Coincub, a digital asset exchange aggregator, did research to determine which nations have the most favorable taxation of cryptocurrencies for their inhabitants. Germany was rated as the world’s crypto tax haven, followed by Italy and Switzerland in that order.

Germany, the largest economy in the EU, has recently received attention from the cryptocurrency community. The nation’s Finance Ministry declared a few months ago that if people keep the assets for longer than a year, they won’t be taxed on the sale of Bitcoin and Ether.

According to Coincub’s estimation, the regulation, together with a number of other reasons, propelled Germany to the top spot among countries with resident-friendly cryptocurrency tax laws.

“Germany has a surprisingly progressive outlook on crypto tax. Overall it has embraced the crypto tax situation and formalized it more than most leading countries. Having a very generous no tax on gains if your crypto is kept for over a year seems to be perfectly in keeping with a country whose population has a long tradition of saving as opposed to spending,” the entity stated.

The second spot goes to Italy, where citizens are exempt from paying taxes if their cryptocurrency-related earnings do not exceed $51,000.

Switzerland comes in third, where each canton has a different taxing system. Nevertheless, most residents are excused from paying taxes. Slovenia and Singapore complete the top five.

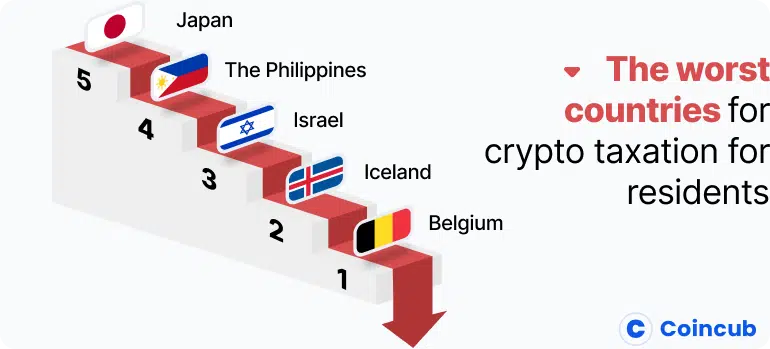

The worst countries for resident cryptocurrency taxation were also identified by Coincub. The first place goes to Belgium, where 33% of the nation’s income comes from the sale of digital assets. In addition, crypto gains that are regarded as professional income may be subject to a tax of up to 50%. The other four countries on that list are Japan, Israel, the Philippines, and Iceland.

The Indian government implemented a 30% taxes rate on residents who earn any revenue from Bitcoin operations in April of this year. Despite this regulation, the second-most populous nation in the world does not rank among the worst crypto tax jurisdictions.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News