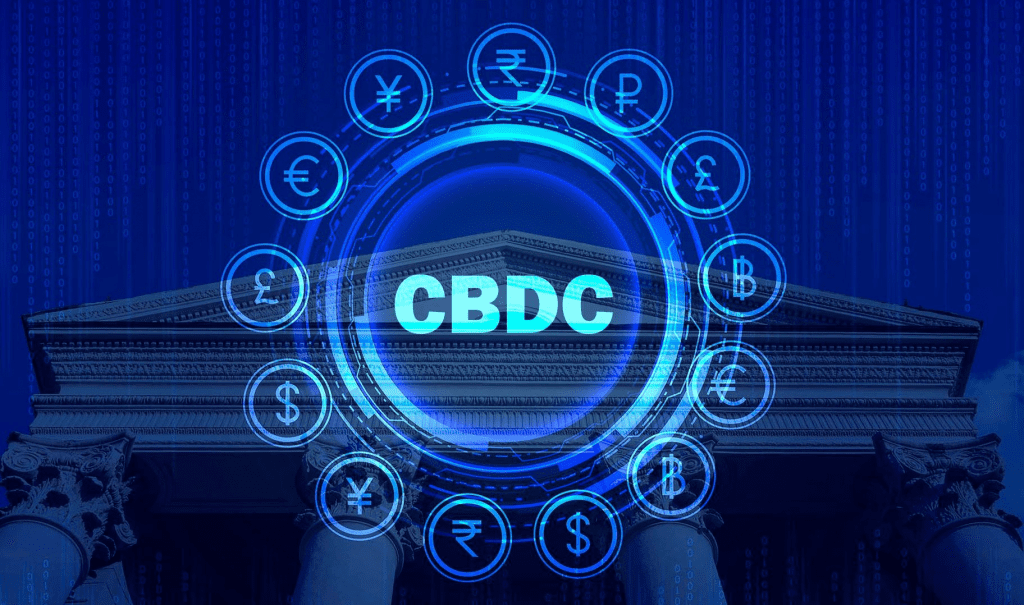

The World Economic Forum (WEF) released a blog on August 31 in response to the Reserve Bank of Australia’s (RBA) plans to begin a CBDC pilot project.

The Reserve Bank of Australia (RBA) said in a statement on August 9 that it is partnering on a year-long study initiative with the Digital Finance Cooperative Research Centre (DFCRC) to investigate new use cases and business models for implementing a CBDC in Australia.

The World Economic Forum (WEF) reiterates the European Central Bank’s (ECB) definition of CBDCs as a risk-free form of currency guaranteed by the state in the blog post while also predicting that all European states will issue their separate digital euro by mid-decade.

Digital currency would be marketed as a more efficient, convenient, and secure method of making daily payments. According to the WEF, CBDC is a supplement to physical cash rather than a replacement.

Regarding the societal benefits of CBDC, the World Economic Forum stated that CBDC might help reduce poverty and boost financial inclusion by making money easier and safer to access.

Because CBDC is redeemable for domestic currencies, it may help increase the resilience of financial systems if cash is in short supply or becomes unavailable. Finally, the potential use of DLT to combat financial crime is an incentive since CBDCs can pave the way for improved AML/KYC functionality and money flow transparency.

According to the WEF’s Central Bank Digital Currency Policy-Maker Toolkit, additional central banks are investigating the usage of CBDC and distributed ledger technologies in addition to the RBA.

WEF is currently assisting central banks in developing, piloting, and implementing DLT and CBDC policies. It underlined that decisions about using the technology should be made after considering input from many sectors and all potential risks that the relatively new technologies may provide.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News