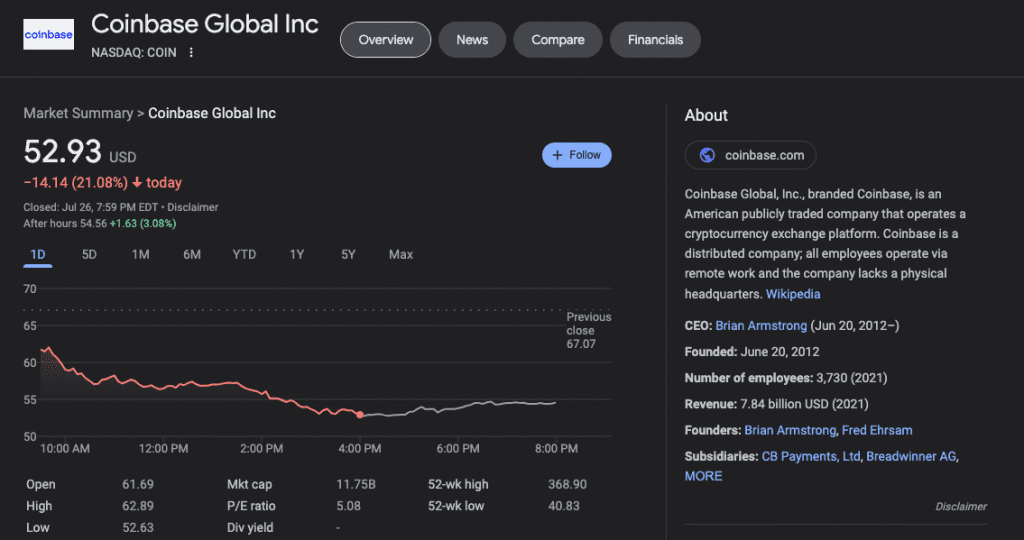

Coinbase stock (COIN) closed at $52.93 on Tuesday — down 21% from its intraday starting price of $61.74. It is now down 75% year on year and 84% from its all-time high.

The drop could be related to a new probe by the US Securities and Exchange Commission (SEC) as the agency investigates whether Coinbase allows Americans to trade unregistered securities.

The SEC has stepped up its investigation into Coinbase since the exchange increased the number of tokens listed on the platform. The largest US exchange currently lists over 150 cryptocurrencies; after keeping the number of tokens listed to a minimum for many years. The exchange starts raising more tokens in 2021 to compete with its rivals.

The top US regulator believes that some of the cryptocurrencies listed at Coinbase are unregistered securities. Of the 150 coins and tokens available on the platform, the SEC claims nine are securities, including Flexa’s AMP, Rally’s RLY, DerivaDEX’s DDX, XY Labs’ XYO, Rari Capital’s RGT, Liechtenstein’s LCX Cryptoassets Exchange, Power’s POWR, DFX Finance’s DFX, and Kromatika Finance’s KROM.

Coinbase is also reeling from the latest indictment of a former insider trading product manager. Furthermore, the exchange was forced to lay off 18% of its staff in June in response to macroeconomic conditions.

The relationship between the SEC and Coinbase is quite tricky. The publicly listed exchange has criticized some of the regulator’s actions toward the crypto space.

In response to the regulator’s latest allegation, the exchange published a blog post asserting it does not list securities and advising the SEC to focus on providing a regulatory framework for the crypto industry.

Other crypto firms, such as San Francisco-based Ripple, also fight lawsuits from SEC.

Compared to Binance and FTX, Coinbase is more selective with its token listings. Coinbase lists over 200 such tokens, according to CoinGecko data.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News