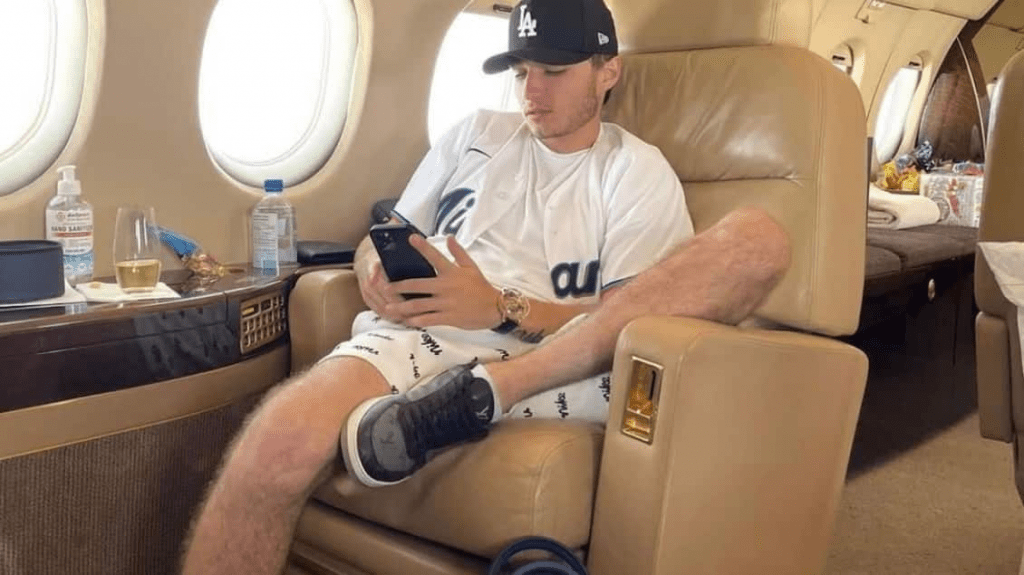

Aiden Pleterski, a self-described “Crypto King” and 23-year-old Canadian trader, is being sued for allegedly failing to return at least $35 million to his investors. Authorities have previously taken two McLarens, two BMWs, and a Lamborghini for $2 million from the Ontarian.

Pleterski owned a company named AP Private Equity Limited, and he promised investors substantial profits through well-timed crypto and Forex trades.

According to CBC, debtors such as Diane Moore invested $60,000 she had set up for her grandchildren’s education. Her contract with Pleterski contained a guarantee of 70% of any financial gains generated by the trader, as well as a complete refund of her initial investment if things went wrong.

The deal offered monthly returns of 10 to 20%. However, just $10,000 of the initial deposit is still available.

“The whole thing was based on trust. What Aiden has done, I think, is awful — and I don’t know how he can live with himself,” Moore said.

Moore now believes that Pleterski was ever a trader in the first place, or that he purposefully defrauded individuals through his investment plan. She is currently one of 29 creditors requesting $13 million in a bankruptcy process against Pleterski.

Norman Groot, the founder of the fraud recovery law company investigating the trader, has gathered information from around 140 impacted investors. Pleterski led a lavish lifestyle, with 11 automobiles, a private plane, and a $45,000-per-month lakeside house in Burlington, Ontario.

“This guy had a large lifestyle burn rate, but it doesn’t account for the amount of money that’s missing,” Groot told CBC Toronto.

Pleterski’s attorney told CBC’s Micheal Simaan that creditors’ accusations against the merchant were “wildly inflated.”

According to his testimony, the trader began investing in cryptocurrency as a youngster, and others began giving him money once they saw how much he was making. He never, however, requested money from others. Simaan wrote:

“Shockingly, it seems that nobody bothered to consider what would happen if the cryptocurrency market plummeted or whether Aiden, as a very young man, was qualified to handle these types of investments.”

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News