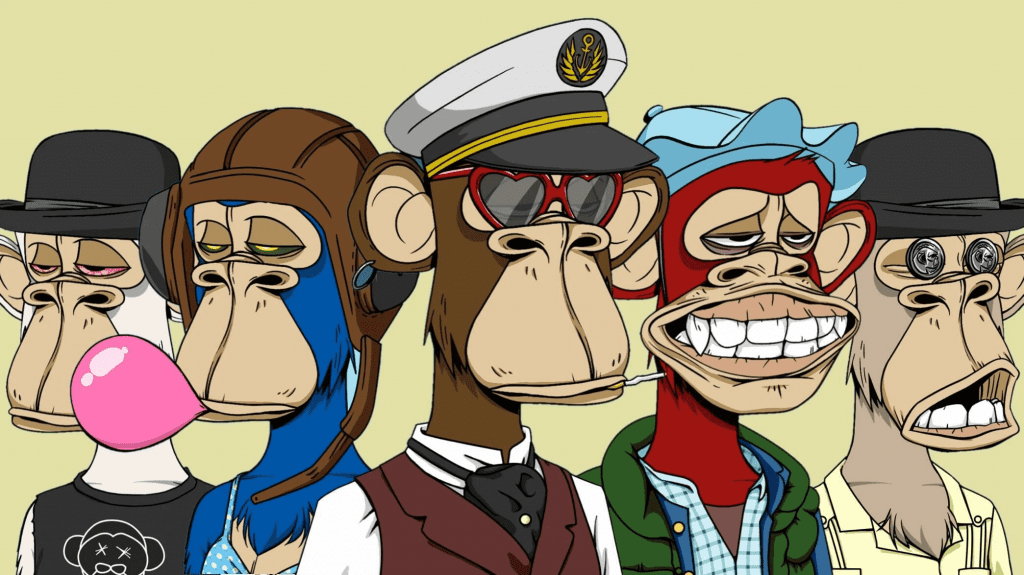

Yuga Labs is potentially facing a class action lawsuit, alleging that NFT Bored Ape Yacht Club (BAYC) and ApeCoin (APE) are securities.

Last month, Yuga Labs, the $4 billion company behind the popular NFT collection Bored Ape Yacht Club (BAYC), caused a stir by using the person who accused BAYC of racism. Yuga Labs is about to find itself on the other side of the court.

Law firm Scott+Scott is currently organizing a class-action suit against Yuga Labs, according to an announcement from the firm late this week. The lawsuit will allege that Yuga falsely promoted Bored Ape NFTs and ApeCoin, the collection’s native Ethereum token, as securities with guaranteed returns but plummeted in value over the last three months.

Plaintiffs in the lawsuit have yet to file an official complaint in federal court. Scott+Scott is continually looking for plaintiffs who experienced damages due to purchasing Yuga-backed NFTs and tokens between April and June. The firm did not immediately return a request for comment on this article.

Once filed, the court’s decision on whether non-fungible tokens are securities, akin to a share in a firm that can rise in value, will be critical to the suit’s success. If a judge rules that the BAYC NFTs are securities, Yuga Labs will have failed to meet the disclosure and registration requirements of issuing securities.

Brian Fyre, a professor of law at the University of Kentucky, said:

“I see very, very, very little likelihood that the SEC is going to want to step in there and … characterize that [Bored Ape NFT collection] as a security. I think they’re going to resist that tooth and nail, because that would open up a huge can of worms for them and force them to regulate all manner of other things that they don’t want to be regulating.”

The Securities and Exchange Commission has thus far refrained from decisively labeling any NFT as security. That may have to do with the fact that such a move would likely bring the broader art market under the SEC’s purview, something the agency has long resisted.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News