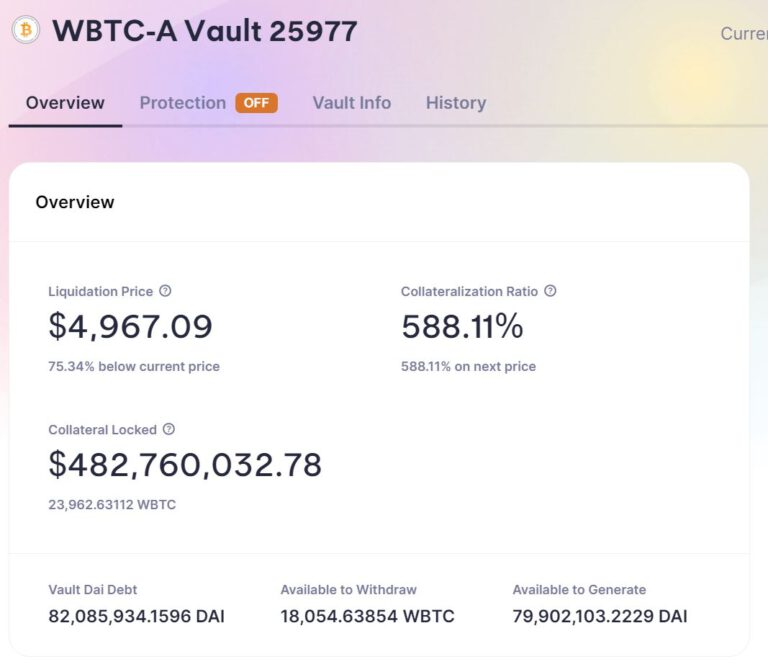

Celsius paid off $120 million in debt, bringing the asset’s liquidation price down to $4,967. However, the question for Celsius customers is what do the refunds mean for their recovery?

The possibility of Celsius being liquidated is still very low

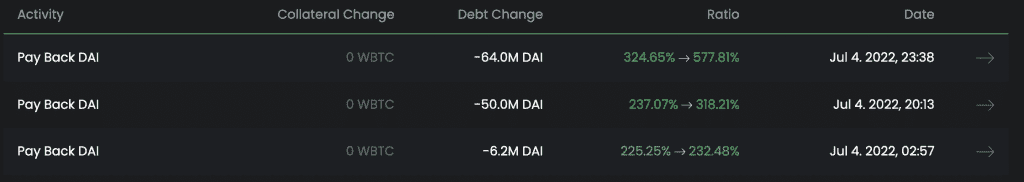

As updated in Coincu News article, on July 3rd and July 4th, 2022, three major refunds of Celsius were made to the multi-collateral Dai vault number 25977. 64 million, 50 million and 6.2 million DAI were exchanged in transactions. The total amount of such transactions, connected to the value of the dollar, is almost 120 million dollars.

With the above move, this lending platform’s new liquidation price dropped, bringing the WBTC collateral liquidation price from $13,600 to just $4,967.

Borrowing positions on Aave and Compound were also reduced to just $178 million and $100 million, respectively. The above collateral has not decreased but still increased.

At present, with the current situation, the money used by Celsius to repay the debt is still unclear where it came from, as well as if there is money, why are they still not opening deposits/withdrawals for users? Although liquidation positions have been reduced, users’ funds are still stuck in the platform.

Meanwhile, accusations that Celsius is trying to cash in on shorting other tokens continue to surface. Specifically, the founder of the Synthetix project, Kain.eth, posted on Twitter accusing a “difficult lending platform” of massively releasing SNX into the market.

Some theories suggest that Celsius is using the rest of the money to try to undo the gauze. They will borrow stablecoins on major DeFi platforms using collateral mostly WBTC and stETH, use these stablecoins to buy tokens, short positions, and release tokens. If this is indeed the way Celsius has been doing in the past few days to get its money back, it would be blatant market manipulation.

However, there is still no clear evidence for these hypotheses.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

Coincu News