The Coin Bureau host warns the prices of cryptocurrencies to show signs of further decline.

Guy says the recent rally is probably short-lived.

“If crypto’s current price action didn’t make it clear enough, the massive purge we saw in the second quarter has set the stage for a serious recovery rally which we’re arguably in.

However, it’s only a matter of time before the markets realize that all the macro factors which caused the recent crypto crashes haven’t been resolved, and this could take crypto to new lows.”

According to the Coin Bureau host, the cryptocurrency has yet to reach “peak capitulation” as it hasn’t experienced full-blown panic.

“In fact, you could make the argument that crypto hasn’t seen peak capitulation. And not just because many institutional investors like Kevin O’Leary believe we haven’t seen total panic yet.”

According to Guy, metrics like transaction volume, the number of decentralized finance (DeFi) users, and the Bitcoin hashrate — an approximation of computing power based on each miner’s hashrate — suggest that the sell-off has not yet occurred. achieve historical rates associated with peak capitulation.

“Although crypto prices have taken a beating, recall that the number of daily DeFi users has remained relatively stable by comparison, that trading volumes have barely budged and that Bitcoin’s hash rate continued to climb even while BTC’s price crashed.

If what we saw over the last half year had truly been maximum pain, then it stands to reason that all these metrics would have fallen by much more.”

According to the Coin Bureau host, the current rally is expected to end in September due to various factors such as Ethereum’s Merge upgrade being worked on.

“If you’re wondering when the current recovery rally could end, my bets are on mid to late September when Ethereum’s merge is expected to occur and when the Federal Reserve will return from its summer holiday with what’s likely to be a fresh rate hike to fight inflation.

Speaking of which, autumn is also when many parts of the world could start to face skyrocketing energy costs in anticipation of oil and gas shortages over the winter. Something that would almost certainly do serious damage to assets across the board.”

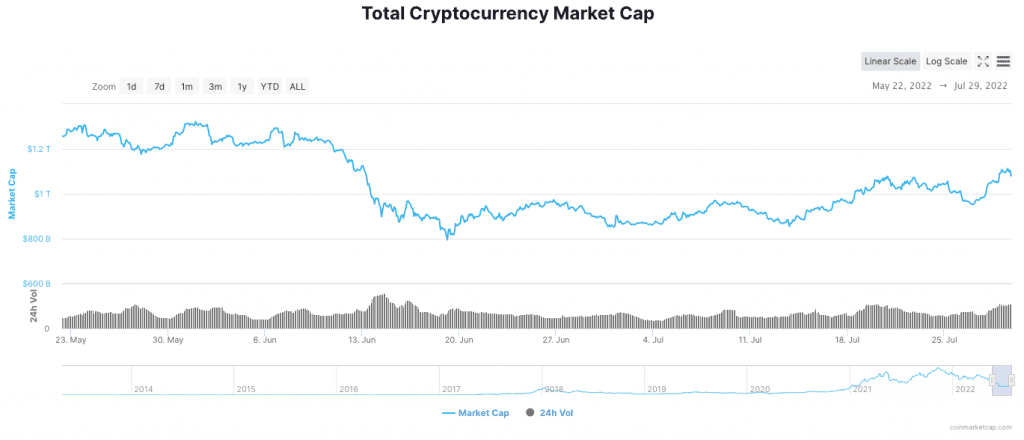

At press time, the cryptocurrency market continues to maintain a total capitalization above the $1 trillion mark.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News