Excitement is pervading the market as Merge Ethereum gets closer. This is also evident in ETH’s price action, which heads towards the $2,000 mark. For now, it is easy for ETH traders to get caught up in the hype and FOMO, but they must be wary of the potential risks ahead.

ETH recorded high capital inflows over the past few days, triggering many gains on the chart. FOMO and excitement surrounding the Merge event are expected to continue to escalate.

However, investors should note that Merge is still a few weeks away. The bullish move has triggered euphoria, but this will create an opportunity for short whales to surprise. Therefore, caution remains the top priority at this time.

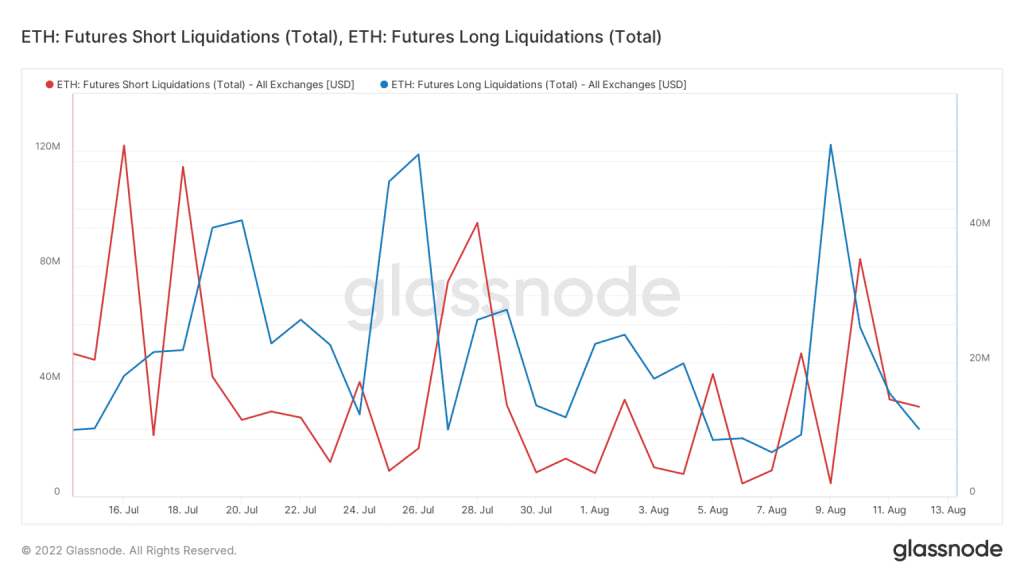

Long liquidation orders in the futures market have fallen sharply since August 9 due to higher prices. Accordingly, Leveraged Long positions thrive in the current market conditions. On the other hand, short futures liquidation orders fell sharply on August 9 but started to increase the next day.

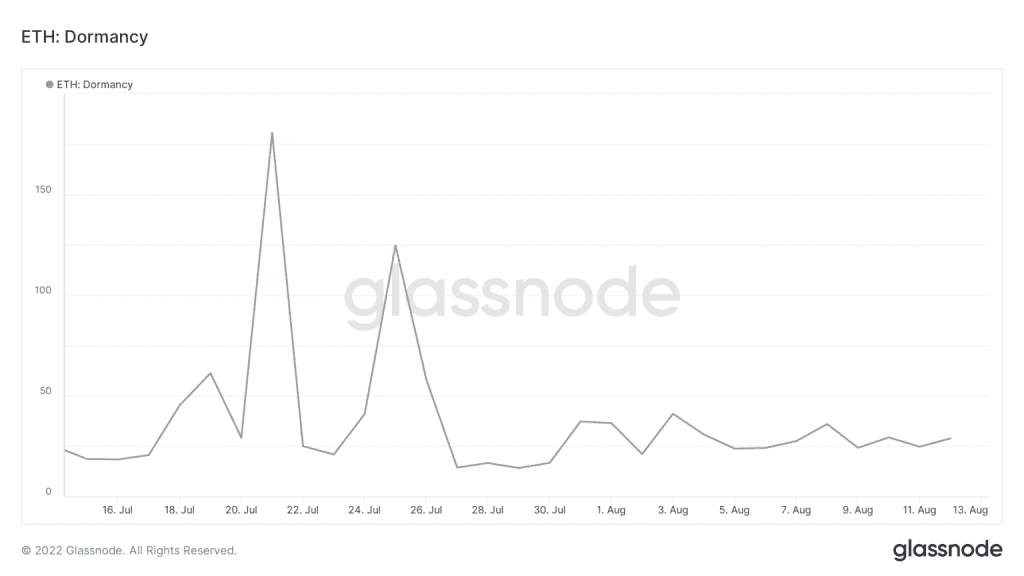

It looks like investors are jumping on the bull train. Furthermore, the ETH immobilization index is in the lower range of its recent 4-week performance at the time of writing. This means that investors choose to hold instead of sell in anticipation of a higher price.

The ETH Immobility Index is consistent with observations regarding long and short positions in the market. Furthermore, this confirms there is strong demand for the largest altcoin by capitalization and low selling pressure. However, note Merge is still a few weeks away, so a lot can happen now and later.

In it, it is possible that whales will take advantage of the recent inflow of money to take large short positions. Such a move will lose some profits while liquidating Leveraged Long positions. As a result, selling pressure increased significantly.

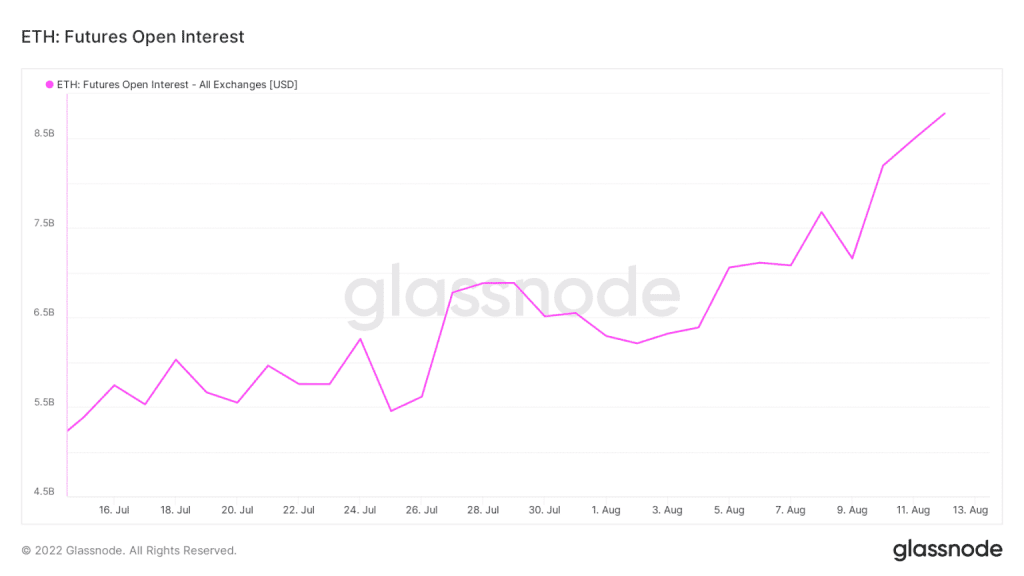

At press time, ETH futures open interest (OI) is at a 4-week high. Market manipulators often look for opportunities in that context.

A lot can happen in the next 4 weeks, such as a significant price retracement due to a major short. Such a move would wipe out leveraged positions, potentially triggering a steep pullback. Note, however, that this is a potential short-term risk and does not necessarily affect ETH’s performance in the long term.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News