With 300M for Series B, the total funding of Sui (by Mysten Labs) is currently 634M. Leading in Series B is FTX Ventures (>=140m). In addition, Sui Blockchain is also supported by Binance Labs and some big funds such as Coinbase Ventures, Jump Crypto, a16z, Circle Ventures. In this part, we will find out if anything is outstanding about the SUI blockchain. In the next part we will analyze the skin-in-the-game opportunities in the ecosystem.

What is Sui Blockchain?

Sui blockchain is the first permissionless Layer 1 designed from the ground up to enable creators and developers to build experiences that cater to the next billion users in web3. As announced by Mysten Labs, the Sui blockchain will be able to scale horizontally to support a wide variety of applications that develop at a fast speed and a low cost.

Similar to Aptos, Sui also has the participation of some members from Facebook Meta’s Diem project (a blockchain project that has been discontinued due to government regulations).

How Sui Works?

The Sui blockchain operates at a speed and scale previously thought unimaginable. Sui assumes the typical blockchain transaction is a simple transfer and optimizes for that use. Sui does this by making each request idempotent, holding network connections open longer, and ensuring transactions complete immediately. Sui optimizes for single-writer objects, allowing a design that forgoes consensus for simple transactions.

So with simple transactions having near instant finality. With this low latency, transactions can easily be incorporated into games and other settings that need completion in real-time. Furthermore, Sui supports smart contracts written in Move, a language designed for blockchains with strong inherent security and a more understandable programming model.

Sui distinguishes between two types of assets (i) owned objects that can be modified only by their specific owner, and (ii) shared objects that have no specific owners and can be modified by more than one user. This distinction allows for a design that achieves very low latency by forgoing consensus for simple transactions involving only owned objects.

Highlights of Sui Blockchain

Simple transactions

Based on Byzantine Consistent Broadcast Sui to forgo consensus and instead use simpler algorithms. These protocols are based on the FastPay design that comes with peer-reviewed security guarantees. In a nutshell, Sui takes the approach of taking a lock (or “stopping the world”) only for the relevant piece of data rather than the whole chain. In this case, the only information needed is the sender address, which can then send only one transaction at a time. By requiring that dependencies be explicit, Sui applies a multi-lane approach to transaction validation, making sure those independent transaction flows can progress without impediment from the others.

Unparalleled scalability, immediate settlement

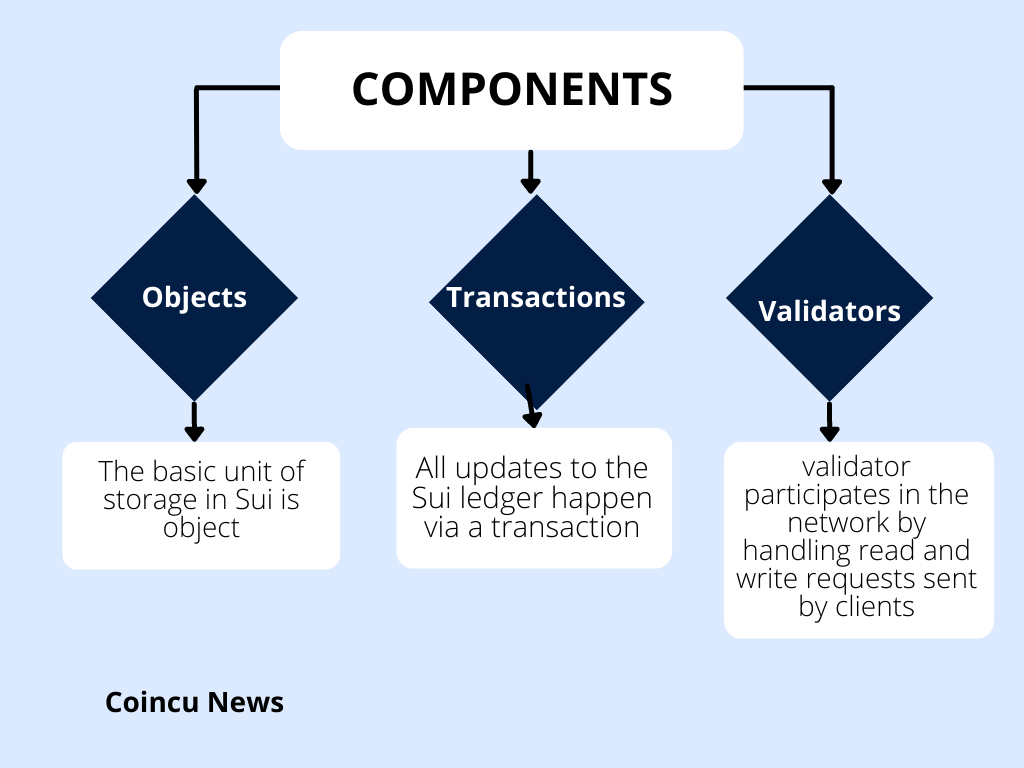

As mentioned, Sui does not impose a total order on the transactions containing only owned objects. Instead, transactions are causally ordered. Sui employs the state-of-the-art Narwhal consensus protocol to totally order transactions involving shared objects. The consensus sub-system also scales in the sense that it can sequence more transactions by adding more machines per validator. There are three main objects processed on the Sui blockchain:

- Owned object: Is held by the owner of the object and can only be modified by the owner.

- Shared object: Can share objects with parties without permission

- Read-only object: Can only be read and cannot be replaced by anyone. Therefore, transactions on the sui blockchain will be processed in parallel and only need consensus for complex transactions. Thereby reducing network latency, increasing throughput, and linear scalability.

Sui uses a novel peer-reviewe d consensus protocol based on Narwhal and Bullshark, which provides a DAG-based mempool and efficient Byzantine Fault Tolerant (BFT) consensus. This is state-of-the-art in terms of both performance and robustness.

High performance TPS: As of Mar. 19, 2022, an unoptimized single-worker Sui validator running on an 8-core M1 Macbook Pro can execute and commit 120,000 token transfer transactions per second (TPS). Throughput scales linearly with the number of cores–the same machine processes 25,000 TPS in a single core configuration.

Move Programming language

The main purpose of blockchain languages is operations with digital assets, and the main quality of such languages is security and verifiability, and the main player on the blockchain languages scene is Solidity. As one of the first blockchain languages, Solidity was designed to implement basic programming language concepts using well-known data types (e.g. byte array, string) and data structures (such as hashmaps).

Move was specifically designed to address both problems based upon the well-supported Rust programming language: representation of digital assets and safe operations over them. It has been co-developed with the Move Prover verification tool to provide additional protection. This allows Move developers to write formal specifications for the key correctness properties of their application, then use the prover to check that these properties will hold for all possible transactions and inputs.

Technical Data

Token Metrics

- Token Name: Sui

- Ticker: SUI

- Blockchain: Sui

- Contract: Updating

- Total supply: 1,000,000,000 SUI

- Circulating supply: Updating

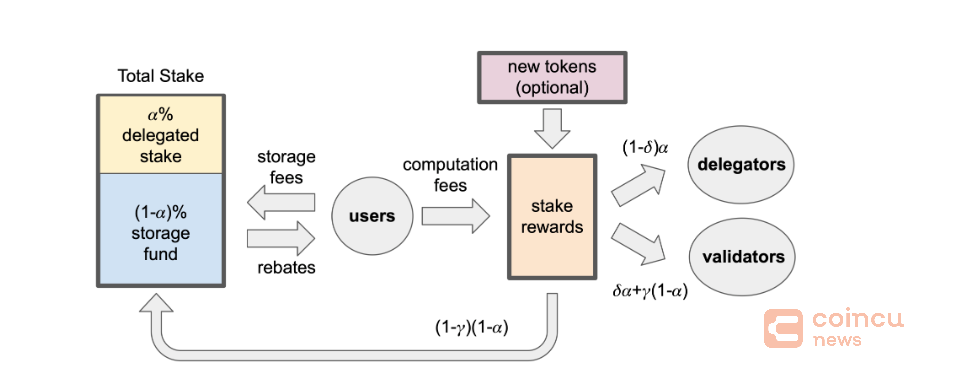

Sui’s tokenomics are designed at the frontier of economic blockchain research, aiming to deliver an economic ecosystem and financial plumbing at par with Sui’s leading engineering design.

- Users submit transactions to the Sui platform in order to create, mutate, and transfer digital assets or interact with more sophisticated applications enabled by smart contracts, interoperability, and composability.

- SUI token holders bear the option of delegating their tokens to validators and participating in the proof-of-stake mechanism. SUI owners also hold the rights to participate in Sui’s governance.

- Validators manage transaction processing and execution on the Sui platform.

The total supply of SUI is capped at 10,000,000,000. A share of SUI’s total supply will be liquid at the mainnet launch, with the remaining tokens vesting over the coming years or distributed as future stake reward subsidies. Each SUI token is divisible up to a large number of decimal places.

Token use case

- SUI can be staked within an epoch in order to participate in the proof-of-stake mechanism.

- SUI is the asset denomination needed for paying the gas fees required to execute and store transactions or other operations on the Sui platform.

- SUI can be used as a versatile and liquid asset for various applications including the standard features of money – a unit of account, a medium of exchange, or a store of value – and more complex functionality enabled by smart contracts, interoperability, and composability across the Sui ecosystem.

- SUI token plays an important role in governance by acting as a right to participate in on-chain voting on issues such as protocol upgrades.

SUI ECOSYSTEM

Currently, Sui is not mainnet, so the ecosystem of this platform is still new, and there are not many projects announced to deploy. Some projects are also devnet and ready to integrate with Sui after Sui mainnet. Let’s learn more about the projects in the ecosystem piece by piece below:

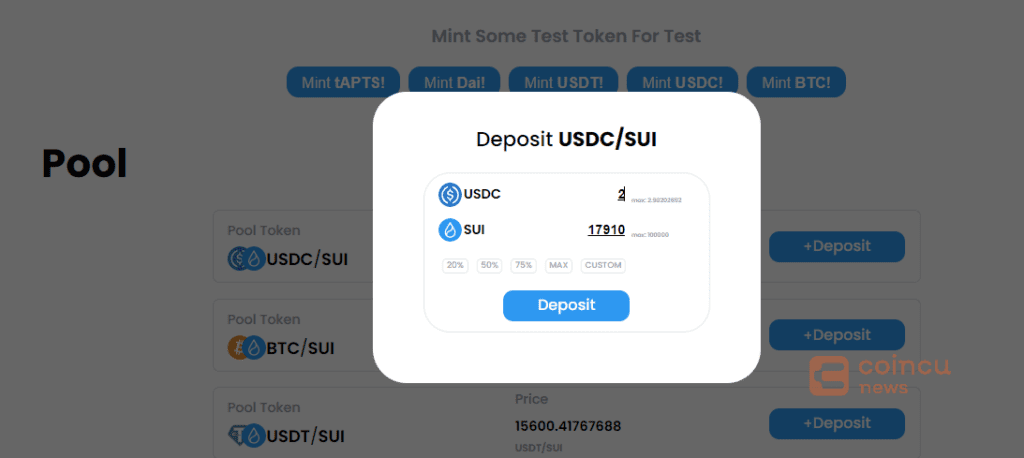

AMM DEX

Suiswap: DEX platform that allows for fast transactions. Currently, Suiswap is undergoing testnet. You can experience creating a Sui wallet and then connect to dApps to perform token swap operations.

Website: https://suiswap.app/app/

OmniBTC: As a project that allows transactions, lending, cross-chain… OmniBTC is supporting blockchains: Ethereum, BNB chain, Polygon, Avalanche and now the project is expanding and developing on Sui and Aptos. They support many wallet, include Martian Aptos or Sui wallet to connect. If you don’t know how to set up these wallets, click Here to read it again.

Website: https://app.omnibtc.finance/swap

KX.Finance: is the first aggregator on Aptos, Sui then the project will develop further on Solana and finally ETH and BSC. Some benefits of KY.Finance. Win more KX crypto:

- User get more KX cryptos in x-to-earn ways (more Pancake ways)

- Trade brand new asset, bond/leverage, SFT(EIP-3525)/NFT/FT etc

- Aggregator to almost wallet in the world

- Provide most depth of trade volume

- Trade almost any asset with one DEX

- Complete the bill in seconds powered by Aptos via 160k TPS

- Trade cross-chain asset through Apots-ETH bridge

Website: https://www.kx.finance/

Wallet

- Sui Wallet: A wallet developed by Mysten Labs for the Sui ecosystem. A DevNet extension now allows you to create a wallet and connect to experience with Sui’s dApps.

- Ethoswallet is another wallet being developed on the Sui ecosystem. The project is currently providing early access to Sui’s DevNet Ethos APIs.

- Suiet: is a wallet built entirely on the platform of the Sui ecosystem under open source design. The project also announced Mysten Labs developed the family. Currently, Suiet supports extensions and mobile apps.

What opportunity to invest in SUI?

Looking at SUI’s competitor that is Aptos ecosystem, there was an epic Airdrop reward event for users. So what opportunity for SUI? Currently, the Sui ecosystem is still in the process of development and completion, no piece of the puzzle is complete. So the simplest opportunity we can all see is skin in the game into Sui. Here are some notable names for you:

1/ Suiswap

Website: https://suiswap.app/

Twitter: https://twitter.com/suiswap_app

You can connect the SUI wallet and make swaps tokens between currency pairs if in the future have airdrop maybe they will make a snapshot and you will have a chance to get it.

2/ Cetus

Website: https://app.cetus.zone/

Twitter: https://twitter.com/CetusProtocol

Crew3: https://cetusprotocol.crew3.xyz/invite/aZ0LpfxuIiGQSqkVlWVj4

Cetus is a pioneer DEX and liquidity protocol built on Aptos and SUI blockchain. It focuses on delivering the best trading experience and superior capital efficiency to DeFi users through the process of building its concentrated liquidity protocol. Through Crew3, you can earn XP to compete on top. The more quests you complete, the more XP you collect, which is related to more future campaigns and potential rewards.

3/ Kriya DEX on #SUI

Website: https://efficacy.finance/kriya-sui-dex/

Twitter: https://twitter.com/KriyaDEX

The first derivatives exchange on Sui. You can connect Sui wallet or Ethos wallet to make swaps. They already have tweets about airdrops in the future. And those who participate in their compain can receive reserve rewards.

Verdict

With a new ecosystem like SUI, there will be a lot of risks along with profits if you know how and invest from the beginning. However, the Sui ecosystem is developed with an experienced team and strong backer, so let’s expect a new ecosystem that solves more problems in this market.

Find more information about: Sui ecosystem

Website: https://sui.io/

Whitepaper: https://github.com/MystenLabs/sui/blob/main/doc/paper/sui.pdf

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary, and does not constitute investment advice. We encourage you to do your own research before investing.

Alan

Coincu Ventures