According to a new Ripple report on the percentage of financial institutions interested in using blockchain for payments, more than three-quarters of them plan to use cryptocurrency by 2025.

According to a global study by Ripple and published on August 11, 76% of global financial institutions want to use cryptocurrency over the next three years, provided that legislation permits it.

Meanwhile, 71% of businesses believe they will use crypto in the next three years, bucking the general trend of firms being more open to digital assets and more optimistic about their benefits.

The most critical factor for businesses and financial institutions to consider when deciding whether or not to include cryptocurrency in their investment portfolio is the widespread use of cryptocurrencies for payments. The utility of cryptocurrency as a hedge of some kind comes in second, followed by the associated use of cryptocurrency as a bridge currency.

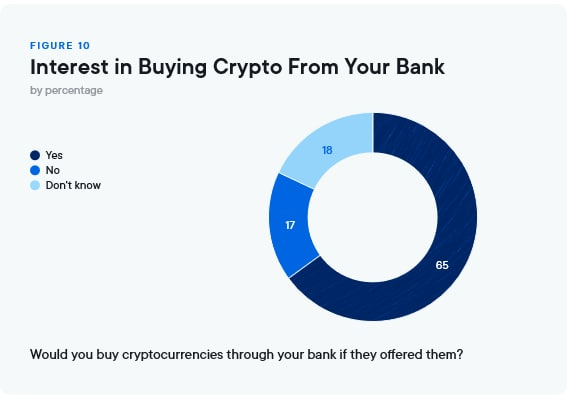

Interestingly, whether due to their trust in banks, their existing relationship with them, or some other factor, the majority of consumers (65%) polled globally said they would purchase cryptocurrency through their bank if the bank offered it.

Notably, nearly 70% of the financial institutions polled for this study expressed a willingness to use blockchain technology for payments in some capacity, whether for internal bank or branch transfers, payments between banks, or payments to customers.

When asked what they believe are the primary benefits of using blockchain and cryptocurrencies for payments, financial institutions gave responses that were fairly evenly distributed across a range of benefits, with data security and quality coming out slightly ahead of additional market expansion and real-time settlement.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News