On July 1, 2022, Three Arrows Capital filed for bankruptcy with the New York Court. The purpose of bankruptcy is to prevent creditors from seizing a company’s assets in the US. But then, Su Zhu-3ac’s CEO sued his company for compensation of $ 5 million.

What is happening after the collapse of 3AC? Let me analyze some events that occur after the collapse of 3AC.

What is 3AC?

There was a previous article I talked about 3AC, which you can read here.

It can be understood, Three Arrows Capital (3AC) Is A Singapore Cryptocurrency Hedge Fund Founded in 2012 by Kyle Davies and Su Zhu.

Stories following 3AC’s bankruptcy.

Three Arrows Capital filed for Chapter 15 bankruptcy on 1st July 2022 in New York. The purpose of a chapter 15 bankruptcy is to prevent creditors from seizing a company’s assets located in the US. Meanwhile, liquidation proceedings will continue in the British Virgin Islands where Three Arrows is based.

Three Arrows Capital owes US$3.5 billion to 27 separate businesses, including Voyager Digital, according to court documents . Genesis Global Trading, which had lent US$2.36 billion to Three Arrows Capital, was one of the company’s other large creditors.

Information about Three Arrows Capital’s remaining assets was also revealed in court documents. These include Deribit and Grayscale Bitcoin Trust shares and cryptocurrencies like Bitcoin, Avalanche, and Near. These unsold assets are worth at least $2.8 billion in total. According to the court statement, the Deribit shares were valued at almost $500 million. the value of the Deribit shares is just about $25 million, according to CoinTelegraph. As a result, it’s possible that there won’t be enough assets to pay out all of Three Arrows Capital’s debtors.

Su Zhu and Kyle Davies sue Three Arrows Capital.

the court issued an order allowing Three Arrows Capital liquidators to demand the pair attend court. However, Both were uncooperative with their liquidators

According to a legal document filed by Three Arrows Capital’s liquidators, there were Zoom calls with a “Su Zhu” and “Kyle.” Their video was turned off, so it was impossible to determine that it was them. Additionally, despite being questioned, neither spoke when their audio was muted.

However, it appears that whilst Su Zhu was filing a claim for $5 million against Three Arrows Capital- his own fund. Kyle Davies also filed an affidavit stating that his wife, Kelli Chen also lent $65.7 million to Three Arrows Capital.

Su Zhu and Kyle Davies buy a yacht with borrowed funds?

According to a legal document submitted by Three Arrows Capital’s liquidators, Su Zhu and Kyle Davies put down money on a $50 million yacht. The yacht would be more significant than any possessed even by Singapore’s wealthiest billionaires; the founders had boasted. The yacht may have been bought with borrowed money, according to the rumor.

Three Arrows Capital CEO Su Zhu to sell US$34.8mil bungalow after liquidation.

Su Zhu, the CEO of Three Arrows Capital, is reportedly working rapidly to sell the Singapore bungalow valued at US$34.8 million after 3AC declared bankruptcy. He bought the 31,854 square foot bungalow in December 2021 and held it in trust for his son, who is 6 years old. The bungalow is being placed up for “extremely urgent sale,” according to text texts going around among real estate agents.

Together, Zhu and his wife possess 3 homes, including the bungalow they intend to sell for more than $59.5 million.

Voyager Digital files for bankruptcy

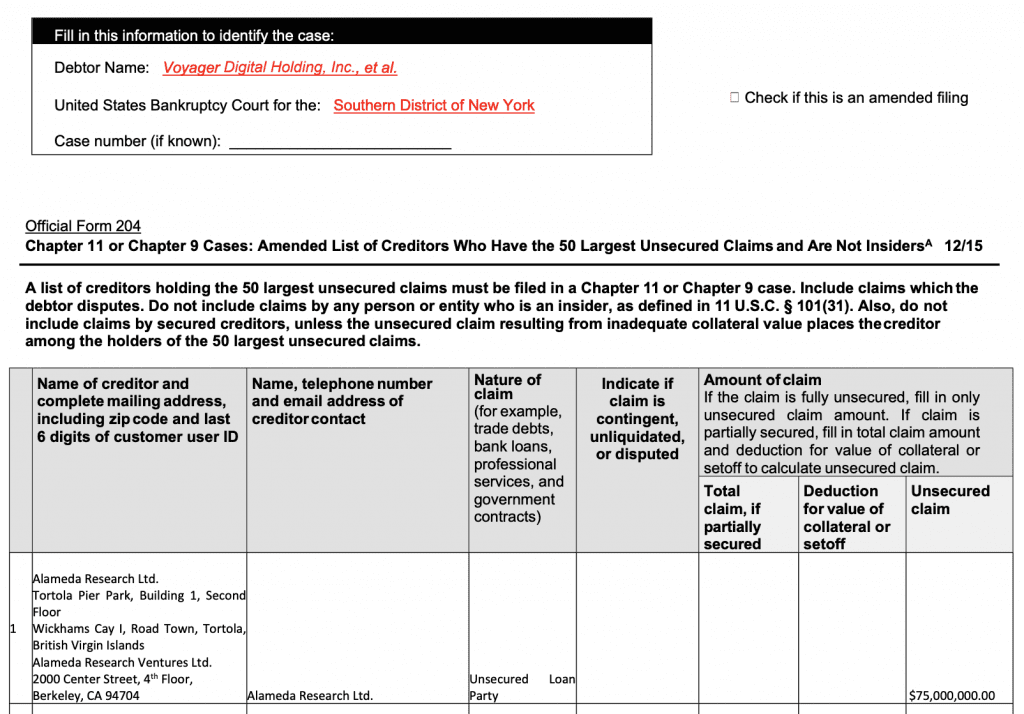

On 5th July 2022, Voyager Digital filed for bankruptcy in the Southern District of New York, a victim of the Three Arrows Capital collapse. Although The Company Also has a US $ 200 million cash and USDC and A 15,000 BTC Revolving Loan from Alameda Ventures Limited.

According to Voyager Digital, it has over 100,000 creditors and total liabilities between US$1 and US$10 billion. The Company estimates that despite its liabilities, it still has assets worth between US$1 and US$10 billion. Additionally, they guarantee will have enough money to pay its unsecured creditors.

According to CEO Stephen Ehrlich’s tweet, the goal of declaring bankruptcy was to “…protect assets on the platform, [and] maximize value for all stakeholders.”

Certainly, Alameda Research is very relieved by this. They are named as Voyager’s top unsecured creditor in court records with nearly US$75 million in unpaid bills. Its second largest unsecured creditor, who has a claim for US$9.7 million, is far smaller than this.

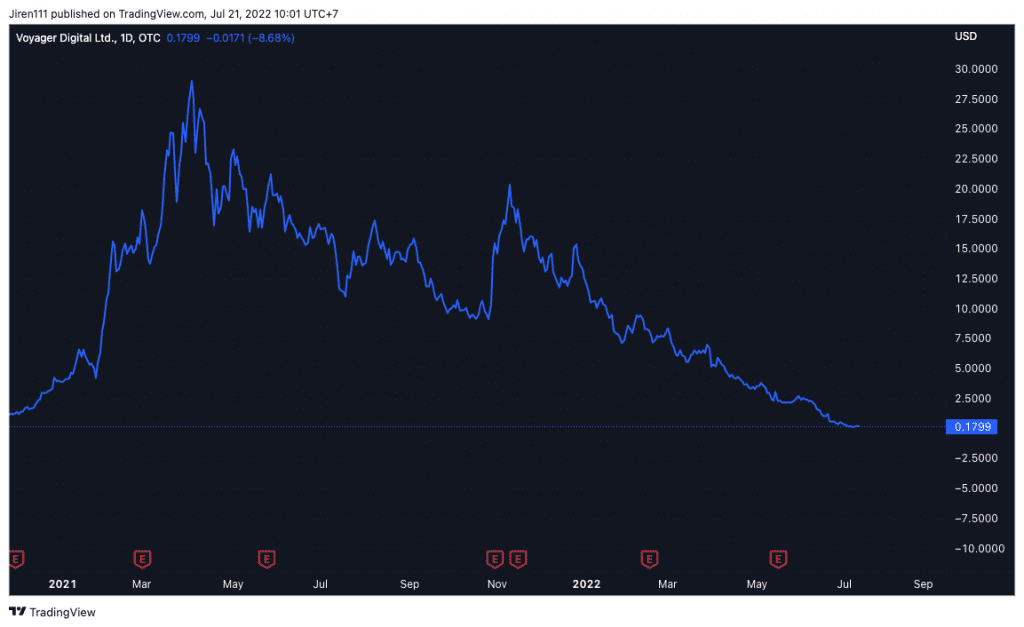

As a result of this incident, the share prices of Voyager Digital Ltd (VYGVF) fell by about 12 percent. Following the revelation of the Company’s engagement with 3AC, share prices for the Company saw a significant decline. Since early June 2022, the price of VYGVF shares has decreased by around 89 percent.

Verdict

Above are my analysis and discovery after the liquidation event of Three Arrows Capital. We can see a lot of aggregates after this event. But in general, the heaviest person is still creditors.

As a Retail Investor, I advise you to understand the organizations and projects before making investment decisions carefully. As well as not putting all your capital into any project. Because investment is never sure.

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Ken. N.

Coincu Ventures