All crypto investors are looking for the date of Sept 21, when Fed is expected to launch a new higher Fed interest rate. The end of this week witnessed the Ethereum level down as a slide.

The event of The Merge on Thursday showed the red on the trading board. Ethereum slide from $1,580 to $1,335, down at least 6% just one hour after the Merge and a total of 15% yesterday as of this writing.

That means Ethereum was down up to 22% the whole last week. In the traditional market, CPI and other indicators on Nasdaq and S&P 500 also showed declines.

The crypto market has witnessed the evaporation of ETH price from the “merge surge”. Some investors like Doctor Profit also showed his point of selling all ETH on Twitter.

In July, the Federal Reserve meeting resulted in the yield of a 0.75% Interest rate. So, the world is looking to the event in the two next coming days, which is expected to a big increase percentage.

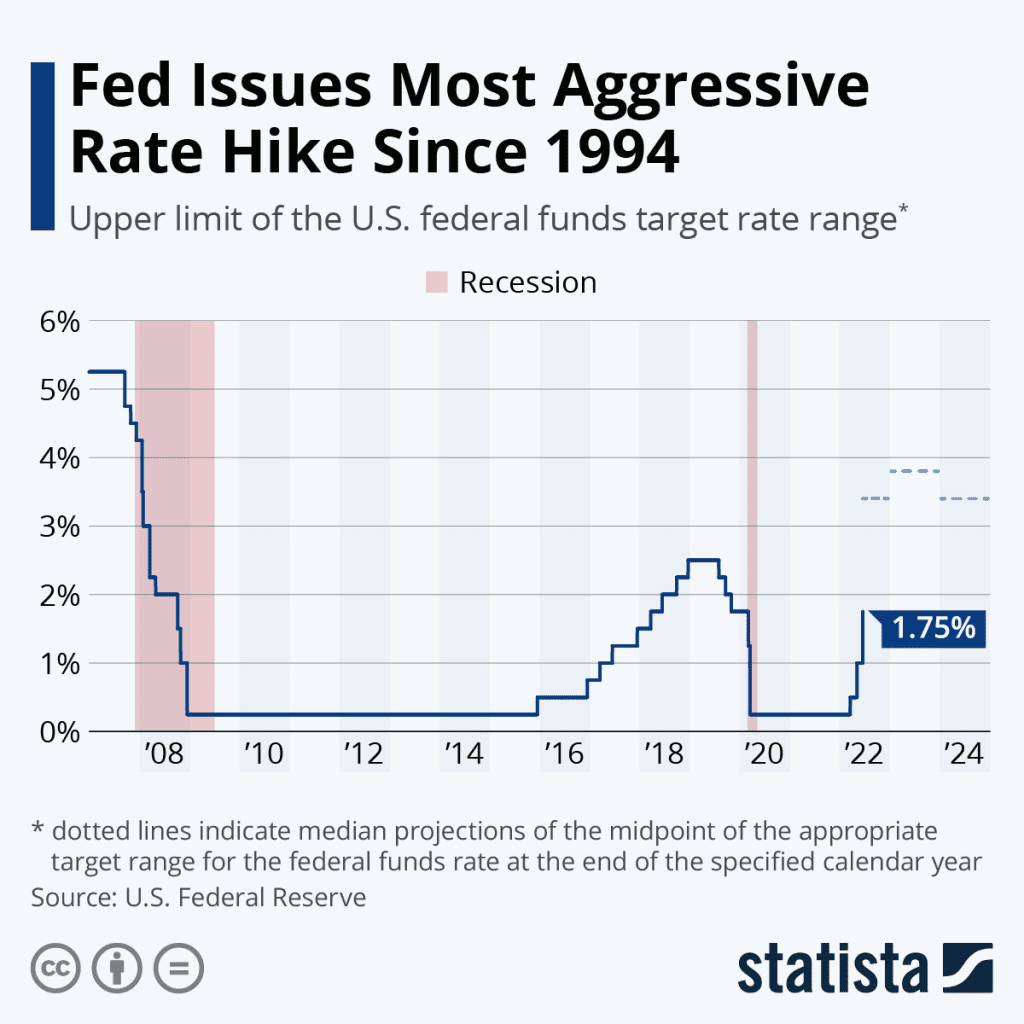

In the article of World Economic Forum titled: “The US makes most aggressive interest rate hike since 1994”, the FED interest rate has increased its create by 75 basic points, up to 1.75% over the 40 years.

In the article of World Economic Forum titled: “The US makes most aggressive interest rate hike since 1994”, the FED interest rate has increased its create by 75 basic points, up to 1.75% over the 40 years. The Fed Interest rate could be up to 3.4% by the end of this year.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Ken

CoinCu News