The SEC Charged Hydrogen And Its Former CEO With Accusations Of Market Manipulation

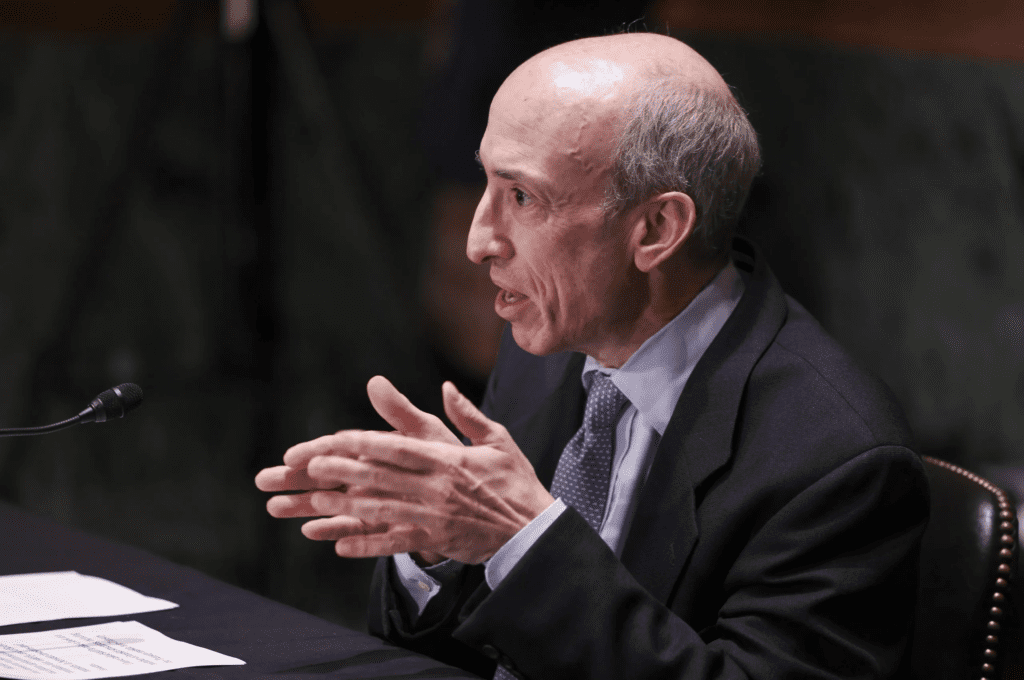

The Securities and Exchange Commission (SEC) has charged The Hydrogen Technology Corporation, Michael Ross Kane, former CEO, and Tyler Ostern, CEO of Moonwalkers Trading Limited, for selling unregistered “crypto asset securities” of Hydro. The SEC further claims that the defendants conducted a scheme to influence the Hydro trade.

According to the SEC complaint, Kane and Hydrogen established their Hydro token in January 2018 and subsequently publicly disseminated the token through different mechanisms, including an airdrop, bounty programs, employee pay, and direct sales on trading platforms.

Not stopping there, CEO Michael Kane was also accused of hiring market maker Moonwalkers as a token price, creating FOMO in the community.

According to the SEC, Hydrogen’s actions constitute both market manipulation and illegal, unregistered securities offering, whether in the form of airdrops or rewards. Carolyn M. Welshhans, Associate Director of the SEC’s Enforcement Division, commented on the enforcement action:

“Companies cannot avoid the federal securities laws by structuring the unregistered offers and sales of their securities as bounties, compensation, or other such methods. As our enforcement action shows, the SEC will enforce the laws that prohibit such unregistered fund-raising schemes in order to protect investors.”

The SEC has filed a complaint in federal district court in Manhattan. The charges allege that Hydrogen, Kane, and Ostern violated the securities laws’ provisions governing registration, antifraud, and market manipulation, and seek permanent injunctive relief, conduct-based injunctions, disgorgement with prejudgment interest, civil penalties, and, in the case of Kane, an officer and director bar.

Ostern has consented to a judgment, subject to court approval, permanently enjoining him from violating these provisions and participating in future securities offerings and ordering him to pay $36,750 in disgorgement and $5,118 in prejudgment interest, with civil monetary penalties to be determined at a later date by the court. Ostern has also consented to an administrative order that would impose a collateral industry and penny stock bar.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News