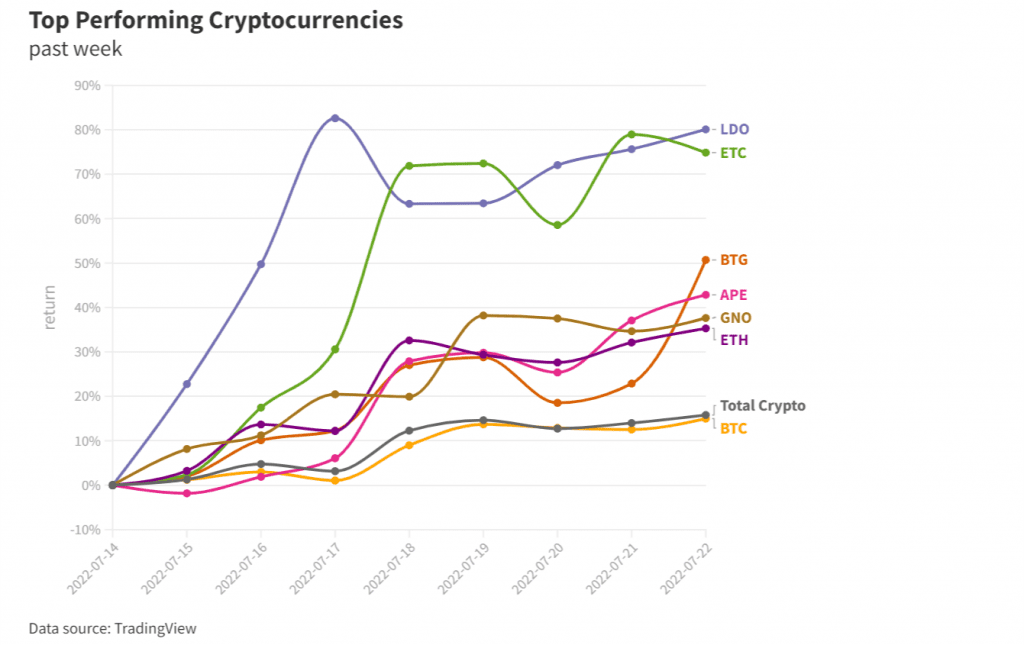

The market became more positive last week. Ethereum now makes up 18.7% of all cryptocurrencies, its highest point since May. Bitcoin dominance dropped slightly after leading altcoins outperformed the top digital asset.

Ethereum Recovers After Set Date The merge

The cryptocurrency market has been showing signs of recovery over the past week. Digital assets have added nearly 16% to their collective capitalization since last Friday, representing nearly $143 billion in nominal value. Altogether, cryptocurrency is now worth $1.045 trillion, per TradingView’s Total Crypto Index, down 52% from the start of the year.

LDO, the governance token for liquid staking community Lido, led the pack with an 80% price explosion. The project this week pledged to expand across the entire Ethereum layer-2 landscape.

Long-serving blockchain forks came in second and third. Ethereum Classic (ETC) surged 75% amid speculation that ether miners might switch to the network following its impending switch to proof-of-stake, while Bitcoin Gold (BTG) added 50% to its price without any clear narrative.

LDO, ETC and BTG were respectively trading 46%, 24% and 42% below their prices from the start of the year.

Bitcoin dominance is shrinking

Recent data from Glassnode shows ether deposits on crypto exchanges have hit a four-year low, as holders pile into the network’s Merge contract in anticipation of yields. Bitcoin (BTC), on the other hand, rose 15% – from about $20,600 to $23,700.

In fact, ether’s recent rally has brought its dominance (which measures how much of the digital asset market is ETH) to its highest point since May, having jumped 16.5 percentage points to 18.7%. Bitcoin dominance fell slightly, from 43.5% to 43.1%.

“It will remain difficult until the Fed can bring down inflation, or if the Fed just gives up on fighting inflation. Either way, it will likely be a difficult few months for markets, especially if Europe’s energy crisis worsens.”

Ganesh Swami, CEO of blockchain data firm Covalent, said

He expects bitcoin to surge once quantitative easing eventually resumes.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

CoinCu News