The US Government’s requirements for censorship of sanctioned transactions are getting stricter and stricter, which has led to the decision of some exchanges to stop staking Ethereum, good example is Coinbase as CoinCu recently reported.

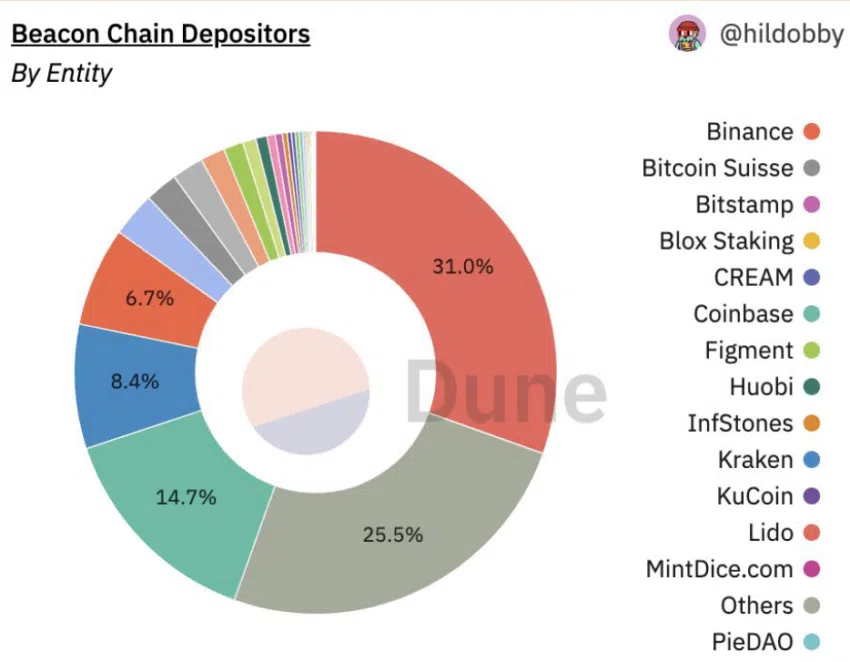

Coinbase accounts for 14.7% of all Ethereum (ETH) staking, according to data from Dune Analytics. That’s about $3.3 billion in current ETH value, and also the equivalent of 1.9 million tokens locked on Ethereum’s Beacon Chain on behalf of the exchange’s users.

Karapetsas asked Lido, Coinbase, Kraken, Bitcoin Suisse AG, and other staking organizations if regulators asked them to censor Ethereum transactions, would they comply? Or will they shut down the staking service to “preserve network integrity?”

The recent Tornado Cash sanctions have sparked massive debate over privacy and over-reach by governments in the crypto industry. The situation became even worse after the arrest of a Tornado Cash developer in the Netherlands.

The Ethereum community is reacting to the flow of sanctions from the US, and many are starting to look at ways to prevent their companies from suffering due to the size of the penalties. And big players like Coinbase are under pressure to choose a side.

Kraken and Lido accounted for 8.4% and 6.7% of the total staking ETH, respectively. Overall, about 66% of all Beacon Chain validators — about four institutions, including Binance — are likely to comply with US Treasury Department sanctions.

Beacon Chain is a new consensus layer on Ethereum. It coordinates a network of investors and introduces Proof of Stake (PoS). The beacon chain is expected to merge with the existing proof-of-work (PoW) chain in September, cutting Ethereum energy usage by 99%.

However, there is concern that the new chain could give major distributors — those who secure the Ethereum network — the power to block transactions in a move aimed at complying with regulatory requirements.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News