The Cryptocurrency Market Cap Is Still Above $1 Trillion Despite Tesla Selling 75% Of Its Bitcoin Holdings.

Tesla, a manufacturer of electric vehicles, has disclosed that during the second quarter it sold $936 million worth of Bitcoin (BTC), or 75% of its holdings, yet the cryptocurrency market cap is still greater than $1 trillion.

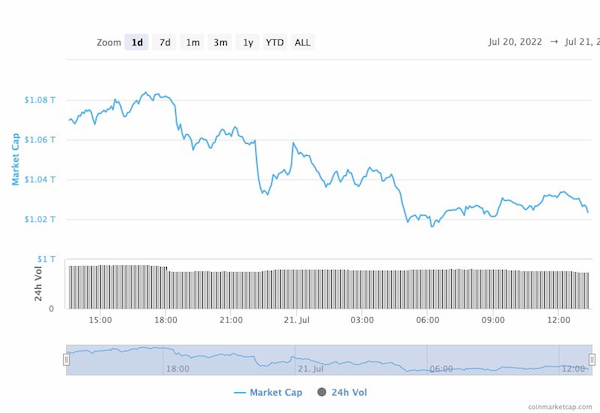

Despite this, the cryptocurrency market cap is still $1.03 trillion, down 2.52% from the previous day, with the Tesla announcement appearing to have an influence on the market.

The price of Bitcoin dropped by approximately 4.3% after the earnings report was released, and as of July 21, the leading digital asset is presently trading below $23,000.

For instance, according to data from CoinMarketCap, the entire volume of the crypto market for the previous 24 hours was $93.55 billion, a decline of 8.06%.

The price of bitcoin dropped immediately by almost 1.6% after the results report was released, falling to $23,300. However, following Musk’s comments on the results call, the price of Bitcoin quickly climbed back to its previous levels.

With a market cap of $434.6 billion, Bitcoin is currently trading at $22,760, down 4.3% in the last 24 hours.

Regarding the company’s earnings report, Elon Musk stated on July 20 that Tesla sold the majority of its Bitcoin to maximize its cash position. Musk stated:

“We are certainly open to increasing our Bitcoin holdings in future, so this should not be taken as some verdict on Bitcoin. It’s just that we were concerned about overall liquidity for the company, given Covid shutdowns in China. And we have not sold any of our Dogecoin.”

Tesla held a total of $218 million in Bitcoin at the end of the second quarter, which is a sharp decline from the $1.26 billion it had in Bitcoin over the three quarters prior.

At the beginning of the quarter, Tesla had about 42,000 Bitcoin; if 75% of them were sold for $936 million, the average selling price for each Bitcoin would be around $29,000.

By selling earlier in the quarter, Tesla avoided a substantial impairment charge on its holdings because the price of bitcoin at the end of the second quarter was close to $18,700. Notably, Tesla continues to own more over 10,000 Bitcoin.

Tesla was rumored to have purchased $1.5 billion worth of bitcoin in February 2021, which directly led to a rise in the price of bitcoin.

The company increased its profit by $272 million after selling 10% of its Bitcoin assets later in the first quarter. It had never bought or sold Bitcoin prior to the most recent statement.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Patrick

CoinCu News