Shorts liquidated crosses $160M when Bitcoin’s price is pushing for $22,000 while ETH surged past $1.4K.

Over $160 Million Shorts Liquidated

The cryptocurrency market continues recovering, and over the past few days, it has gained a total of $150 billion to its capitalization, which now stands above $1 trillion.

Bitcoin’s price is currently trading around $22,000, charting an increase of about 5% in the past seven days and 2.1% in the past 24 hours.

Ethereum, on the other hand, is the absolute leader in terms of price performance over the past days, up 22.6% on the week and 5.5% in the past day.

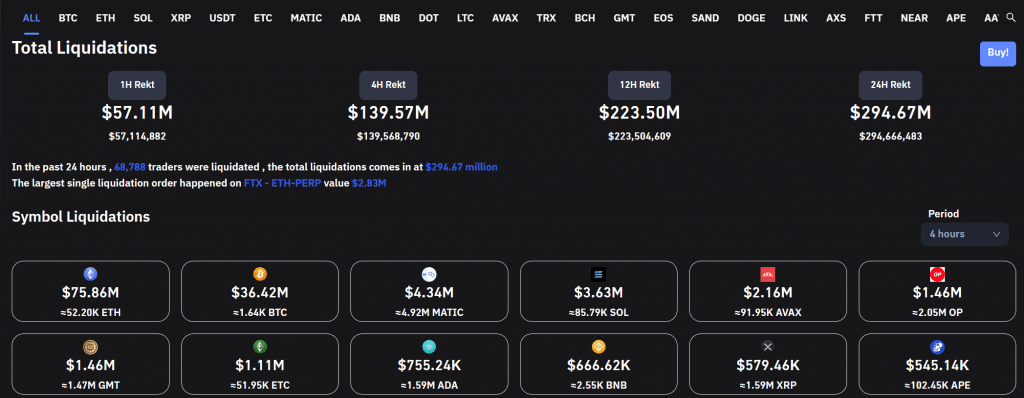

This has led to over $250 million in total liquidations, more than $160 million of which were of short positions – somewhat expectedly.

Data from Coinglass reveals that the largest single liquidation order took place on FTX, and it was an ETH perpetual contract with a face value of $2.83 million.

ETH is also in the lead in terms of overall liquidations over the past 4 hours, with 65K worth of it getting liquidated (a total of around $94 million).

In aggregation, 64% of the positions that were liquidated were short across the most prominent exchanges, with the biggest liquidation volume being on OKX.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

CoinCu News