BendDAO, a lending system, has exhausted the Wrapped Ether (wETH) in its contract. Only 15 WETH and an estimated 15,000 Ether (ETH) remain in the contract at this moment to be paid to lenders.

In a Twitter discussion, researcher NFTStatistics.eth broke down the problem and pointed out that NFT platform borrowers now had to pay 100% interest on the ETH they borrowed. Additionally, there is an increase in the debt secured by NFTs.

The study also pointed out that many of the defaulting NFTs that were utilized as collateral today had no bids. In connection with this, the platform’s alert list has more NFTs, which are NFTs about to default and come to auction because of the falling NFT floor prices or rising debt and high-interest rates.

BendDAO claims that their team is developing a proposal to alter the NFT lending platform’s parameters

Within 24 hours after the vote’s conclusion, the modification will go into effect.

A Twitter user used the problem as an opportunity to mock the company, noting that even BendDAO’s co-founder was about to be liquidated by their own loan platform.

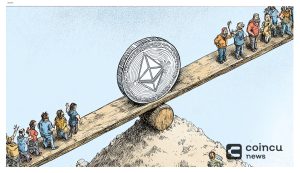

Analysts predicted last week that a series of $55 million NFT liquidations may be forthcoming to recoup loans on BendDAO. The situation might result in a “death spiral” for the entire NFT market and the Bored Ape Yacht Club (BAYC) ecosystem, according to DoubleQ, the founder of Double Studio.

The NFT industry as a whole isn’t doing any better, though. The recently created GameStop NFT marketplace has suffered as floor prices of BAYC and Mutant Ape Yacht Club (MAYC) collections have plummeted, with its daily fee revenue falling below $4,000 at the time.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Annie

CoinCu News